Successful trading in the Forex market is impossible without applying strategies. Forex strategies themselves are a system of rules, following which a trader makes more successful trades than unsuccessful ones. Clearer adherence to a trading plan almost always brings a positive result. Your Forex trading becomes profitable, eliminating the influence of human factors and random spontaneous decisions that significantly increase the risk of losing capital. And anyone who started trading Forex knows how challenging it can be to find a really working strategy. In this article, we are going to reveal some of the most applied Forex trading strategies, choose one you like.

Picking the Best Forex & CFD Strategy for You in 2020

Profitable and accurate Forex trading strategies are based on three principles:

Any strategy should be based on in-depth analysis. Each of the existing analytical methods has its advantages and disadvantages. When developing the best trading strategies, both technical and fundamental approaches analysis are used comprehensively. It is essential since factors affecting the rate can occur spontaneously, and the use of only one approach often does not allow "catching" all the changes that occur.

Knowledge of the market fundamentals is the key to a break-even strategy of working with the Forex market. Any trader should understand the nuances of the currency market functioning, as well as know-how to work with the principal financial instruments. Therefore, a fundamental profile or financial education plays an important role. If there is no possibility to get it, as well as to study the methods of analysis, you can consider the appropriate courses.

Consolidation of results in practice. One cannot say that strategy is profitable unless it has been tested. It is not recommended to immediately put a large capital into action, as there is a high probability to go into a "deep" minus. To begin with, you should also resort to specialized educational programs, implemented under the guidance of practicing traders. Thus, on specialized courses, for example, you can practice using any new strategy.

Choosing the right Forex trading strategy is quite a challenging and time-consuming task. What may be working for one may be a disaster for another. Some cope with complicated Forex trading strategies that can win on some trades, but mostly only earn a few points. Traders who prefer these types of strategies should use trading strategies with high returns, which allow them to trade for a certain amount of time if they can catch a trend. Others prefer strategies that are regularly making a profit, no matter how little they earn on each trade - these traders should choose trading approaches with a high probability. Others do not have the time or patience to sit all day watching the market. And some traders can not wait a week to close an order, so they would prefer to spend the day trading. Either way, the best type of trading strategy - the one that best suits a trader, you!

50-Pips a Day Forex Strategy

It is the strategy Forex traders prefer the most since it is meant to catch the early market move of GBP/USD or EUR/USD. Do not take it as an axiom, don't be afraid to test on the other currency pairs.

It is a pretty simple day trading strategy. It doesn't mean that it is not effective - best trading Forex strategies are actually simple in the form which makes them pretty efficient. Moreover, it can be a perfect strategy for beginners because it doesn`t require the implication of complicated indicators or price patterns.

This strategy is similar to London breakout and our main goal here is to capture 1/3 – 1/2 of the daily trading range of the currency pair of choice.

We will use 7 a.m. GMT candlestick on the 1-hour chart.

Here are the steps to follow:

As soon as the 7 a.m. GMT candlestick closes, you place two opposite pending orders: a Buy Stop order 2 pips above the high and Sell Stop order 2 pips below the low of the 7 a.m. GMT candlestick;

When price triggers one of the pending orders, you delete the other pending order;

Place a Stop-Loss order anywhere from 5-10 pips above the high/low of the 7 a.m. GMT candlestick after it closes (or has formed) to manage the risk. If you see that this candlestick is too short and that placing the Stop-Loss will be too close to the opening price, then raise your Stop-Loss distance to anywhere from 15-20 pips;

Set your profit target to 50 pips;

Once you have entered the trade, let the market do the job;

If your trade reaches its profit target for the day - good job! Repeat the same process tomorrow;

If you trade has a floating profit or a loss, wait until the end of the day and close the position, notwithstanding if it's positive or negative.

Forex Daily Charts Strategy

Trading on the daily chart can be both medium-term and long-term, depending on the duration of the trades. It has many advantages over short-term trading and allows you to make good profits. Trading Forex strategies for the D1 chart can be both indicator-based and non-indicator-based. It is recommended you test each separately and choose the one that will bring you the most profit.

Trading based on the daily chart has its own features:

Few signals for opening positions compared to short-term trading methods.

Positions are opened for 1 day or more, in most cases carried over to the next day. Therefore, you should consider the swap expenses.

It takes little time to analyze the chart, there is no need to monitor the price movement all day long. Such trading is suitable for those who are busy most of the time at their main job.

One successful trade can bring a profit of 100 points and more. High profit from trading.

The rules of technical and fundamental analysis work out more clearly, unlike trading on low time frames, where the price often behaves unpredictably.

The D1 strategy will not suit impatient traders, as signals in such trading are quite rare. That is why many people prefer to work with several currency pairs, rather than one, in order to compensate for this disadvantage somehow. On the daily chart, there are much fewer false signals than on the charts with lower time frames. In addition, candlesticks and graphical shapes on D1 work much better. As for Stop-Losses and Take-Profits, they are much higher than in short-term trading.

Another feature of trading on D1 is that it requires a significant deposit. Otherwise, the profit from trades will be insignificant. Consideration of the fundamental analysis rules is important for successful trading on daily charts. Global trends on the daily chart do not change frequently, usually no more than 5-8 times a year under the influence of significant economic or political news. Given this factor, we can assume that trends on the daily chart are usually stable, so trading on them is another opportunity to make a decent profit.

You can trade on any currency pair except for exotic low-liquid assets. At the moment of trading, the market should be volatile. It is better to choose popular assets such as GBP/USD, EUR/USD, JPY/USD, etc.

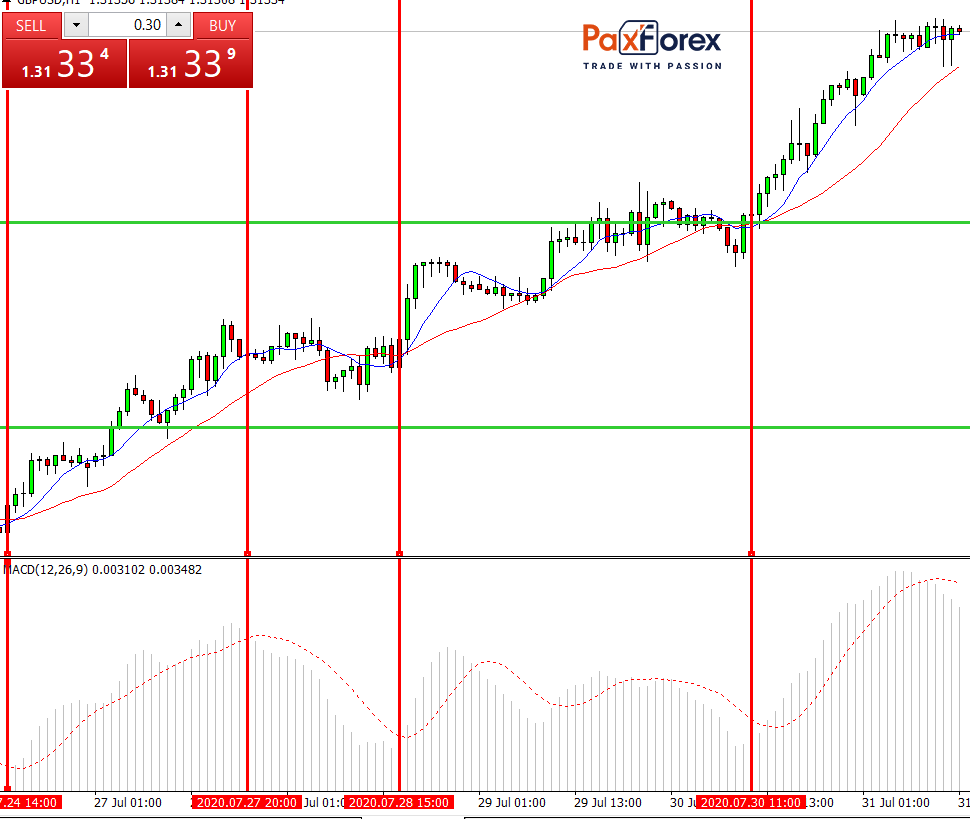

Forex 1-Hour Trading Strategy

Another working strategy of Forex trading is the ones using the H1 time frame. It is advised to use it for such as currency pairs as EUR/USD, USD/JPY, GBP/USD, and the AUD/USD. The main advantage of this approach is that it requires only one technical oscillator - MACD. In order to place it on the chart go to the Insert tab on the left top of the terminal and choose Indicators. In the appeared menu click on the Oscillators option and find here MACD.

The principle of work with the linear indicator MACD in the market is based on the intersection of the main and signal lines. Moreover, if the signal line crosses the main indicator line from bottom to top, it is a buy signal. If there is a crossover from top to bottom, it is a sell signal. It should be mentioned that when the main solid line is located above the signal line - it is an indicator of the presence of a bullish trend in the market, therefore, we open a long position. And vice versa, if the signal dotted line is above the mainline - then bearish trend prevails in the market, then we open a short position.

Forex Weekly Trading Strategy

Many novice traders do not pay attention to the weekly time frame, considering trading on it unprofitable and even boring. The reason is that on the weekly chart signals for opening a position appear every 2-3 months, or even less often. After all, if the time of candlestick formation is one week, it is not difficult to imagine how many months it will take to form at least one candlestick pattern.

To correctly determine the market movement and find a good moment to enter the market, you need to learn to analyze weekly candlesticks.

Now we will have a look at one of the patterns that can be very lucrative if detected in time.

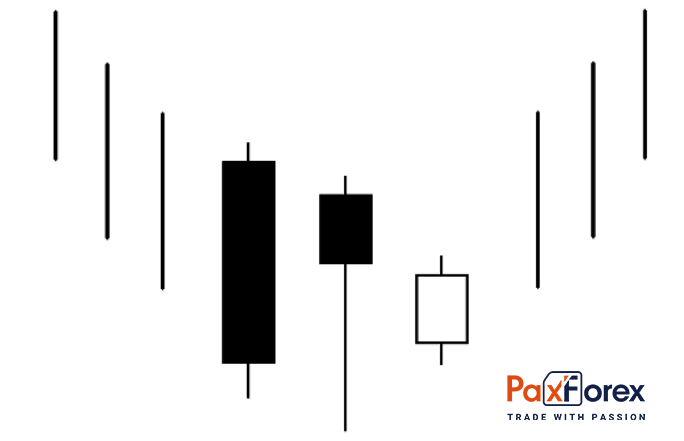

Unique Three River Bottom is a reversal model of Japanese candlesticks, formed on a falling market and predicting its reversal upwards. This pattern is quite rare in the Forex market and can be met mainly on a weekly time frame. However, it has high accuracy and does not require mandatory confirmation (although it will not hurt), so it will be very useful for the trader to know it.

Graphically, the Unique Three River Bottom model is a combination of three candlesticks formed in a downtrend.

Let us consider the features of these candlesticks:

The first candle - has a long black body, with short shadows.

The second candle - also a black candle, but with a small body, located near the opening price of the first candle, but within its body. That is, a bullish Harami should be formed when the body of the first candle completely absorbs the body of the second candle. An important feature of the second candle - it has a long lower shadow, which forms the minimum of the whole model. It looks like a hammer candle.

The third candle is white, also with a short body. It should be placed below the second candle. By the way, this model is similar to Morning Star. But of course, these are completely different candle formations, and they should not be confused.

Gere is a possible sequence of actions of a trader, who has met this rare pattern:

Open a candlestick chart of the currency pair you like, which has a downtrend. Time frame - W1. We can also use a volume indicator (for example, standard Volumes). As already mentioned, confirmation for this model is not necessary, but it will not be superfluous.

When the Three River model is formed, we check its reliability using Volumes. The volume should increase significantly at the second and third candlesticks of the pattern. And to a greater extent, it is on the third candle.

It also increases the probability of the market's rapid reversal by the large length of the lower shadow at the second candle of the pattern.

If the pattern is confirmed, we wait for the next candle to close in the right direction for reliability. After that we enter the market, placing a Buy order.

Stop-Loss can be placed on a pair of points below the pattern`s low.

Take Profit can be placed at the level of the last local maximum.

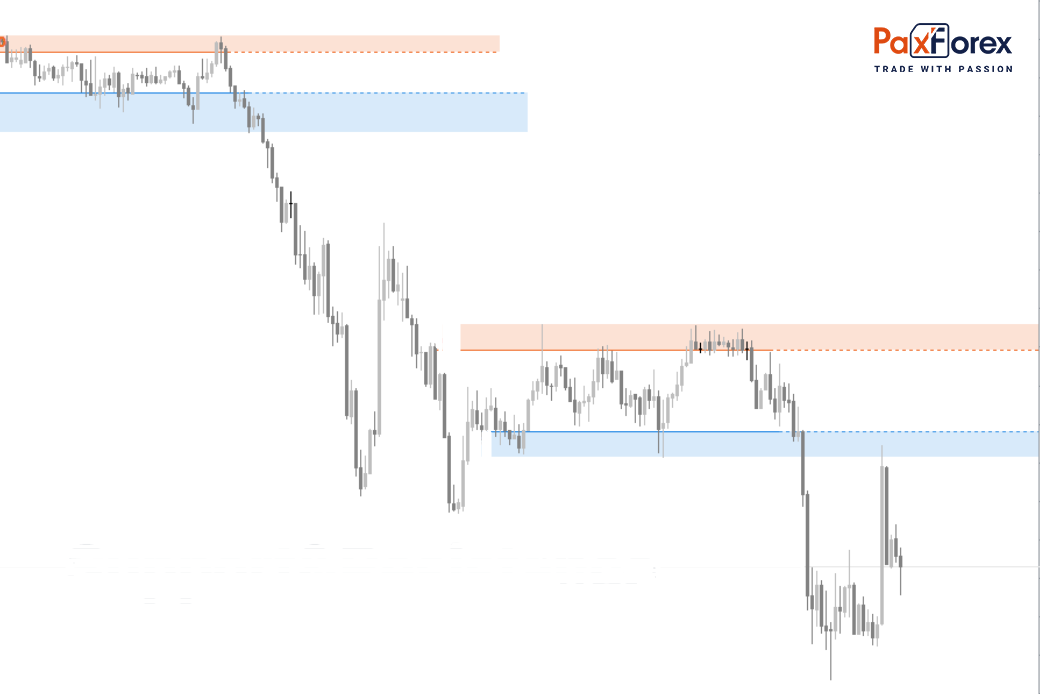

The Role of Price Action Trading in Forex Strategies

Price Action is based on the identification of certain patterns of price behavior, which can be further used for trading. Price Action is a continuation of the development of technical market analysis, as it also uses support/resistance levels and price patterns. The main rule of Price Action (and technical analysis) is: "The Market Discounts Everything". That is, the price movement on the market takes into account all the events that occur in the world: economic, political, force majeure. All news has an immediate impact on price changes, so the quotes charts are analyzed directly, without evaluating the outgoing fundamental data.

In technical analysis, the most important factor for market analysis is support/resistance levels. In Price Action they are called supply and demand zones (levels). It is demand and supply that is responsible for price movement. Areas of supply and demand represent a limited price range, in which quotes have changed their direction or a strong momentum has started. For traders, supply and demand zones play a primary role. Almost always they provide the best entry points with an advantageous risk-to-profit ratio. The higher the chart time frame, the more important are the supply and demand zones built on it. The key time frames are daily, weekly, and monthly. Much attention in Price Action is paid to trading patterns formed in supply and demand areas.

Trend-Following Trading Forex Strategies

The most important thing to remember when the market is in a strong trend is not to think! Markets are going much further than we think. Therefore, we need to trade following the trend until it is over.

One of the main factors of large stable trends is the fact that the market continues to filter out traders who trade against the trend - and there are more of them than it seems. When a trader opens a sell trade, i.e. he bets against the bullish market, and the price continues to rise - closing a losing trade on the Stop-Loss is a buy, which in turn leads to further price growth. So a strong trend can continue this way for a long time, it is not worth betting against the trend.

Let`s consider an example of the trend-following strategy.

This strategy gives excellent results and is suitable even for beginners. It has shown the best results when working in the H4 time frame, but it can be tested on other time frames.

The following tools will be required for trading:

Moving Exponential Average Line (EMA). It will show the direction of the current trend. The moving period should be 100.

CCI Oscillator (Commodity Channel Index). It will determine the moments of price hitting the overbought and oversold areas, as well as show the magnitude of the chart line deviation from the moving EMA. In the settings of the period, we set 14.

If the CCI price falls into the oversold zone (below -100), and the EMA line indicates an uptrend, then we can open a Buy position. If, on the contrary, the price enters the overbought zone (above +100) by CCI, and the EMA curve indicates a downtrend, then we place a Sell order.

Stop-Loss is 100 points. Once profit reaches 100 pips, we move the Stop-Loss to a break-even. When profit is up to 200 pips, we set a Trailing-Stop (stop step - 100 pips).

The momentum and strength of the trend are the best market conditions for trading, which allows us to get a quick profit. Unfortunately, strong trends do not occur very often so when we see such a market, we need to know what to do and act decisively.

4-Hour Forex Trading Strategy

Forex trading strategies for the four-hour chart are distinguished by their accuracy and the small number of incoming signals.

The strategy was developed specifically for the EUR/USD pair, but you can test it on other trading instruments as well.

Signals will come from three tools - Parabolic, MA and RSI. Add them to the H4 chart and configure the input parameters as follows:

Parabolic SAR. Step is 0.03 units. The value of Max is 0.03. Color the line in blue, leave the other settings as default.

MA (Moving Average). The period should be equal to 70 bars, all calculations are applied to Close prices. MA method is Simple.

RSI. The period value is set to 14 bars and the levels are 60 and 40.

Make sure to change the chart to a candlestick one.

Buy signals: The extreme candle of the chart has closed above the MA moving. The Parabolic has fallen under the chart candlesticks. RSI is above 60. If all the signals coincide, we place a

Buy order at the moment of opening the candlestick immediately after the signal one. We place the protective Stop-Loss at a distance of 80 points from the market entry point. Take Profit is placed at a distance of 500 points. When the price passes the interval equal to Stop-Loss, we move Stop-Loss to break-even and keep the position open until the trend changes its direction or the price reaches Take-Profit.

Sell Signals: The extreme candlestick closed under the MA curve. Parabolic is above the chart. RSI has fallen under 40. If the signals coincide, we set a Sell order immediately after the candlestick opens, following the signal. Take-Profit and Stop-Loss are set according to the same rules as for a Buy trade.

Counter-Trend Forex Strategies

Trading against the trend seems illogical at first glance. After all, if the price goes up, it would be logical to buy the asset or sell it on a falling market. But the market reality makes its adjustments. The market is volatile, and the trend is never a perfectly straight ascending line. There is always room for local corrections, bullish and bearish capital struggle, etc. There are many reasons for pullbacks. Moreover, no one can predict from 100% whether the pullback is the origin of a new strong trend in the opposite direction. As practice shows, a clear upward or downward movement of the price shows only 25-30% of the fixed period, the rest of the time fluctuating in the flat.

Counter-trend is a risk, as you cannot open a position against the main direction at random. The trade will quickly close at a Stop-Loss, so it is not recommended for beginners.

Trading on Forex against the trend is opening a position according to the prediction of a rapid reversal. It provides several options (strategies):

trading on pullbacks. As we all know, 60-70 percent of the time, the price is moving against its main direction. So to say, against the trend. It is due to such a phenomenon as a pullback or correction, which usually occurs after sharp trend movements. Many traders who trade on the news use this tendency, opening a position in one direction, and after the correction starts in the opposite direction, having closed the previous one. It significantly increases the size of the profit.

scalping. The most common strategy in the flat, providing a profit on short price movements, both on the trend and against it. The duration of the trade - up to 10 minutes;

trading in the channel. It can be applied with the help of Bollinger bands or resistance and support levels. Therefore, you can set a pending order on their value in the reverse direction with a Stop-Loss 1.5 times higher than the standard correction for the last few time frames.

Discovering the Best FX Strategy for You

Choosing a trading strategy is one of the most vital steps for successful work. Due to the working method you can stay in the profit zone in total: to determine the favorable moments for market entry and exit from unprofitable trades with minimal losses. Even simple trading Forex strategies can bring profit if they perfectly correspond to the experience and style of work of a trader. The main thing a trader gets is a clear understanding of the market and a plan. Besides, the strategy removes such a bothering question as to the choice of an asset. Many approaches are designed for specific currency pairs and help to determine the behavior of this asset.

Using a strategy can protect a trader from complete zeroing of the account, which often happens in haphazard trading. Of course, 100% success is not guaranteed even in this case, but Forex trading strategies help to trade more competently, as they are all designed for a certain level of risk and profitability.

Even though there are many strategies, the best one is the one tailored by the trader himself through the method of trial and error. But for mistakes not to become fatal, you need not only to try but to learn, to master ready-made strategies, and enrich them with your own experience.