Almost every novice trader, who has decided to seriously study the main methods of analysis and techniques, faces such a notion as Price Action. At the same time, not all beginners correctly understand the essence of the price action trading method, mistakenly taking it as a trading system or strategy. In this article, we will learn what is Price Action and how to trade Price Action.

What is Price Action?

Contrary to the stereotype popular among beginner Forex traders, Price Action is not a trading system, but rather a trading style based on some templates. The candlestick analysis itself is more comprehensive and includes many techniques. Price Action trading is one of such methods and not the simplest, but one of the most effective.

Price Action trading is carried out with the help of setups, or patterns. Patterns are candlesticks of a certain type (or group of candlesticks), which signal a certain price behavior. Patterns in Price Action perform the same function as figures like "double bottom" or "pennant" in graphical analysis, or crossover in indicator analysis.

However, the significant difference is that Price Action setups demonstrate price behavior in the most "pure" form, without imposing additional instruments or indicators. Many experienced traders appreciate Price Action precisely for the lack of additional filters, which, in their opinion, only overload the chart and confuse traders.

What is a Price Action Indicator?

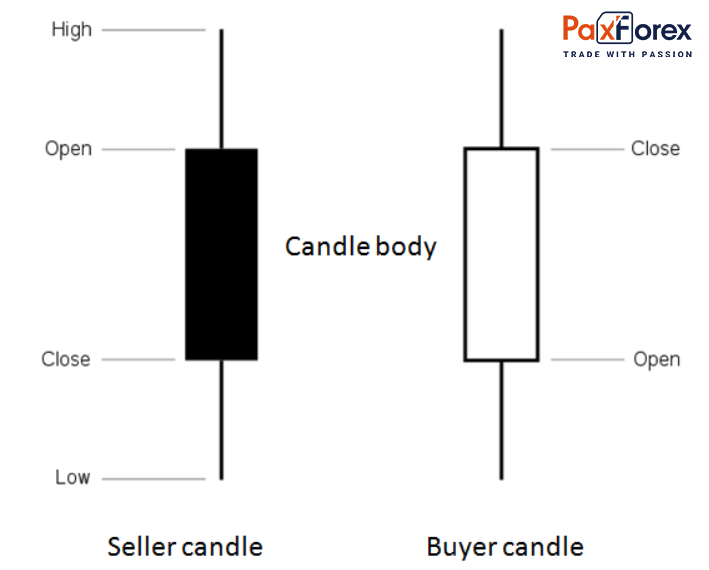

We have already mentioned that the Price Action trading approach is all about analyzing the actions of the buyers and sellers that operate in the financial market. To learn that very approach we need to pay attention to the Price Action indicator. Candlestick is known to be very useful as an indicator because it conveys all the information trader needs - open, high, low, and close values for each time period trader wants to display. To make it easier to grasp, let us have a look at the example:

Pay attention that choosing the W1 time frame, you will see that the shown candles will indicate the whole week of trading of this or that asset. Buyer and seller candles deliver to the trader a bunch of useful information including:

A long hollow (or white) candle indicates that the bulls won the game without any effort. The trend is moving upwards.

A long black candle says the opposite. The trend goes down.

A small candle reports that the rivals played very carefully (small trading volumes) and on equal terms. The price is likely to move in the direction from which it came.

The long lower shadow indicates that the bears attacked the whole game but succumbed after a quick counterattack at the end. Traders need to be prepared for the reversal from descending to ascending trend.

The long upper shadow is the opposite of the previously mentioned - the direction of a trend will change from ascending to descending.

Both long shadows indicate that the rivalry was very tense (high trading volumes), resulting in a tie. The previous trend has obviously slowed down, so we have to wait for the next candle to appear to decide on the trading direction.

Any trader should pay attention to the candlesticks setups in order to create or improve the Price Action strategy in Forex. Here are some useful tips:

In case the short candle is followed by a lower one we should be ready to place sell orders since it indicates that traders hold their short positions and downtrend is prevailing.

In case the long candle is followed by a higher candle that creates a new high, we should be ready to place buy orders since it indicates that traders hold their long positions and uptrend is prevailing.

The above-mentioned approach is one of the possible ways traders can analyze the market situation in terms of applying candlestick setups as a Price Action indicator. Nevertheless, apart from being used alone, candlesticks create patterns that will be handy while creating a Price Action strategy in Forex. There are a lot of such patterns but we offer you to get familiarized with the most popular ones.

Price Action Forex Trading

As we know by now, Price Action trading entails studying, reading, and interpreting the price movement of a market over time, which involves the use of raw price charts to trade the financial assets (with no indicators). Consequently, it is understandable that Price Action trading can be implemented in any market: Forex, indices, stocks, bonds, commodities, and even crypto market. The algorithm is the same for any market - open a candlestick chart, study it, then analyze using the chosen Price Action strategy in Forex and act accordingly.

We can`t but mention that even though Price Action can be used in all the markets, the Forex market is still the best variant due to some reasons:

FX markets are open 24 hours a day, 5 days a week. A trader can make instant decisions and act immediately after the news release. Instead, in other markets, you have to wait for the opening of the exchange along with thousands of other traders who have the same information and made the same decision.

High liquidity provides the trader with the opportunity to open positions of any volume at the same market quote. In other markets, there is often a situation where only a limited number of assets can be bought or sold at one price.

Low cost. In the Forex market, there is no commission for trades, and a low market spread (the difference between the buy and sell price) makes the cost of transactions less than in other financial markets.

Leverage. Small initial capital allows you to place orders for amounts many times (dozens and hundreds of times) exceeding it. In case of success, it allows us to receive the big profit - sometimes comparable to the size of the initial deposit.

We have enlisted just the main aspects that make Price Action forex strategy so prevalent among traders. In the next paragraph we will learn the most popular Price Action strategies using candlestick patterns and after that will talk about the Price Action scalping

Price Action Trading Strategies

It's hard to tell how many Price Action patterns exist. Due to the popularity of this method of trading, many traders are eager to make their contribution and offer their own empirically identified patterns. Some of these patterns do turn out to be working, while others are created just to attract the attention of the community, and do not bring users anything but losses.

We have done our research and prepared for you the most popular and time-tested patterns, the effectiveness of which is beyond doubt for most experienced traders using Price Action

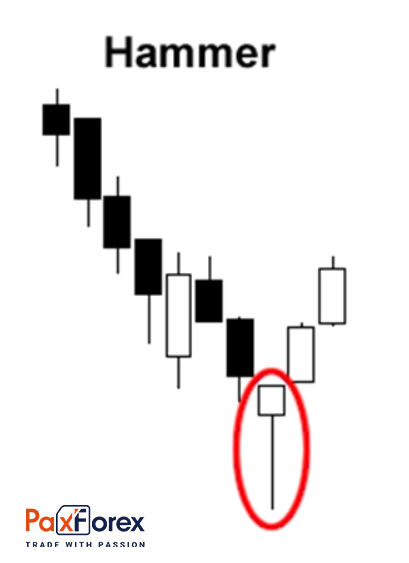

Price Action Strategy #1: The Hammer

Hammer is a figure on the candlestick chart consisting of just one candle. Characteristic features of the Hammer is that this candle has a long lower shadow and a short body, ie, graphically reminiscent of a hammer, so it is very easy to see on the chart.

The Hammer is formed on a downtrend (otherwise, a candle with the same characteristics will be called a Hanging Man). It marks local lows and heralds further growth. Therefore, the Hammer is a bullish figure.

Before studying the classification of Japanese candlesticks, it is worth getting acquainted with Japanese candles in general, and have an idea of types of charts.

The color of the Hammer does not matter. What matters more is the length of shadows and the body. In order for a Japanese candle to meet the criteria to be called the Hammer, it must have the following simple features:

a small body (close to a square in shape);

long lower shadow (at least twice as long as the body);

no upper shadow (or very little shadow);

large daily price spread (i.e. minimum minus maximum);

is formed on a downward trend (otherwise, has a different name).

Technical analysts use the single candle Hammer to identify oversold points of the asset. It is used to confirm support and determine the moments of a trend reversal.

The psychology of the market during the formation of the pattern is explained simply: a long minimum in the period of the candlestick indicates that the bears were pulling the price down with a relatively large force. But as the candlestick formed, the bulls did pull the price higher than the short body and the long lower candlestick.

Variants to enter the market:

at the closing price of a reversing candle. Applicable only for perfect patterns, but even in this case the risk is high;

with Buy Stop order located at the High of the Hammer + Spread + 4-5 points for insurance. This technique ensures the trader against situations where the trend resumes immediately after the Hammer. It can be a false breakdown of the level, a pending order saves from losses in such cases;

with Buy Stop, but located above the High of the confirming candlestick. We wait for the Hammer pattern to appear, then the candlestick should form in the direction of the supposed movement. The Buy Stop is located above its maximum, it is possible to place a deal at the closing price of the confirming candlestick, the risk is acceptable;

with a limit order with the expected correction to the 50.00% of the Hammer reduces the stop, but there is a risk of missing the reversal.

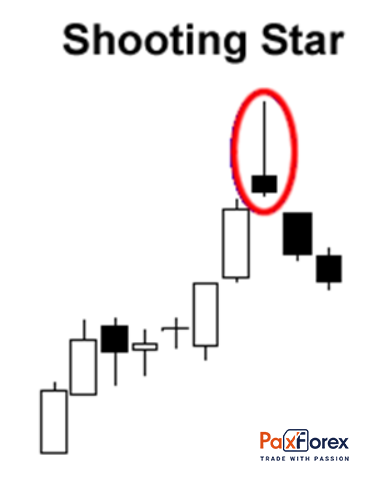

Price Action Strategy #2: The Shooting Star

A Shooting Star is a figure which consists of one candle. This candle opens with a window upwards, has a short body, and a long upper shadow. The Shooting Star is a bearish figure, i.e. it predicts the drop of a financial asset.

Since the Shooting Star consists of only one candle, it is also easy to determine it on the chart: you just need to check it for several criteria. If all criteria coincide, then the figure is genuine, and the probability of the price falling will increase significantly.

Characteristics of the Shooting Star:

first, it should be noted that before the formation of the figure there should be growth, at least short-term in a few candles. Then, if the candlestick meets all the above criteria, we refer it to the Shooting Star and draw the appropriate conclusions;

the opening of the candlestick happened with a gap upwards;

the body of the candle is relatively short (it should visually look like a square);

the upper shadow of the candle is at least twice as long as the body;

the lower shadow is either absent or less than half the body height

All these features must be present, otherwise, it is not a Shooting Star.

It is not difficult to see that the key factors of the figure are the gap and the large upper shadow. Such aspects of the candlesticks suggest that the market sentiment was positive at the beginning of the period.

As the pattern shapes, we see that the bulls were pushing the price high up (which is the reason for the high upper shadow). But as a result, the price dropped to the previous level, around which the period will open. This behavior indicates a sharp drop in traders' interest in the asset, which, in turn, forecasts the decline in price.

There are several ways to trade the Shooting Star pattern:

after candle closes. The risk is not justified - if the growth continues, you will get a stop;

with a Sell Stop order. It' s a few points below the Low reversal candlestick. If the reversal actually occurs, it is guaranteed not to miss the entry point. Since the lower shadow is small, the profit decreases insignificantly;

after the confirming candlestick closes. The logic is the following - after the pattern, we wait for the formation of the next candle, if it is bearish, then at its closing we open a Sell trade;

with the Sell Limit order. We place it based on the probable ascending correction for the reversing candlestick. Usually, the Sell Limit is placed at 38.2-50.0% of the Shooting Star.

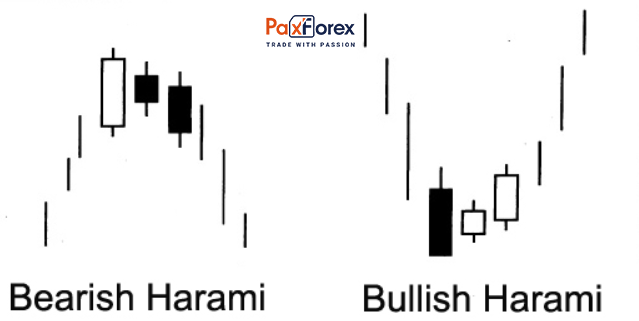

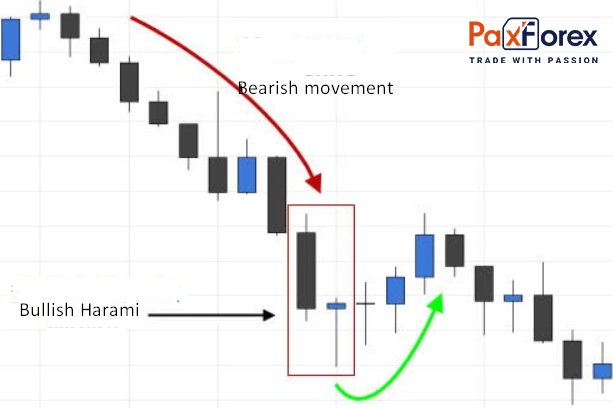

Price Action Strategy #3: The Harami

The Harami is a reversal figure on the chart of Japanese candlesticks. It consists of 2 candles, the second of which is smaller than the first one, with the body and shadows of the second candle must be within the first candle.

Harami reverses the previous trend, the direction of which is a much more important signal than the colors of candlesticks. Even though different sources claim different information about the colors of candlesticks in Harami, we have concluded that the color combinations are of little importance.

Generally, Harami is observed at the ends of trends. They can be both long trends in a few months, and short trends in a few days. To understand Harami, we need to analyze what happens during the trading period during its formation.

Note that regardless of the color of the first candle, the opening of the second candle occurs with the window from the closing of the first candle. Moreover, this window is in the opposite direction from the price movement in the first candle.

That is, if the price falls in the first candle (and the first candle, respectively, is dark), the second candle opens with the window higher than the first candle closed. On the other hand, if the price in the first candle raised, then in the second candle the price will open with a gap lower. This gap (window) in the opposite direction from the price movement in the first candle is the key point of the Harami pattern.

The smaller is the second candle in Harami, the more reliable is the figure. If the second candle is a Doji, the figure's reliability increases greatly.

Naturally, since Harami is a figure of the U-turn, its main applied meaning is the discovery of U-turns. Because of that Harami is an excellent assistant when analyzing financial instruments that are in the price corridor. When Harami detects near support or resistance areas, you should take appropriate actions, as Harami indicates a reversal.

You can also use Harami not only in the price corridor, and simply identify the reversal of the current trend, but it is worth using an additional instrument of technical analysis (for example, some indicator) to confirm the trend reversal.

The Harami candlestick model assumes several variants of market entry points, the risk for each of them is different:

maximum risk - enter the market as soon as the second pattern candlestick closes. We recommend you to study history and estimate how many candlestick patterns fail to work out. Moreover, at first, you will have no experience in filtering patterns, you will be more likely to make mistakes;

with a pending Buy Stop order (beyond the maximum of the 2nd pattern candlestick) or a Sell Stop order (it is placed under the minimum of the 2nd pattern candlestick). The Pending order filters out situations where the movement continues in the same direction immediately after Harami;

entry with a confirming candlestick using pending orders. The color of the first candlestick after the reversal pattern should correspond to the expected movement. It is a more conservative variant, but the Take Profit/Stop Loss ratio is changing not in our favor.

Trading The Bullish Harami Price Action Pattern:

How to determine the bullish Harami:

Identify the downtrend.

Find signals that the momentum is slowing down / reversing (Stochastic oscillators, a bullish crossover of moving averages, or formation of subsequent bullish candlesticks).

Make sure that the body of a small green candle is no more than 25% of the previous bearish candle. In the stock market, a green candle will open in the middle of the previous one. In the Forex market, the closing/opening levels of these two candlesticks will be at the same level.

Make sure that all bullish candlesticks are within the range of the previous bearish candlestick body.

Look for strong support levels to reinforce your position.

Forex market works 24/5 which means that a second candle opens almost at the closing level of the previous candle. In periods of high volatility, this pattern may not be followed.

Looking at the GBP / USD chart below, we can note the following:

There is an obvious downtrend.

A bullish hammer appears in front of the Harami, which gives the first hint that the trend may reverse.

A bullish candlestick is no more than 25% of the previous candlestick range.

A bullish candlestick opens and closes within the range of the previous candlestick.

RSI indicates that the asset has been oversold. This may mean that bearish momentum is reaching its lowest point, but traders wait for the RSI to cross the neutral line (30 pips) again to confirm the signal.

Stop Loss can be placed below a new low, and traders can enter the market when a candlestick opens following a bullish pattern. Since theoretically, Harami appears at the beginning of an uptrend, traders can use several target levels to get the most out of the entire uptrend range. These targets can be located at the last support and resistance levels.

Price Action Strategy #4: Forex Price Action Scalping

The combination of scalping and Price Action trading is quite unusual, but very productive. When we use scalping, candlesticks can also be useful, it is necessary to keep at hand a list of the best and most common patterns.

Another absolute advantage is that we may have quite a lot of signals on low periods, as suitable trading situations will occur quite often. At the same time, there is no need to limit oneself to

the Forex market instrument, one can work on any charts, as the principle remains the same.

So, Price Action scalping is based on the following principles, which are implemented consistently:

Determine potential reversal areas on the chart. It is not difficult to find them at all, we will use the simplest option - support and resistance areas. To do this, we should highlight the levels of a higher time frame, where reversals took place. For example, if we trade within scalping on periods from five minutes to fifteen minutes, then support and resistance will be highlighted on the hour and four-hour charts. We mark the areas and move on to the next stage.

We wait for the price to approach this area and enter it. This is the key point because there is a high probability that a reversal will occur. So, the price enters the reversal area, after which it generates a reversal signal. In our case, we need a candlestick pattern, even if it will be formed on a very low time frame. In Metatrader 4 it is possible to create any period, so you can create M10 and monitor it, or hold a standard M5 and M15. So, the appropriate and most common patterns we can use scalping in scalping: hammer, shooting star, or Harami. These models should be carefully studied, they work perfectly on low periods.

The Price Action scalping itself. We have an important reversal area, we have a candlestick pattern, now we can consider entering the trade. Usually, candlestick patterns on M15 without reasonable levels are not suitable for trading, there are too many false signals. And here we have everything ready. From classic scalping techniques, we can add a couple of filters, use a standard combination of two MAs with different periods and wait for the crossover, or use some oscillators. In other words, it will be another confirmation that the price is reversing. The Stochastic oscillator with standard settings (5;3;3) is a very good fit, it is quite sensitive to reversals.

That is the scheme turns out to be extremely simple, intuitive. The basic idea is that we use different patterns and approaches, but they all focus on the same thing. As in any trading system, the more filters, the better the signal is obtained, but on the other hand, it significantly reduces the number of such signals. In case of Price Action scalping everything works out harmoniously - we just have to wait for the moment and then enter the market

Conclusion

Studying price movement and candlestick patterns in terms of Price Action, a trader will always be a few steps ahead of his colleagues who use indicator trading strategies. Do not get confused with all the Price Action trading patterns you will find online, just choose several, let's say the ones we have discussed today. Make sure you master how and what to do with this information and later you can always broaden your arsenal with some new patterns. So, start practicing right now, and good luck!