Source: PaxForex Premium Analytics Portal, Fundamental Insight

The New Zealand Unemployment Rate for the second quarter was reported at 4.0%. Economists predicted an Unemployment Rate of 5.8%. Forex traders can compare this to the Unemployment Rate for the first quarter, reported at 4.2%. The Unemployment Change for the second quarter decreased by 0.4%. Economists predicted a decrease of 2.0%. Forex traders can compare this to the Unemployment Change for the first quarter, which increased by 0.7% quarterly. The Participation Rate for the second quarter was reported at 69.7%. Economists predicted a Participation Rate of 69.8%. Forex traders can compare this to the Participation Rate for the first, reported at 70.5%. The Labor Cost Index for the second increased by 0.2% quarterly and by 1.8% annualized. Economists predicted an increase of 0.3% and 1.9%. Forex traders can compare this to the Labor Cost Index for the first quarter, which increased by 0.3% quarterly and by 2.4% annualized.

The US ADP Employment Change for July is predicted at 1,500K. Forex traders can compare this to the US ADP Employment Change for June, reported at 2,369K. The US Trade Balance for June is predicted at -$50.1B. Forex traders can compare this to the US Trade Balance for May, reported at -$54.6B. The US Final Markit Services PMI for July is predicted at 49.6, and the US Final Markit Composite PMI is predicted at 50.0. Forex traders can compare this to the US Markit Services PMI for June, reported at 47.9 and to the US Markit Composite PMI, reported at 47.9. The US ISM Non-Manufacturing PMI for July is predicted at 55.0, and the ISM Non-Manufacturing Business Activity Index for July at 60.0. Forex traders can compare this to the US ISM Non-Manufacturing PMI for June, reported at 57.1., and to the ISM Non-Manufacturing Business Activity Index for June, reported at 66.0.

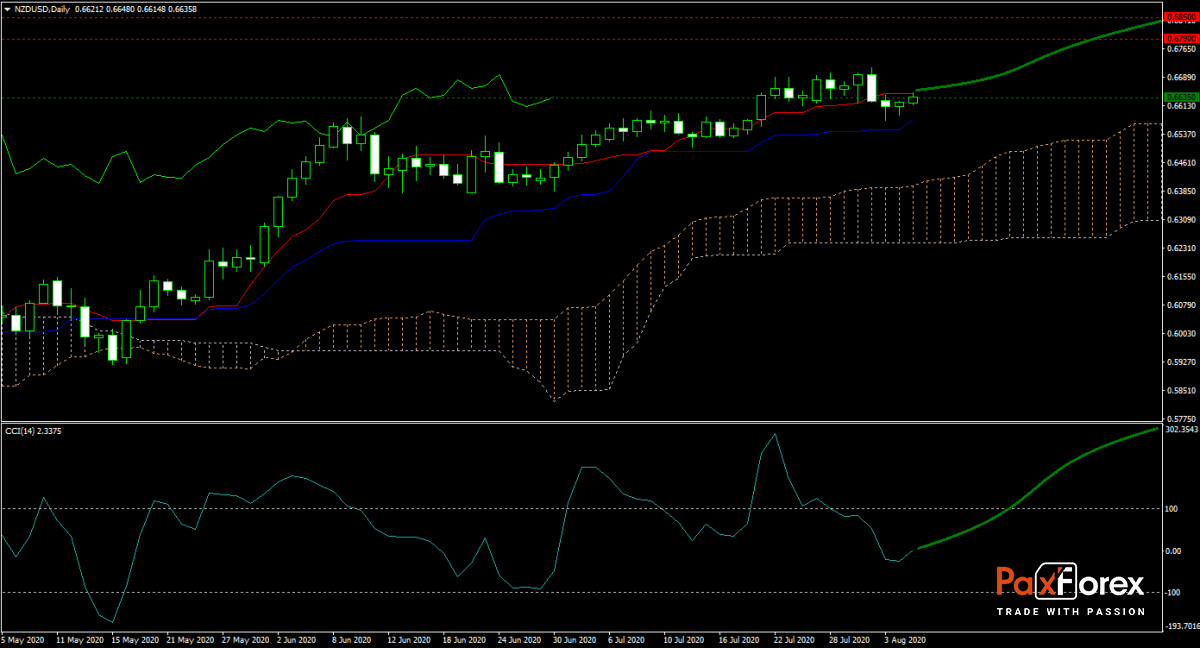

The forecast for the NZD/USD remains bullish after better-than-expected labor market data out of New Zealand. At the same time, the US employment picture is softening, and traders await the July ADP report for the first look into Friday’s NFP data. Initial jobless claims have increased over the past two weeks, but it may not show until the August NFP reading. The ascending Ichimoku Kinko Hyo Cloud, together with the Kijun-sen, should push price action into its next horizontal resistance area. Will bulls get the required economic catalyst today? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the NZD/USD remain inside the or breakout above the 0.6580 to 0.6680 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 0.6635

- Take Profit Zone: 0.6790 – 0.6850

- Stop Loss Level: 0.6530

Should price action for the NZD/USD breakdown below 0.6580 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 0.6530

- Take Profit Zone: 0.6370 – 0.6450

- Stop Loss Level: 0.6580

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.