Source: PaxForex Premium Analytics Portal, Fundamental Insight

The final UK Markit/CIPS Manufacturing PMI for August is predicted at 55.3. Forex traders can compare this to the UK Markit/CIPS Manufacturing PMI for July, reported at 53.3. UK Mortgage Approvals for July are predicted at 54.84K. Forex traders can compare this to UK Mortgage Approvals for June, reported at 40.01K. UK Net Consumer Credit for July is predicted at £0.678B, and Net Lending Securities on Dwellings is predicted at £2.800B. Forex traders can compare this to UK Net Consumer Credit for June, reported at -£0.086B, and to Net Lending Securities on Dwellings, reported at £1.900B.

The Final US Markit Manufacturing PMI for August is predicted at 53.6. Forex traders can compare this to the US Markit Manufacturing PMI for July, reported at 50.9. US Construction Spending for July is predicted to increase by 1.0% monthly. Forex traders can compare this to US Construction Spending for June, which decreased by 0.7% monthly. The US ISM Manufacturing Index for August is predicted at 54.5. Forex traders can compare this to the US ISM Manufacturing Index for July, reported at 54.2. ISM Prices Paid for August are predicted at 54.0. Forex traders can compare this to ISM Prices Paid for July, reported at 53.2. ISM Employment for August is predicted at 45.8. Forex traders can compare this to ISM Employment for July, reported at 44.3.

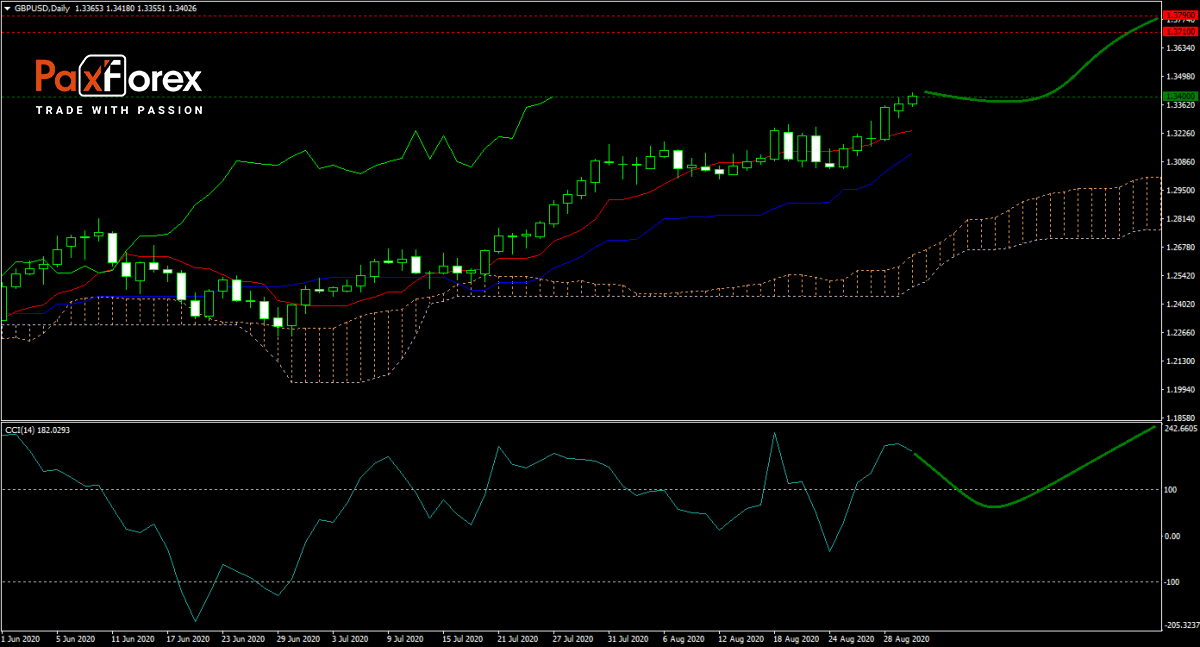

The forecast for the GBP/USD remains bullish after the US Federal Reserve vowed to keep interest rates depressed. A report claims that US President Trump and the White House concealed Covid-19 related facts. Forex traders will seek clues from today’s economic data out of the UK and the US. Price action remains well-supported by its ascending Kijun-sen and Tenkan-sen, while the Ichimoku Kinko Hyo Cloud is sloping upwards. Will bulls receive the catalyst to drive this currency pair into its next horizontal resistance area? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the GBP/USD remain inside the or breakout above the 1.3355 to 1.3420 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.3400

- Take Profit Zone: 1.3710 – 1.3790

- Stop Loss Level: 1.3300

Should price action for the GBP/USD breakdown below 1.3355 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.3300

- Take Profit Zone: 1.3130 – 1.3185

- Stop Loss Level: 1.3355

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.