Source: PaxForex Premium Analytics Portal, Fundamental Insight

US Personal Income for June is predicted to decrease by 0.5% monthly, and Personal Spending to increase by 5.5% monthly. Forex traders can compare this to Personal Income for May, which decreased by 4.2% monthly, and to Personal Spending, which increased by 8.0% monthly. The PCE Core Deflator for June is predicted to increase by 0.2% monthly, and by 1.0% annualized. Forex traders can compare this to the PCE Core Deflator for May, which increased by 0.1% monthly and by 1.0% annualized.

The US Chicago PMI for July is predicted at 43.9. Forex traders can compare this to the US Chicago PMI for June, reported at 36.6. Final US Michigan Consumer Sentiment for July is predicted at 73.0. Forex traders can compare this to US Michigan Consumer Confidence for May, reported at 73.3. Final Current Conditions for July are predicted at 84.2, and Final Expectations are predicted at 66.2. Forex traders can compare this to Current Conditions for June, which were reported at 87.1 and to Expectations, which were reported at 72.3.

The Canadian GDP for May is predicted to increase by 3.5% monthly. Forex traders can compare this to the Canadian GDP for April, which decreased by 11.6% monthly. The Canadian Industrial Product Price Index for June is predicted to increase by 0.5% monthly, and the Canadian Raw Materials Price Index is predicted to increase by 6.9% monthly. Forex traders can compare this to the Canadian Industrial Product Price Index for May, which increased by 1.2% monthly and to the Canadian Raw Materials Price Index, which increased by 16.4% monthly.

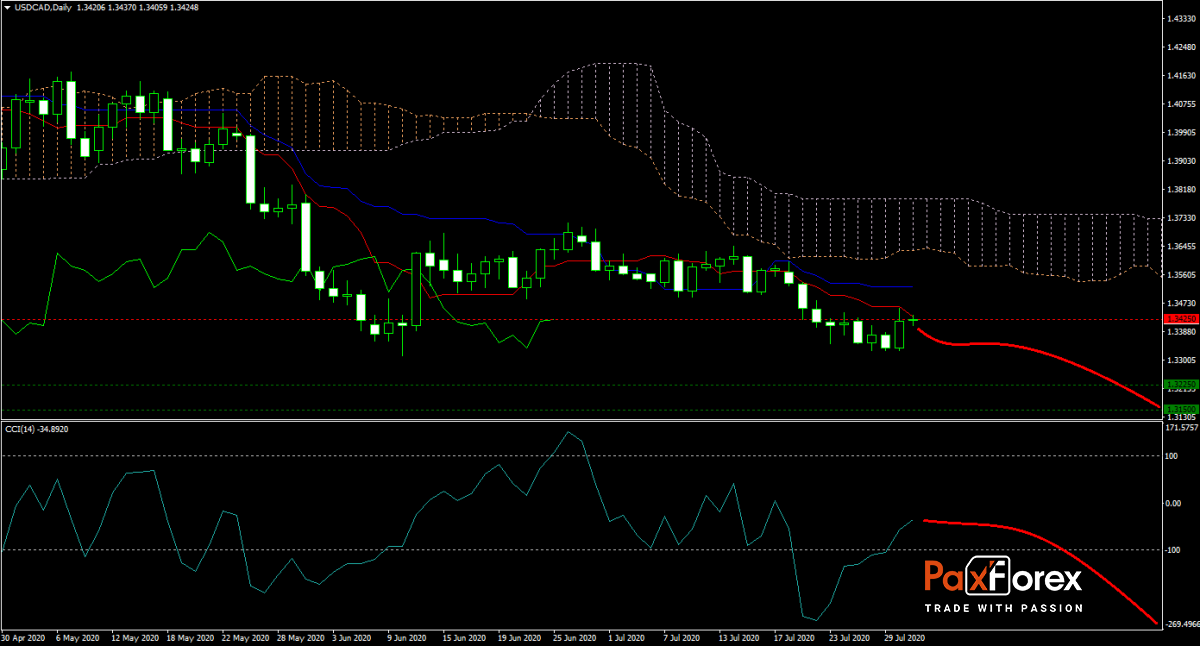

The forecast for the USD/CAD remains bearish after the US reported a record quarterly collapse in GDP, and initial jobless claims are trending higher once again. Today’s income and spending data are in focus together with the Chicago PMI. Canada will also release its May GDP. The Tenkan-sen is adding downside pressure on price action while the Ichimoku Kinko Hyo Cloud is slowly descending. Will bears force a sell-off into the weekend? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the USD/CAD remain inside the or breakdown below the 1.3385 to 1.3460 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.3425

- Take Profit Zone: 1.3150 – 1.3225

- Stop Loss Level: 1.3525

Should price action for the USD/CAD breakout above 1.3460 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.3525

- Take Profit Zone: 1.3645 – 1.3680

- Stop Loss Level: 1.3460

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.