Source: PaxForex Premium Analytics Portal, Fundamental Insight

The Final Japanese Jibun Bank Services PMI for August was reported at 45.0, and the Final Japanese Jibun Bank Composite PMI at 45.2. Economists predicted a figure of 45.0 and 44.9. Forex traders can compare this to the previous Japanese Jibun Bank Services PMI for August, reported at 45.4, and to the previous Japanese Jibun Bank Composite PMI, reported at 44.9.

US Initial Jobless Claims for the week of August 29th are predicted at 950K, and US Continuing Claims for the week of August 22nd are predicted at 14,000K. Forex traders can compare this to US Initial Jobless Claims for the week of August 22nd, which were reported at 1,006K, and to US Continuing Claims for the week of August 15th, which were reported at 14,535K.

Final US Non-Farm Productivity for the second quarter is predicted to increase by 7.5% quarterly, and Unit Labor Costs are predicted to increase by 12.1% quarterly. Forex traders can compare this to US Non-Farm Productivity for the first quarter, which increased by 7.3% quarterly, and to Unit Labor Costs, which increased by 12.2% quarterly. The US Trade Balance for July is predicted at -$58.0B. Forex traders can compare this to the US Trade Balance for June, reported at -$50.7B.

The US Final Markit Services PMI for August is predicted at 54.8, and the US Final Markit Composite PMI is predicted at 54.7. Forex traders can compare this to the US Markit Services PMI for July, reported at 50.0, and to the US Markit Composite PMI, reported at 50.3. The US ISM Non-Manufacturing PMI for August is predicted at 57.0. Forex traders can compare this to the US ISM Non-Manufacturing PMI for July, reported at 58.1. The ISM Non-Manufacturing Business Activity Index for August is predicted at 65.0. Forex traders can compare this to the ISM Non-Manufacturing Business Activity Index for July, reported at 67.2.

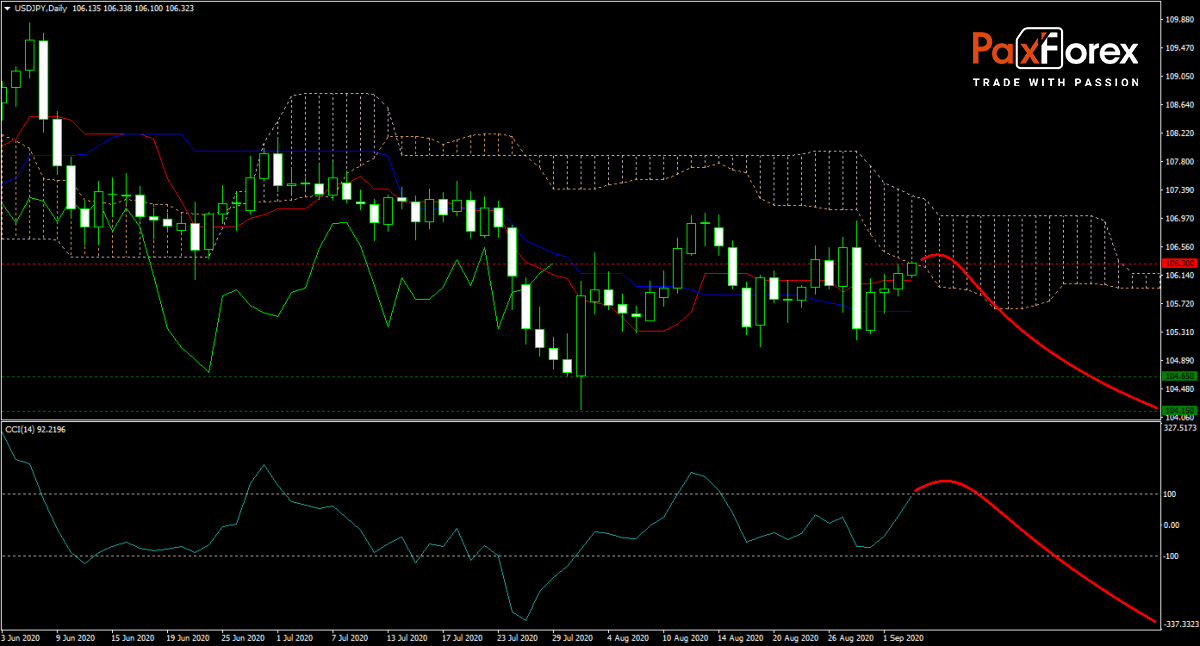

The forecast for the USD/JPY turned bearish after yesterday’s ADP data for August disappointed. Forex traders will look forward to today’s initial jobless claims data and tomorrow’s NFP report, to get a better assessment of the state of the labor market. Price action approached the Senkou Span A of its downward sloping Ichimoku Kinko Hyo Cloud. Can bears force this currency pair into a retreat into its horizontal support area? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the USDJPY remain inside the or breakdown below the 106.100 to 106.600 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 106.300

- Take Profit Zone: 104.150 – 104.650

- Stop Loss Level: 106.950

Should price action for the USDJPY breakout above 106.600 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 106.950

- Take Profit Zone: 107.500 – 108.150

- Stop Loss Level: 106.600

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.