Source: PaxForex Premium Analytics Portal, Fundamental Insight

The Preliminary Japanese Manufacturing PMI for July was reported at 42.6 and the Preliminary Services PMI at 45.2. Forex traders can compare this to the Japanese Manufacturing PMI for June, reported at 40.1, and to the Services PMI, reported at 45.0. US Existing Home Sales for June are predicted to increase by 24.5% monthly to 4.78M. Forex traders can compare this to US Existing Home Sales for May, which decreased by 9.7% monthly to 3.91M.

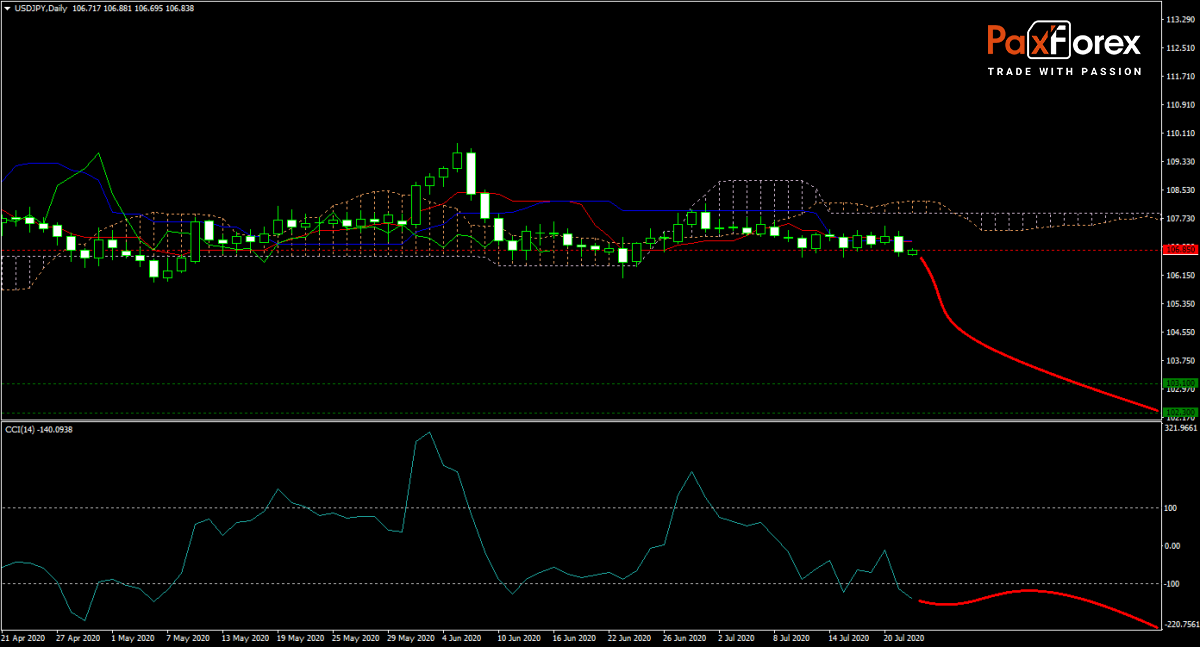

The forecast for the USD/JPY remains bearish with the Covid-19 pandemic continuing to impact the global economy negatively in a period where the virus was supposed to be less aggressive. US President Donald Trump, one of the last leaders to admit the severity of the crisis, noted that the pandemic is likely to worsen from present levels before it can improve. Price action is below the Kijun-sen and Tenkan-sen, as well as below t a flat Ichimoku Kinko Hyo Cloud. A sell-off into its next horizontal support area is presently expected. Will bears awaken this week? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the USDJPY remain inside the or breakdown below the 106.350 to 107.350 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 106.850

- Take Profit Zone: 102.300 – 103.100

- Stop Loss Level: 108.000

Should price action for the USDJPY breakout above 107.350 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 108.000

- Take Profit Zone: 109.200 – 109.850

- Stop Loss Level: 107.350

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.