New Zealand Food Prices for March increased by 0.7% monthly. Forex traders can compare this to New Zealand Food Prices for February, which increased by 2.1% monthly. US Advanced Retail Sales for March are predicted to decrease by 8.0% monthly, and Retail Sales Less Autos are predicted to decrease by 4.8% monthly. Forex traders can compare this to US Advanced Retail Sales for February, which decreased by 0.5% monthly and to Retail Sales Less Autos, which decreased by 0.4% monthly. Retail Sales Less Autos and Gas for March are predicted to decrease by 6.2% monthly, and Retail Sales Control Group are predicted to decrease by 1.8% monthly. Forex traders can compare this to Retail Sales Less Autos and Gas for February, which decreased by 0.2% monthly and to Retail Sales Control Group, which were reported flat at 0.0% monthly.

US Industrial Production for March is predicted to decrease by 4.2% monthly, and Manufacturing Production is predicted to decrease by 3.6% monthly. Forex traders can compare this to US Industrial Production for February, which increased by 0.6% monthly and to Manufacturing Production which increased by 0.1% monthly. Capacity Utilization for March is predicted at 73.9%. Forex traders can compare this to Capacity Utilization for February, which was reported at 77.0%. US Business Inventories for February are predicted to decrease by 0.4% monthly. Forex traders can compare this to US Business Inventories for January, which decreased by 0.1% monthly. The US NAHB Housing Market Index for April is predicted at 58. Forex traders can compare this to the US NAHB Housing Market Index for March, which was reported at 72.

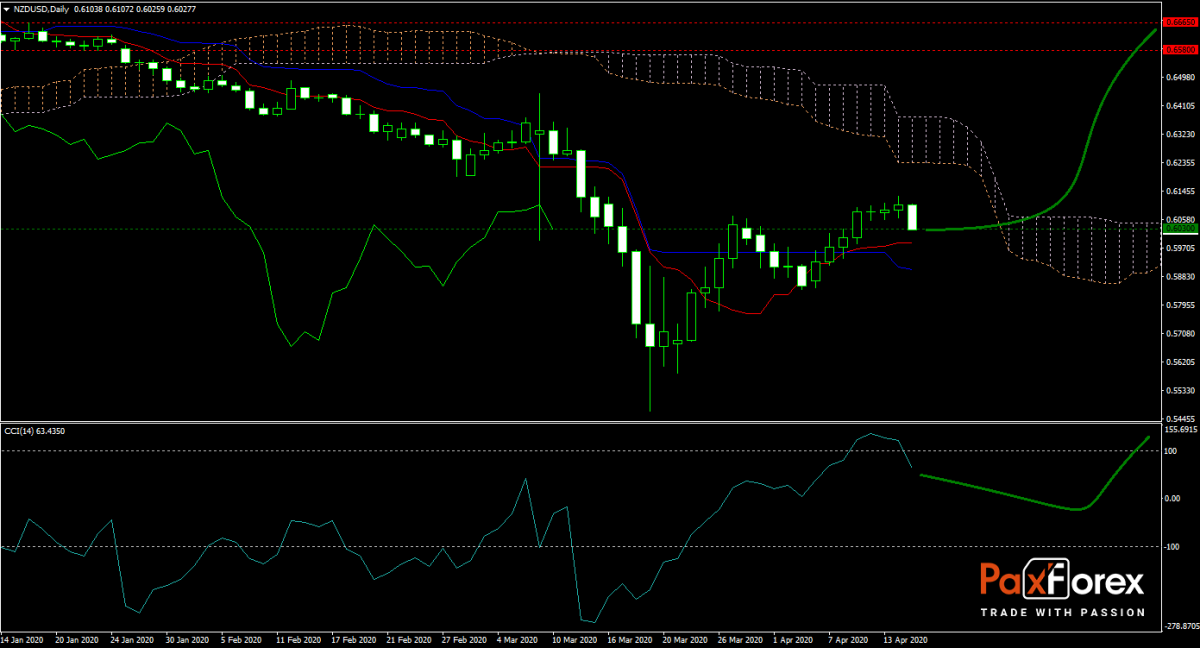

The NZD/USD forecast turned significantly more bullish after price action pushed through the Kijun-sen. A bullish signal was also delivered by the crossover of the Tenkan-sen above the Kijun-sen. This currency pair is now trading near the level of its Chikou Span from where more upside is expected to take it through the Senkou Span A and Senkou Span B into its next horizontal resistance area. Will bulls get enough fundamental pressure delivered by today’s US economic data? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the NZD/USD remain inside the or breakout above the 0.5985 to 0.6055 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 0.6030

- Take Profit Zone: 0.6580 – 0.6665

- Stop Loss Level: 0.5940

Should price action for the NZD/USD breakdown below 0.5985 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 0.5940

- Take Profit Zone: 0.5775 – 0.5840

- Stop Loss Level: 0.5985

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.