Source: PaxForex Premium Analytics Portal, Fundamental Insight

Japanese Household Spending for June increased by 13.0% monthly and decreased by 1.2% annualized. Economists predicted an increase of 7.5% and a decrease of 7.5% annualized. Forex traders can compare this to Japanese Household Spending for May, which decreased by 0.1% monthly and by 16.2% annualized. Japanese Average Cash Earnings for June decreased by 1.7% annualized, and Japanese Overall Wage Income decreased by 1.7% annualized. Forex traders can compare this to Japanese Average Cash Earnings for May, which decreased by 2.3% annualized and to Overall Wage Income, which decreased by 2.3% annualized.

Japanese FX Reserves for July were reported at $1.402.5B. Forex traders can compare this to Japanese FX Reserves for June, reported at $1.383.2B. The Preliminary Japanese Leading Index for June was reported at 85.0, and the Preliminary Japanese Coincident Index was reported at 76.4. Forex traders can compare this to the Japanese Leading Index for May, reported at 78.4, and to the Japanese Coincident Index, reported at 72.9.

The US NFP Report for July is predicted to show 1,600K job additions and an unemployment rate of 10.5%. Forex traders can compare this to the US NFP Report for June, which showed 4,800K job additions and an unemployment rate of 11.1%. Private Payrolls for July are predicted to show 1,474K job additions and Manufacturing Payrolls 253K job additions. Forex traders can compare this to Private Payrolls for June, which showed 4,767K job additions, and to Manufacturing Payrolls, which showed 356K job additions. The Average Work Week for July is predicted at 34.4 hours. Forex traders can compare this to the Average Work Week for June, reported at 34.5 hours. Average Hourly Earnings for July are predicted to decrease by 0.5% monthly and to increase by 4.1% annualized. Forex traders can compare this to Average Hourly Earnings for June, which decreased by 1.2% monthly, and which increased by 5.0% annualized.

US Wholesale Inventories for June are predicted to decrease by 2.0% monthly, and Wholesale Trade Sales are predicted to increase by 4.9% monthly. Forex traders can compare this to US Wholesale Inventories for May, which decreased by 1.2% monthly, and to US Wholesale Trade Sales, which increased by 5.4% monthly. US Consumer Credit for June is predicted at 10.00B. Forex traders can compare this to US Consumer Credit for May, reported at -$18.28B.

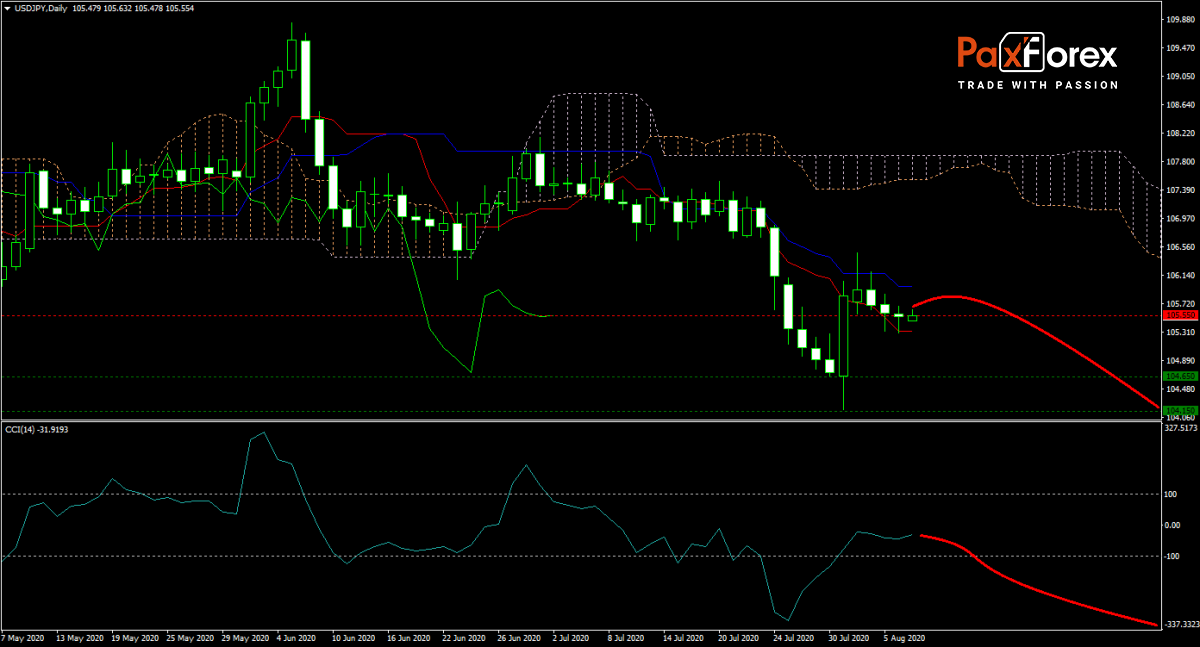

The forecast for the USD/JPY remains bearish. This morning’s data revealed better than expected household spending data for June out of Japan. The Japanese Yen continues to experience safe-haven capital inflows with the global Covid-19 pandemic approaching 20,000,000 infections. Today’s NFP data will be in focus, favored delivering the next major catalyst. Will bears extend the sell-off, assisted by the descending Ichimoku Kinko Hyo Cloud? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the USDJPY remain inside the or breakdown below the 105.350 to 106.000 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 105.550

- Take Profit Zone: 104.150 – 104.650

- Stop Loss Level: 106.450

Should price action for the USDJPY breakout above 106.000 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 106.450

- Take Profit Zone: 107.200 – 107.500

- Stop Loss Level: 106.000

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.