Source: PaxForex Premium Analytics Portal, Fundamental Insight

Singapore Industrial Production for May decreased by 16.5% monthly and by 7.4% annualized. Economists predicted a decrease of 6.0% and an increase of 6.6%. Forex traders can compare this to Singapore Industrial Production for April, which decreased by 0.5% monthly, and which increased by 13.6% annualized.

US Personal Income for May is predicted to decrease by 6.0% monthly, and Personal Spending is predicted to increase by 9.0% monthly. Forex traders can compare this to Personal Income for April, which increased by 10.5% monthly and to Personal Spending, which decreased by 13.6% monthly. The PCE Core Deflator for May is predicted to increase by 0.2% monthly and by 0.9% annualized. Forex traders can compare this to the PCE Core Deflator for April, which decreased by 0.4% monthly, and which increased by 1.0% annualized.

Final US Michigan Consumer Sentiment for June is predicted at 79.0. Forex traders can compare this to US Michigan Consumer Confidence for May, which was reported at 72.3. Final Current Conditions for June are predicted at 87.8 and Final Expectations are predicted at 73.1. Forex traders can compare this to Current Conditions for May, which were reported at 82.3, and to Expectations, which were reported at 65.9.

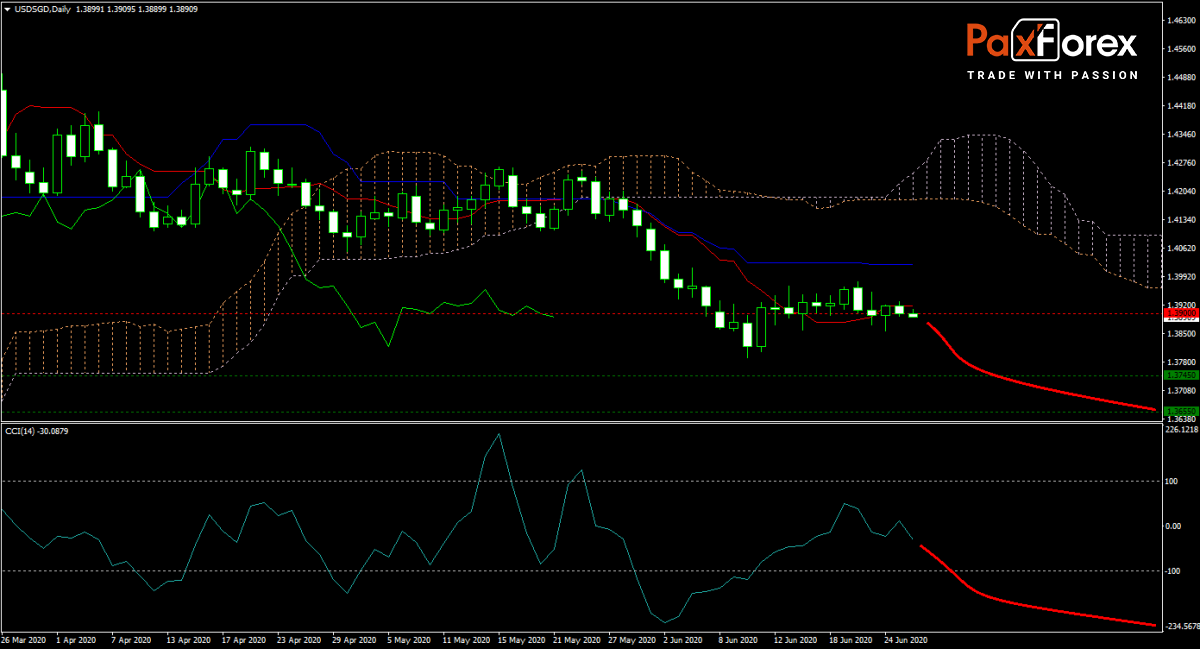

The USD/SGD forecast remains bearish after the US Federal Reserve mandated numerous banks to suspend dividend payments. The central bank conducted a stress test, and not all banks passed. Capital concerns remain a growing issue, despite trillion of cash pumped into the financial system over the last decade. The Tenkan-sen is keeping price action in check as the Ichimoku Kinko Hyo Cloud is descending. Will bears force a new sell-off? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the USD/SGD remain inside the or breakdown below the 1.3855 to 1.3930 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.3900

- Take Profit Zone: 1.3655 – 1.3745

- Stop Loss Level: 1.3980

Should price action for the USD/SGD breakout above 1.3930 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.3980

- Take Profit Zone: 1.4125 – 1.4200

- Stop Loss Level: 1.3930

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.