UK Mortgage Approvals for January were reported at 70.9K. Economists predicted a figure of 68.0K. Forex traders can compare this to UK Mortgage Approvals for December, which were reported at 67.9K. Net Consumer Credit for January was reported at £1.2B, and Net Lending Securities on Dwellings was reported at £4.0B. Economists predicted a figure of £1.0B and £4.6B. Forex traders can compare this to UK Net Consumer Credit for December, which was reported at £1.3B and to Net Lending Securities on Dwellings, which was reported at £4.4B.

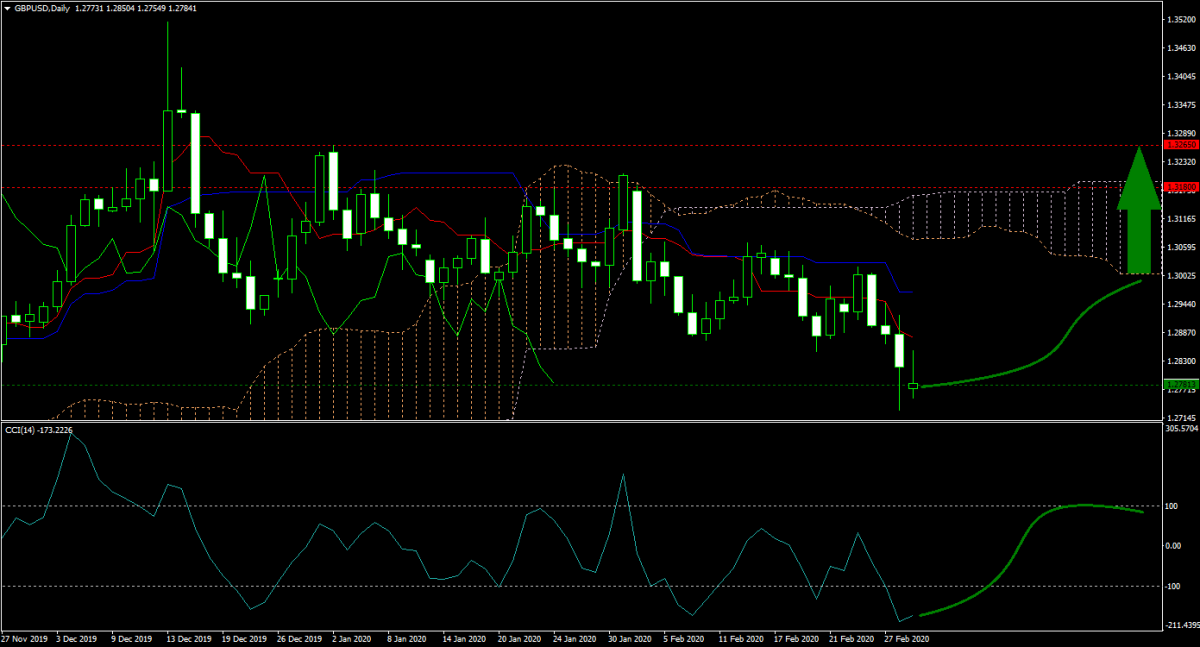

Today’s UK data surprised to the upside yet again, extending the streak since PM Johnson took office in December with an overwhelming majority. Trade talks between the EU and the UK will start today. Both sides vow to work towards a comprehensive trade deal while deep divisions remain. The GBP/USD remains in a holding pattern inside of its horizontal support area, where will price action move from here?

Forex traders now eagerly await the US ISM Manufacturing report. Economists expect a reading below 50.0, indicating contraction, but at a slower pace as was reported in January. China’s PMI readings disappointed with upside surprises out of India, Russia, Spain, Switzerland, France, and Germany, as Italy underperformed. The GBP/USD forecast remains cautiously bullish, partially fueled by a potential interest rate cut by the US Fed in response to the coronavirus.

Should price action for the GBP/USD remain inside the or breakout above the 1.2730 to 1.2815 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.2780

- Take Profit Zone: 1.3180 – 1.3265

- Stop Loss Level: 1.2700

Should price action for the GBP/USD breakdown below 1.2730 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.2700

- Take Profit Zone: 1.2580 – 1.2610

- Stop Loss Level: 1.2780

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio. Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.