Source: PaxForex Premium Analytics Portal, Fundamental Insight

Singapore Industrial Production for July increased by 1.6% monthly and decreased by 8.4% annualized. Economists predicted an increase of 6.0% and a decrease of 5.7%. Forex traders can compare this to Singapore Industrial Production for June, which increased by 0.6% monthly, and which decreased by 6.5% annualized.

US Preliminary Durable Goods Orders for July are predicted to increase by 4.3% monthly, and Durables Excluding Transportation are predicted to increase by 2.0% monthly. Forex traders can compare this to US Durable Goods Orders for June, which increased by 7.6% monthly and to Durables Excluding Transportation, which increased by 3.6% monthly.

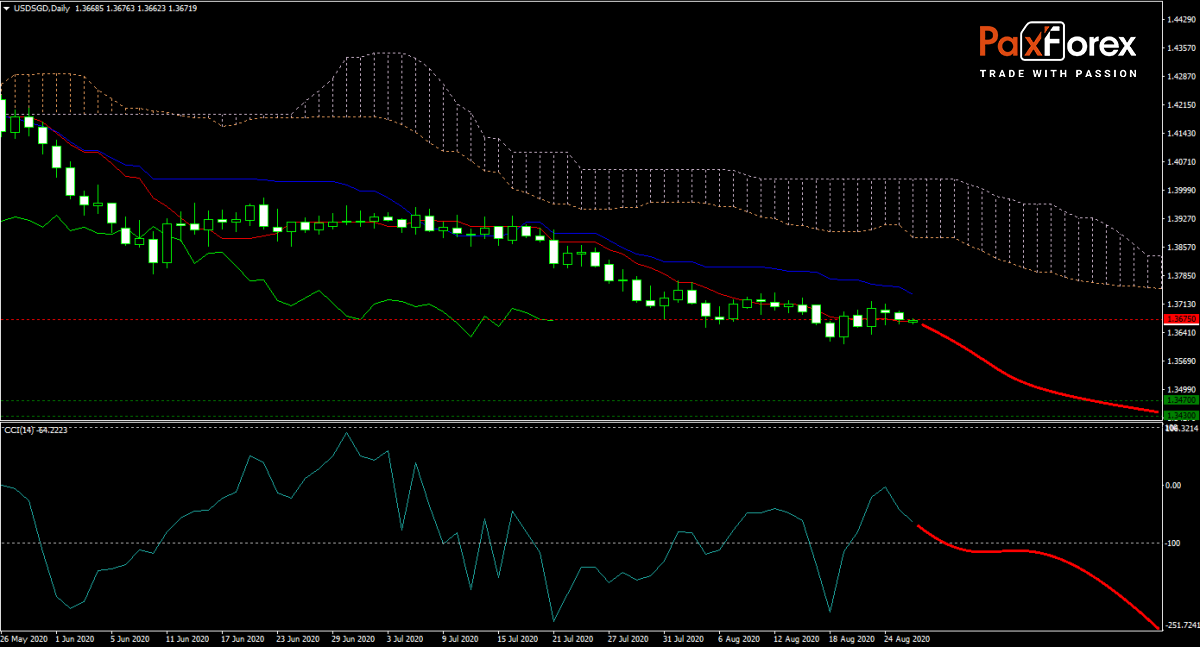

The forecast for the USD/SGD remains bearish, with the Kijun-sen and the Ichimoku Kinko Hyo Cloud sloping downwards. Global economic indicators continue to come in below expectations, pointing to a slowdown in the post-Covid-19 lockdown boom. With the prospects of a long recovery gaining traction, price action is expected to maintain its downtrend. Will bears accelerate this currency pair into its next horizontal support area? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the USD/SGD remain inside the or breakdown below the 1.3635 to 1.3700 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.3675

- Take Profit Zone: 1.3430 – 1.3470

- Stop Loss Level: 1.3735

Should price action for the USD/SGD breakout above 1.3700 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.3735

- Take Profit Zone: 1.3800 – 1.3860

- Stop Loss Level: 1.3700

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.