Source: PaxForex Premium Analytics Portal, Fundamental Insight

US Personal Income for July is predicted to decrease by 0.2% monthly, and Personal Spending to increase by 1.5% monthly. Forex traders can compare this to Personal Income for June, which decreased by 1.1% monthly and to Personal Spending, which increased by 5.6% monthly. The PCE Core Deflator for July is predicted to increase by 0.5% monthly and by 1.2% annualized. Forex traders can compare this to the PCE Core Deflator for June, which increased by 0.2% monthly and by 0.9% annualized.

The US Chicago PMI for August is predicted at 52.0. Forex traders can compare this to the US Chicago PMI for July, reported at 51.9. Final US Michigan Consumer Sentiment for August is predicted at 72.8. Forex traders can compare this to US Michigan Consumer Confidence for July, reported at 72.5. The final Current Conditions for August are predicted at 82.5, and Final Expectations at 66.5. Forex traders can compare this to the Current Conditions for July, reported at 82.8 and to Expectations, reported at 65.9.

The Canadian GDP for June is predicted to increase by 5.6% monthly. Forex traders can compare this to the Canadian GDP for May, which increased by 4.5% monthly. The Canadian GDP for the second quarter is predicted to decrease by 39.6%. Forex traders can compare this to the Canadian GDP for the first quarter, which decreased by 8.2% quarterly.

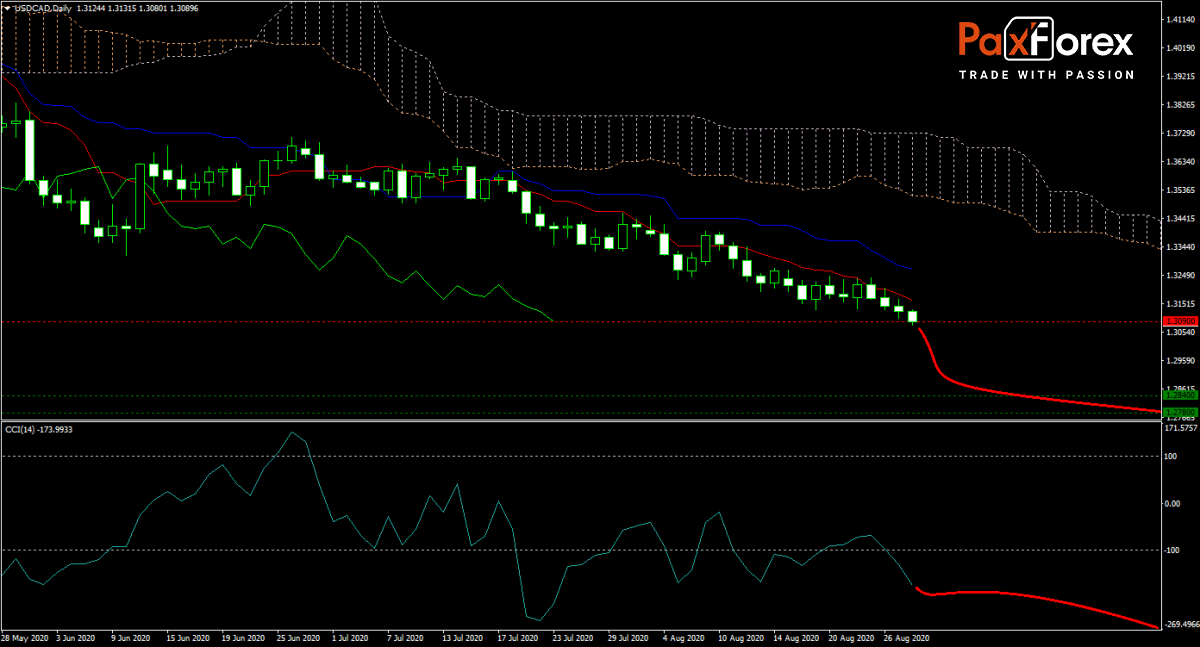

The forecast for the USD/CAD maintains a bearish bias. Yesterday, US Federal Reserve Chairman Jerome Powell outlined new measures to inflation targeting and full employment. It ensures that interest rates will remain on hold until inflation maintains a level above 2.0% for several months, adding to selling pressure in the US Dollar. Price action is trending lower below its descending Kijun-sen and Tenkan-sen, supported by a downward sloping Ichimoku Kinko Hyo Cloud. Will bears succeed in accelerating the sell-off into its next horizontal support area? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the USD/CAD remain inside the or breakdown below the 1.3315 to 1.3160 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.3090

- Take Profit Zone: 1.2780 – 1.2840

- Stop Loss Level: 1.3210

Should price action for the USD/CAD breakout above 1.3160 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.3210

- Take Profit Zone: 1.3360 – 1.3400

- Stop Loss Level: 1.3160

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.