Trouble does not come alone: the coronavirus pandemic has caused unprecedented problems in the world economy, the consequences of which people around the world will feel over the next few years. The new economic crisis announced by the International Monetary Fund could be the biggest and most severe since the Great Depression of the 1930s. And the date and consequences of its end are almost impossible to predict, as the coronavirus pandemic is still ongoing.

The decline in stocks and the collapse of the oil market, the depreciation of major world currencies are by no means all the consequences of a global pandemic of the Chinese virus. Still, traders can take advantage of bear market investing in the assets that have hit bottom and will definitely recover. Learning how to trade in bear market is vital for everyone who wants to take care of the investment portfolio and get lucrative profits from the falling market.

In this article, we will learn what a bear market is, how to differentiate it from a bullish one, as well as how to trade in bear markets using different types of assets.

What is a Bear Market?

A bear market is the state of the market, in which assets` prices are falling, and widespread pessimism leads to a negative self-contained mood. While investors expect losses in the bear market and sales continue, pessimism only increases. Although the numbers may change, for many, a decline of 20% or more in a few broad market indices such as the Dow Jones Industrial Average (DJIA) or 500 Standard & Poors (S&P 500) in at least two months is considered an entry into a bear market.

When it comes to a single company, it is possible to judge the phase of the market it is in by looking at its share price chart. For example, a chart of Tesla shares:

As you can see from the chart, the period from November 2018 to July 2019 was the most bearish.

When it comes to the stock market in general, you can rely on charts of so-called stock indices. After all, it is known that stock indices are built based on share prices of companies - the most typical market representatives.

For example, let's have a look at the chart the S&P 500 index:

It is based on the share prices of 500 largest companies traded on the largest U.S. stock exchanges. Therefore, we can say that its chart reflects the state of affairs in the U.S. stock market as a whole.

As can be seen from the above figure, the U.S. stock market has been showing quite an enviable growth throughout its recent history. However, there are a couple of periods ( 2000- 2003 and 2007-2009), when it turns from bullish to bearish for some time.

As a matter of fact, in the graphical representation, a bearish market is a usual downtrend visible on charts with rather high time frames (from D1 and above). And the reversal of almost any price trend can be predicted using such technical analysis tools as reversal patterns and support/resistance levels.

The Difference Between a Bear Vs Bull Market

Needless to say, the fundamental factor in choosing the direction of the trade is the trend. Everyone will agree that it is quite challenging to identify an already existing trend. It's because the influence of bears or bulls sometimes is not that obvious. However, if you use technical and fundamental analysis to study the market, you can determine what moods are inherent to the trend at the moment. Beginners should know that it is better to start trading by opening long positions at the moment when an uptrend appears, and the price begins to rise. For those who have long been familiar with the stock market, the direction of position does not play a decisive role. The main thing is (especially for novice traders) that the order should be placed strictly according to the trend.

Before we move to how to trade in bear market, let us consider both market states to make sure that we know who is who.

- Bullish market

Logically, bulls will prevail in this market. In other words, those traders who open trades to buy, thus they stimulate demand and cause the rate to rise. We can say that this category includes the most optimistic traders who expect positive news on the asset, or economy as a whole.

Often, an uptrend dominates at such moments on the stock exchange, but there is no hurry to open short positions. First of all, it is necessary to find out what is the duration of the price increase and possible prospects for a trend reversal. There can exist a bullish market until the moment when game-changing news is released or until the moment when the price reaches the maximum possible level and starts moving in the opposite direction.

- Bearish market

The bear market can still be called a pessimistic market, as most players are focused on lowering the price and placing sell orders. It is a well-known fact that the value of financial instruments, especially currency pairs, is falling due to the pressure of negative news and a continuous increase in the number of Sell orders.

Periodically, investing in bear markets increases odds of closing more positions, the main thing is to catch the right moment when the price reaches its bottom, and you should be extremely careful not to use correction for a trend reversal.

To recognize what moods reign in the market at the moment, it will be enough to look at the feed of recent events, and then assess the current price movement.

A trader needs to consider the fact that a downtrend cannot last forever. One day it will be replaced by an uptrend, and the market will be taken over by the bulls. It is crucial to determine the duration of the bearish trend before opening a short position. One of the most common bear market trading strategies is to close the buy orders, which are more or less at risk.

No matter what market you trade on, you should first of all pay attention to the trading system signals and fundamental and technical analysis data.

What to Invest in a Bear Market

Once you decide to start trading a bear market, the number one thing you need to do is to take a deep breath and not to jump in with both feet buying discount stocks. And it is not just about bear market investing. The same rules apply to each trading decision you make. It can be either placing an order or closing losing position. The point is that during a crisis, investors tend to panic and sell everything they have before the price drops too much, or buy everything that is at sell-off. Think carefully of what you are going to do and what is your target, moving blindly and hoping for the best is not an option when it comes to bear market trading.

As each trader has a different trading approach and risk tolerance, they all act differently in investing in bear markets. Some of them prefer focusing on sector rotation, and the others would prefer to concentrate on safe-haven assets, like gold or some of the currencies. Let us look at both of them, so you choose which one is better for you and complies with your bear market trading strategies.

Bear market investing using sector rotation

The basic idea behind this strategy is based on the "unevenness" of market value dynamics of assets. It assumes that regardless of the conditions in the financial markets, different assets belonging to the same class will show heterogeneous dynamics. Under this strategy, the "unevenness" is subject to certain regularities based on which it is possible to forecast the movement of market quotes of assets with a certain degree of reliability.

Based on these forecasts, the investor regularly reviews the structure of his portfolio to maximize the share of those assets that are expected to outperform other similar assets.

There are two main options for implementing the rotation strategy:

Inclusion and exclusion of assets from the portfolio at the moment of its revision (at each rebalancing the investor gets rid of those assets that have exhausted their potential and include new, more promising assets, i.e. in this case the structure of the portfolio undergoes radical changes);

Change in specific weights of individual assets (each rebalancing of the portfolio changes shares of individual assets: shares of "promising" assets increase and shares of "depressed" assets decrease, while the assets as a whole do not undergo fundamental changes).

As the practice shows, the most effective asset rotation strategy turns out to be the one that meets the following conditions at the same time:

assets included in the investment portfolio are characterized by a high level of liquidity;

assets have a comparable level of volatility;

assets have a sufficiently long market history.

Theoretically, assets can be rotated based on almost any "price" pattern identified by an investor, but in world practice, three main approaches have become widely known, each of which can be effectively implemented in bear market trading.

Geographic rotation. Implies "unevenness" of dynamics of macro-regional or national markets, that are conditioned by the specifics of the world economy development in general. Even in the presence of stable macroeconomic trends, local stock markets will show unbalanced dynamics due to the impact of internal factors: level of public debt, unemployment, the demographic structure of the population, etc.

Sectoral rotation. The investor redistributes shares between separate sectors within his investment portfolio. This approach to rotation implies that the investor tries to use existing patterns in the "unevenness" of the movement of individual sectors of the economy. For example, industries oriented to consumer demand are much more responsive to changes in the average income level of the population as compared to the ones that pay attention to investment demand.

Seasonal rotation. It takes into account that in many sectors of the world economy, the distribution of income during the year is uneven. Such "unevenness" is caused by specific features, which are peculiar to this or that type of business. For example, strongly pronounced seasonality is typical for tourism, agriculture, production of soft drinks, ice cream, catering, etc. Regardless of the variant of practical implementation of the rotation strategy, it allows investors to increase return on bear market investment at a controlled level of accepted risks.

Bear market investing into safe-haven assets

The COVID-19 outbreak has shaken the financial stability of the world economy, including traders and investors of different spheres. In such moments, when financial markets have been falling for months, safe-haven instruments are either maintaining or increasing their value.

An asset that can become a safe-haven must have at least three properties. Firstly, it must have a negative correlation with other major asset classes over a long period. Second, a safe-haven asset should have the highest credit quality and near-zero default risk and very low storage and settlement risks.

Thirdly, a secure asset should have a liquid market that will not lose its capacity during the crisis, even if liquidity in other markets disappears.

In early 2020, in the realities of market panic due to the spread of the coronavirus COVID-2019 and oil turbulence, gold, and some currencies became such safe-haven.

Gold enjoys a reputation as the best safe-haven asset in times of economic crisis and financial turmoil. Even though in the second half of the twentieth-century gold lost most of these functions and interest, and rent income gold does not bring, the growth of the exchange value of quotes of this precious metal is a long-term trend. Gold copes with protection against inflation much better than any fiat money. So much better than the price of the basket of basic products, expressed in gold, has not changed in two thousand years in Europe. Indeed, a decade of extremely low inflation in most developed economies has significantly reduced the need to hedge against inflation. In countries with negative interest rates on deposits, it is more profitable to keep assets in gold bars than in bank accounts. And the role of gold, as a means of diversifying the portfolio, and, especially, in providing positive returns in case of a fall in stocks remains very relevant.

Cash is also considered to be a safe-haven asset, but some national currencies are at risk of devaluation. Still, some assets can indeed support in the most challenging times.

Swiss franc

Such financial instruments include the Swiss franc, as it shows itself quite steadily. A viable currency is almost unaffected by crisis factors. The last devaluation happened in 1936, but after the Great Depression, there were no such situations, and the exchange value of the CHF remained almost unchanged.

Looking at the world crisis of 1973 and 2008, one can see how the stable franc keeps its former position. It is for this reason that the currency unit is still considered a reserve and serves to preserve capital.

It should be mentioned that such stability is ensured by the banking system. Local institutions serve not only their residents but also many wealthy guests. They have brought the country huge cash flow and a reputation as a global bank.

Another important factor of influence is the provision of gold reserves for banknotes. At the beginning of the 2000s, reserves covered about 40% of all national money. Although currency is rarely used in international settlements, its rate is easily predicted even by beginners. To analyze the currency pair, it is enough to examine one country, while the state of the second rarely changes.

Japanese Yen

Japan's economic situation is an example for most countries. This country is developing with great speed and is considered attractive for foreign investments. Local currency allows us to store funds safely and securely because sharp price hikes on the quotes chart are almost impossible.

Before investing, a trader needs to understand what affects the valuation of the Japanese yen. The currency rate directly depends on the local economy and business development. The better the product is sold, the more money the Japanese get. Good trading relations also contribute to the liquidity of JPY. It is because all transactions, except for the U.S., are made through the local currency.

Specialists note good prospects for the yen and the franc. These currencies have proved themselves perfectly in recent years, and now they are market leaders. When selecting assets to create a reserve, many government agencies are focused on this money, because unlike the U.S. dollar, they are not affected by political conflicts and trade wars. The calm domestic and external environment guarantees Japan and Switzerland a sustainable economic system.

How to Trade a Bear Market

For the economy as a whole, the bear market is not the best option. After all, the drop in prices leads to a decline in corporate profits. As a result, - an increase in unemployment and other related issues.

However, from a trader's point of view, it does not matter which market to make money on. He can make money on the bull market and, with the same success, make money on the falling bear market. It can be done with the help of CFDs (Contract for Difference). Basically, it is an agreement between two parties (seller and buyer) to transfer the difference between the value of an asset at the time of opening a position and its value at the time of closing. So, let us see how to trade in bear market.

Bear market trading using hedging strategies

One of the options to prevent unexpected fluctuations in market assets is hedging, which has already proved its effectiveness over many years. It can be considered a reliable way to protect your finances. It turns out that the asset price becomes fixed for you at the time of the trade.

There are several hedging methods:

Intermarket hedging. Trades at the spot market are "interrupted" by futures or options. Let's say you bought EUR/USD - it means you need to buy a CALL option with the same volume. There is nothing complicated in this strategy. Having access to the options market, a trader can buy contracts in the opposite direction, risking only the option contract reward. If you have correctly determined the direction of the asset, you can sell the option by losing the reward (a small amount compared to the total amount of the trade). If you make a mistake, the option hedging will work and prevent you from losing your deposit.

Cross-hedging. It assumes the opening of the opposite order on another currency pair. A pair with a negative correlation to the main instrument is chosen. It requires certain experience for a successful closing of the position, as well as double investments.

Lock. Locking of positions assumes that one trade will bring profit and the other loss. Risks are associated with the misuse of a trading strategy and possible losses in both directions. But if you manage to master this complex trading instrument, you will be able to get profit from both positions. The main thing here is that the profit from successful orders is more than losses from losing ones. To use hedging while trading bear market, the first thing you need to do is to analyze which assets correlate with each other. If there is a bullish trend on the EUR/USD chart and EUR/JPY is in uptrend too, and combinations of Japanese candlesticks are similar, both assets can be used. This example is called hedging of unidirectional currency pairs. In this case, we are buying on the EUR/USD pair in terms of the current trend. For insurance purposes, in case the rate reverses EUR/JPY, we sell the same volume as the first trade.

Locking hedge strategy is based on parallel or mirror rate fluctuations, as a result of which we get an opportunity to compensate for the failures. Correct use of the described technique will allow not only to minimize losses but also to increase profits significantly.

Bear market short-selling

One of the ways to invest in a bear market is short-selling with the help of CFDs.

In trading, short positions can be used for speculation or hedging purposes. Consequently, traders place short orders to benefit from the potential decline in a particular asset or the market as a whole. Hedgers use this strategy to protect profits or reduce losses in the portfolio

Experienced traders and institutional investors often use short positions in bear market trading strategies, both for speculation and hedging. Hedge funds are among the most active users of short positions in individual stocks or sectors to hedge their long positions.

Short-selling offers traders the opportunity to profit from a bear market investing in the assets that are dropping in value. Note that these strategies should only be used by experienced traders and advanced investors due to the risk of large losses.

Traders who believe that "trend is your friend" are more likely to earn on short positions trading bear market than during a strong bullish market phase. Learning how to trade in the bear market, traders can sufficiently grow their capital since n times of the recession market falls fastly and deeply, like in 2008-09. In such periods bears can make more profit.

Are We in a Bull or Bear Market in 2020?

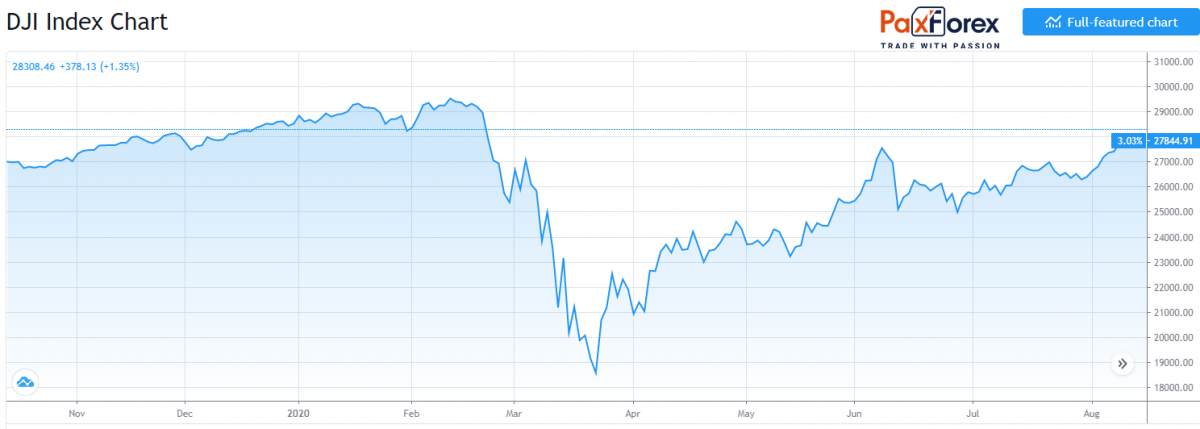

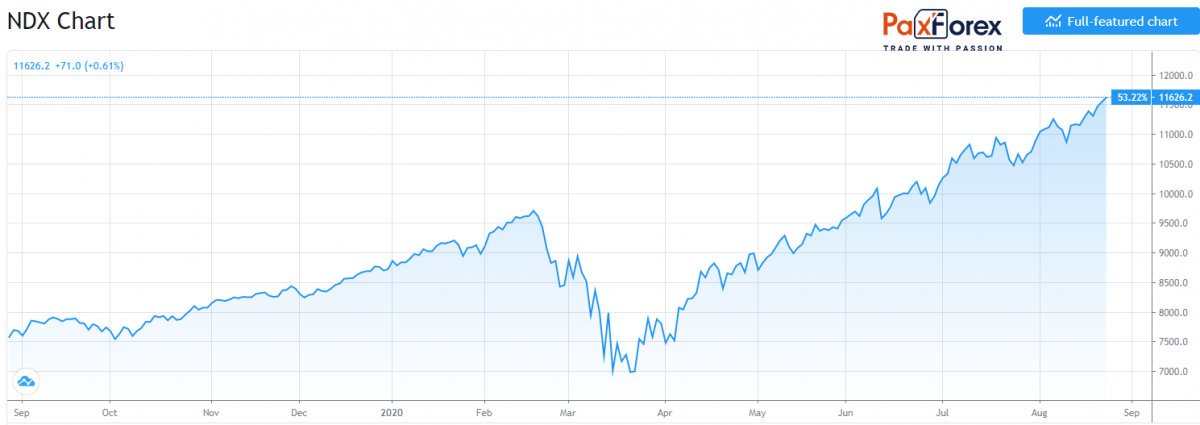

February and March 2020 are the worst months for world stock markets since 2008. Exchange indices have lost tens of percent, and experts say that the 11-year growth cycle since the last financial crisis has come to an end.

Against the backdrop of a new disease outbreak, investors have reconsidered their views on the future of the world economy. Restrictive measures introduced in different countries harmed almost all industries related to consumer activity: tourism, trade, catering, entertainment, and others. Under quarantine conditions, people spend and move less.

On Thursday, March 12, the New York Stock Exchange experienced the largest - since "black Monday" 1987 - collapse, despite the decision of the Federal Reserve, acting as the U.S. Central Bank, to allocate $1.5 trillion as short-term loans to stimulate the national economy and stabilize the financial system.

Thus, the American industrial index Dow Jones lost 9.99% at a certain point of trading, having dropped by 2352.60 points to 21,200.62. The S&P 500 stock index, which includes the 500 largest companies in the U.S. market and is called the "barometer of the American economy," collapsed by 9.51 percent (260.74 points) and broke down the mark of 2480.64 points. Nasdaq, an index specializing in high-tech stocks, dropped 9.43 percent (750.25 points) to 7,201, 80.

Currently, we can see optimism in the markets, as the second wave of the pandemic was not that severe, adding to that the anticipation of the vaccine developed by different pharmaceutical companies. Of course, we cannot say right now that the crisis is over since it will take several years (at least) for economies to recover.

Paying attention to what we have just discussed above, a trader will be able to diversify a portfolio investing in bear market.

Why Trade a Bear Market With Paxforex?

Trading a bear market with PaxForex allows you to get the best trading experience powered by the most convenient and fastest platform MetaTrader 4. We have tailored several account types to best suit our clients` needs and personalities. Here you can take advantage of bear market short-selling since PaxForex offers CFDs trading on the most popular US stocks and commodities.

Open an account right now and get the most out of trading a bear market with the best CFD broker!