The Tokyo CPI for March increased by 0.4% annualized. Economists predicted an increase of 0.3% annualized. Forex traders can compare this to the Tokyo CPI for February, which increased by 0.4% annualized. The Tokyo Core CPI for March increased by 0.7% annualized. Economists predicted an increase of 0.6% annualized. Forex traders can compare this to the Tokyo Core CPI for February, which increased by 0.7% annualized. The Tokyo CPI Excluding Fresh Food for March increased by 0.4% annualized. Economists predicted an increase of 0.4% annualized. Forex traders can compare this to the Tokyo CPI Excluding Fresh Food for February, which increased by 0.5% annualized.

US Personal Income for February is predicted to increase by 0.4% monthly, and Personal Spending is predicted to increase by 0.2% monthly. Forex traders can compare this to Personal Income for January, which increased by 0.6% monthly and to Personal Spending, which increased by 0.2% monthly. Real Personal Spending for February is predicted to increase by 0.2% monthly. Forex traders can compare this to Real Personal Spending for January, which increased by 0.1% monthly. The PCE Deflator for February is predicted to increase by 0.1% monthly and by 1.7% annualized. Forex traders can compare this to the PCE Deflator for January, which increased by 0.1% monthly and by 1.7% annualized. The PCE Core Deflator for February is predicted to increase by 0.2% monthly and by 1.7% annualized. Forex traders can compare this to the PCE Core Deflator for January, which increased by 0.1% monthly and by 1.6% annualized.

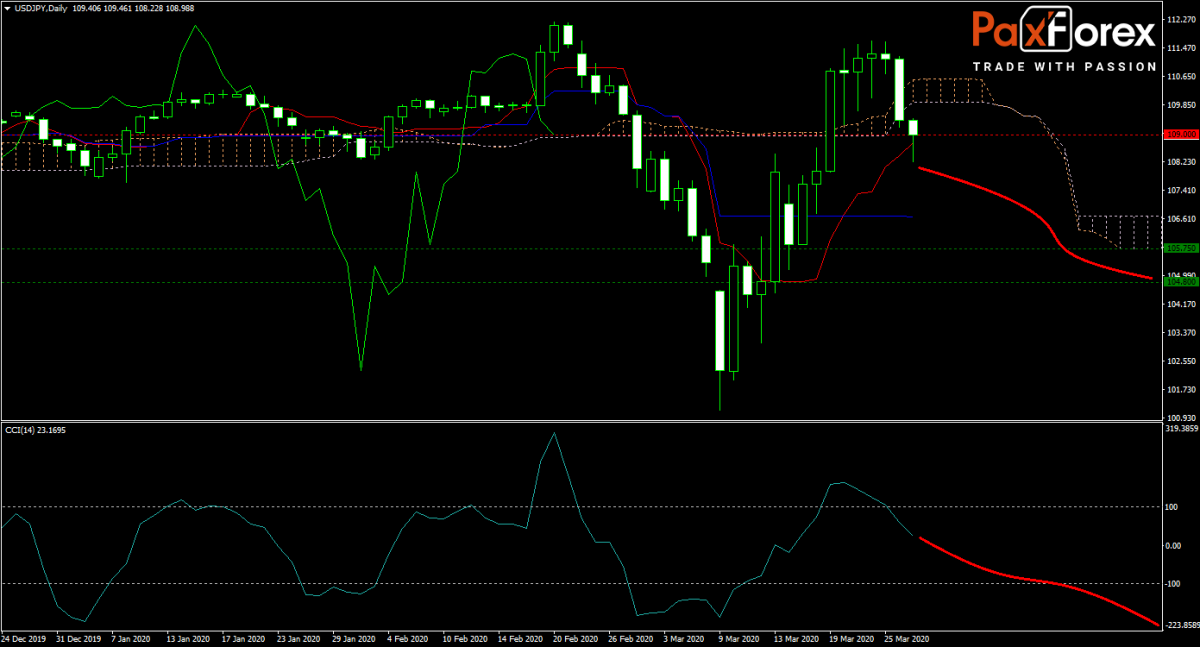

Final US Michigan Consumer Sentiment for March is predicted at 90.0. Forex traders can compare this to previous US Michigan Consumer Confidence for March, which was reported at 95.9. Final Current Conditions for March are predicted at 112.5. and Final Expectations are predicted at 85.3. Forex traders can compare this to previous Current Conditions for March, which were reported at 112.5 and to Expectations, which were reported at 85.3. The USD/JPY completed a breakdown below its horizontal resistance area, and the forecast has now turned bearish. Where is price action headed to next? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the USD/JPY remain inside the or breakdown below the 108.500 to 109.600 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 109.000

- Take Profit Zone: 104.800 – 105.750

- Stop Loss Level: 110.000

Should price action for the USD/JPY breakout above 109.600 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 110.000

- Take Profit Zone: 111.650 – 112.200

- Stop Loss Level: 109.600

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.