UK Retail Sales for February decreased by 0.5% monthly and increased by 0.5% annualized. Economists predicted a decrease of 0.3% and an increase of 1.1%. Forex traders can compare this to UK Retail Sales for January, which increased by 1.8% monthly and 1.3% annualized. UK Retail Sales Including Auto and Fuel for February decreased by 0.3% monthly and were reported flat at 0.0% annualized. Economists predicted an increase of 0.2% and 0.7%. Forex traders can compare this to UK Retail Sales Including Auto and Fuel for January, which increased by 1.1% monthly and by 0.9% annualized. The Bank of England is predicted to keep interest rates at 0.10%, the Asset Purchase Target £635B, and the Corporate Bond Target at £20B. Forex traders can compare this to the previous Bank of England meeting where the UK central bank lowered interest rates by 15 basis points, increased the Asset Purchase Target by £200B, and kept the Corporate Bond Target at £10B.

The US Advanced Goods Trade Balance for February is predicted at -$63.8B. Forex traders can compare this to the US Advanced Goods Trade Balance for January, which was reported at -$65.5B. The Advanced US GDP for the fourth quarter is predicted to increase by 2.1% annualized. Forex traders can compare this to the previous fourth-quarter GDP, which increased by 2.1% annualized. Personal Consumption for the fourth quarter is predicted to increase by 1.7% annualized. Forex traders can compare this to the previous third-quarter Personal Consumption, which increased by 1.7% annualized. The GDP Price Index for the fourth quarter is predicted to increase by 1.3% annualized. Forex traders can compare this to the previous fourth-quarter GDP Price Index, which increased by 1.3% annualized. The Core PCE for the fourth quarter is predicted to increase by 1.2% annualized. Forex traders can compare this to the previous fourth-quarter Core PCE, which increased by 1.2% annualized.

US Initial Jobless Claims for the week of March 21st are predicted at 1,500K, and US Continuing Claims for the week of March 14th are predicted at 1,782K. Forex traders can compare this to US Initial Jobless Claims for the week of March 14th, which were reported at 281K and to US Continuing Claims for the week of March 7th, which were reported at 1,701K. US Preliminary Wholesale Inventories for February are predicted to decrease by 0.4% monthly. Forex traders can compare this to US Wholesale Inventories for January, which decreased by 0.4% monthly. The US Kansas City Fed Manufacturing Activity Index for March is predicted at -10. Forex traders can compare this to the US Kansas City Fed Manufacturing Activity Index for February, which was reported at 5.

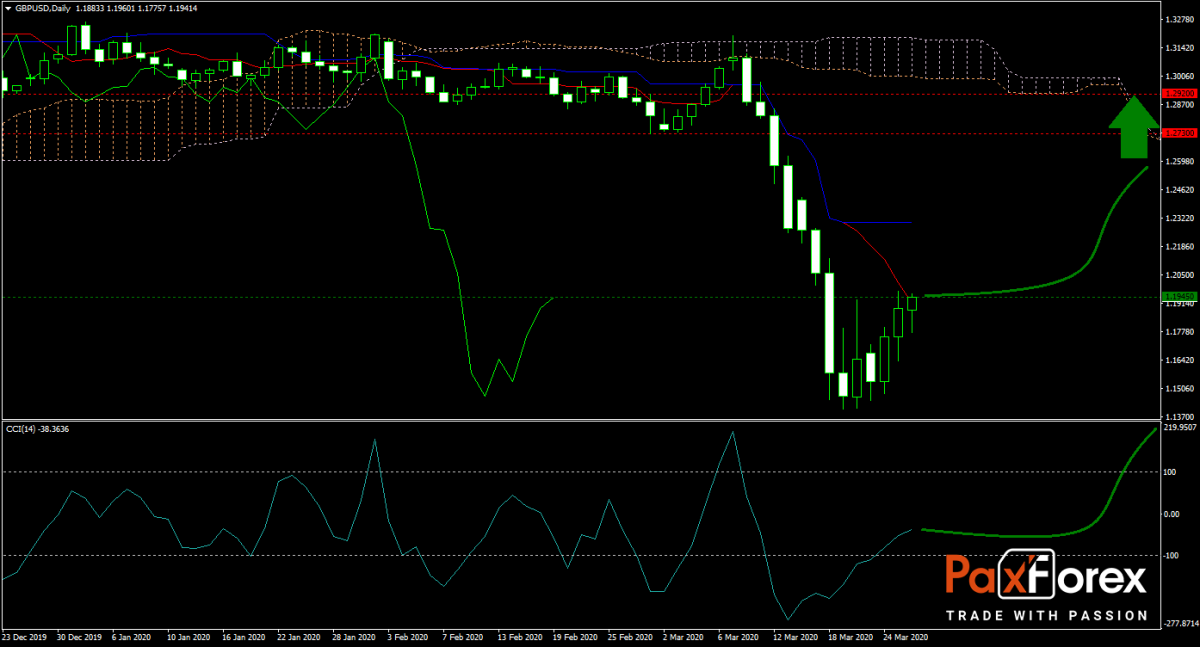

After the GBP/USD collapsed to thirty-year lows, a strong reversal took shape. The US central bank is flooding the market with US Dollars, which is diluting the value of the greenback. At the same time demand is slowly fading, and the forecast for price action is turning bullish. Will bulls push this currency pair back into resistance, or will bears attempt a second sell-off? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the GBP/USD remain inside the or breakout above the 1.1775 to 1.2000 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.1945

- Take Profit Zone: 1.2730 – 1.2920

- Stop Loss Level: 1.1715

Should price action for the GBP/USD breakdown below 1.1775 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.1715

- Take Profit Zone: 1.1400 – 1.1480

- Stop Loss Level: 1.1775

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.