Source: PaxForex Premium Analytics Portal, Fundamental Insight

The US PPI for June is predicted to increase by 0.4% monthly and to decrease by 0.2% annualized. Forex traders can compare this to the US PPI for May, which increased by 0.4% monthly, and which decreased by 0.8% annualized. The US Core PPI for June is predicted to increase by 0.1% monthly and by 0.4% annualized. Forex traders can compare this to the US Core PPI for May, which decreased by 0.1% monthly, and which increased by 0.3% annualized.

The Canadian Employment Report for June is predicted to show the loss of 700.0K jobs and an Unemployment Rate of 12.0%. Forex traders can compare this to the Canadian Employment Report for May, which showed the addition of 289.6K jobs and an Unemployment Rate of 13.7%.

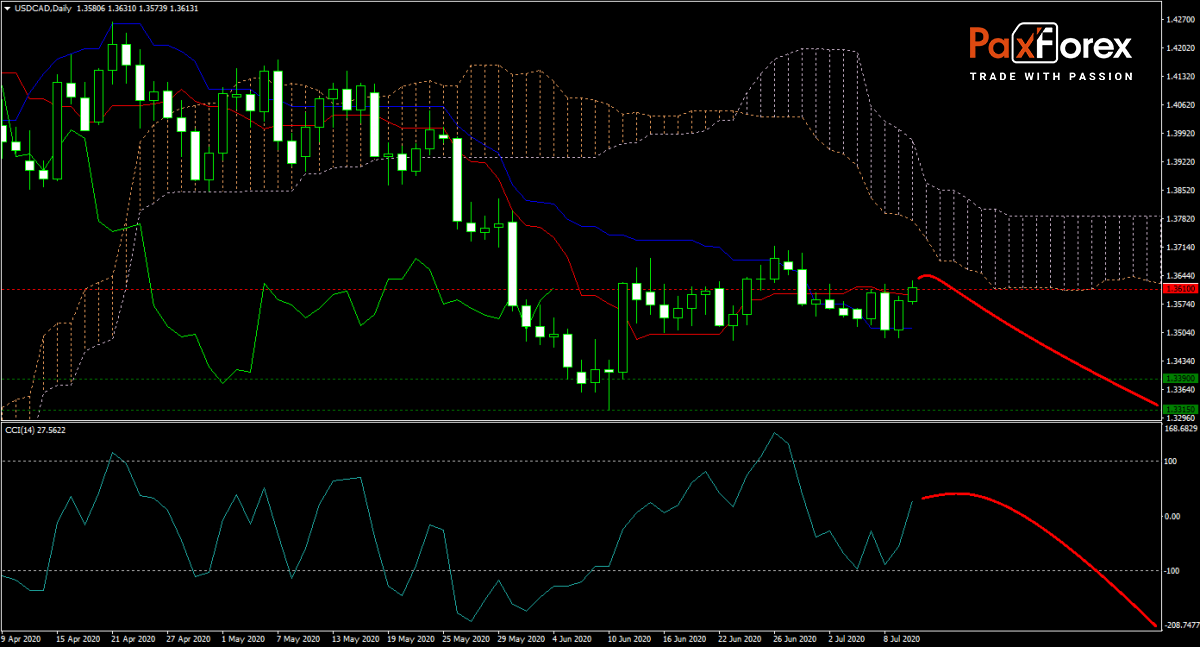

The USD/CAD forecast remains bearish as Canada appears to have control over the Covid-19 pandemic while the US lost it, with new infections threatening the health system and the economy in a growing area across the US. Price action is faced with depressive forces delivered by its Ichimoku Kinko Hyo Cloud. Today’s employment report out of Canada could give bears a push to drive this currency pair into its horizontal support area. Will economic data deliver this afternoon? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the USD/CAD remain inside the or breakdown below the 1.3580 to 1.3630 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.3610

- Take Profit Zone: 1.3315 – 1.3390

- Stop Loss Level: 1.3670

Should price action for the USD/CAD breakout above 1.3630 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.3670

- Take Profit Zone: 1.3715 – 1.3800

- Stop Loss Level: 1.3630

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.