The Singapore CPI for February increased by 0.3% annualized. Economists predicted an increase of 0.4%. Forex traders can compare this to the Singapore CPI for January, which increased by 0.8% annualized. Canadian Wholesale Trade Sales for January are predicted to decrease by 0.2% monthly. Forex traders can compare this to Canadian Wholesale Trade Sales for December, which increased by 0.9% monthly. The US Chicago Fed National Activity Index for February is predicted at -0.29. Forex traders can compare this to the US Chicago Fed National Activity Index for January, which was reported at -0.25. Advanced Eurozone Consumer Confidence for March is predicted at -14.2. Forex traders can compare this to the previous Eurozone Consumer Confidence for March, which was reported at -6.2.

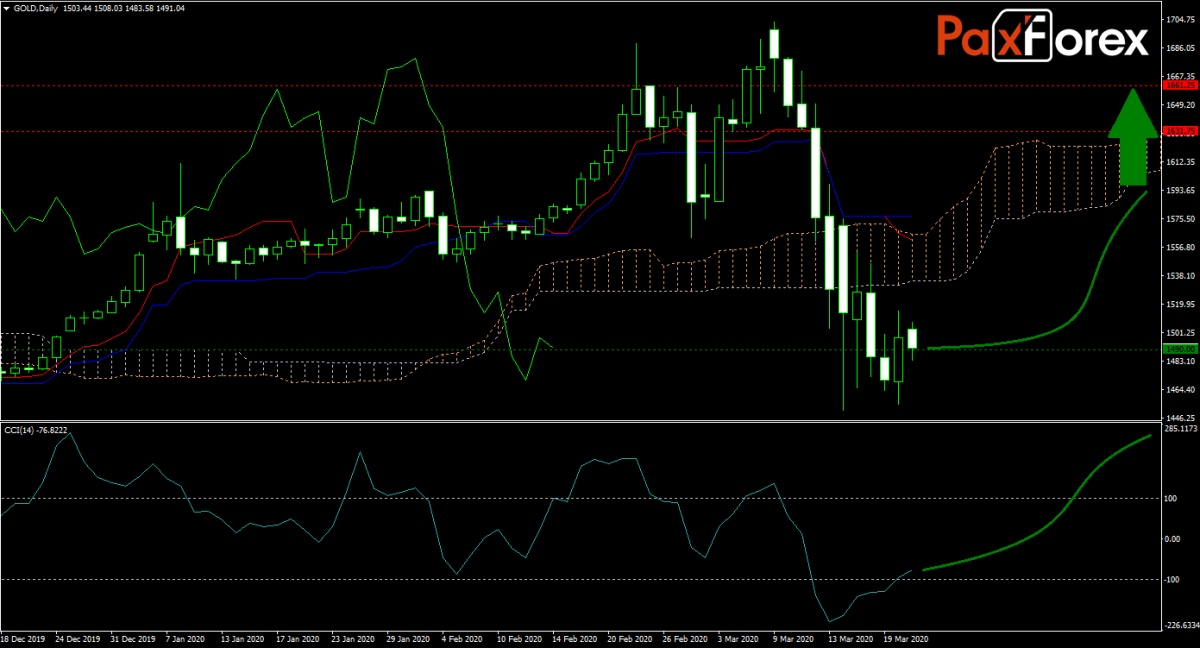

Gold was caught in the global sell-off as margin calls forced portfolio managers and retail traders to seek capital. After plunging into a strong horizontal support zone, hugging the key 1,500 level, the forecast turned dominantly bullish. Will bulls step in and resurrect the strong advance in this precious metal? Do you hedge your forex trading account properly and protect it from downside risk? Find out how to properly secure your forex investment at PaxForex Daily Fundamental Analysis, where you can grow your portfolio trade-by-trade!

Should price action for XAU/USD remain inside the or breakout above the 1,470.00 to 1,515.00 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1,490.00

- Take Profit Zone: 1,631.75 – 1,661.25

- Stop Loss Level: 1,455.00

Should price action for XAU/USD breakdown below 1,470.00 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1,455.00

- Take Profit Zone: 1,400.00 – 1,439.00

- Stop Loss Level: 1,470.00

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.