The Final UK Markit/CIPS Services PMI for March is predicted at 34.8, and the Final UK Markit/CIPS Composite PMI is predicted at 36.0. Forex traders can compare this to the previous UK Markit/CIPS Services PMI for March, which was reported at 35.7 and to the previous UK Markit/CIPS Composite PMI, which was reported at 37.1.

The US NFP Report for March is predicted to show 100K job losses and an unemployment rate of 3.8%. Forex traders can compare this to the US NFP Report for February, which showed 273K job additions and an unemployment rate of 3.5%. Private Payrolls for March are predicted to show 117K job losses and Manufacturing Payrolls 10K job losses. Forex traders can compare this to Private Payrolls for February, which showed 228K job additions and to Manufacturing Payrolls, which showed 15K job additions. The Average Work Week for March is predicted at 34.2 hours. Forex traders can compare this to the Average Work Week for February, which was reported at 34.4 hours. Average Hourly Earnings for March are predicted to increase by 0.2% monthly and by 3.0% annualized. Forex traders can compare this to Average Hourly Earnings for February, which increased by 0.3% monthly and by 3.0% annualized. The Labor Force Participation Rate for March is predicted at 63.3%. Forex traders can compare this to the Labor Force Participation Rate for February, which was reported at 63.4%.

The US Final Markit Services PMI for March is predicted at 39.1, and the US Final Markit Composite PMI is predicted at 40.5. Forex traders can compare this to the previous US Markit Services PMI for March, which was reported at 39.1 and to the previous US Markit Composite PMI, which was reported at 40.5. The US ISM Non-Manufacturing PMI for March is predicted at 44.0. Forex traders can compare this to the US ISM Non-Manufacturing PMI for February, which was reported at 57.3. The ISM Non-Manufacturing Business Activity Index for March is predicted at 45.0. Forex traders can compare this to the ISM Non-Manufacturing Business Activity Index for February, which was reported at 57.8.

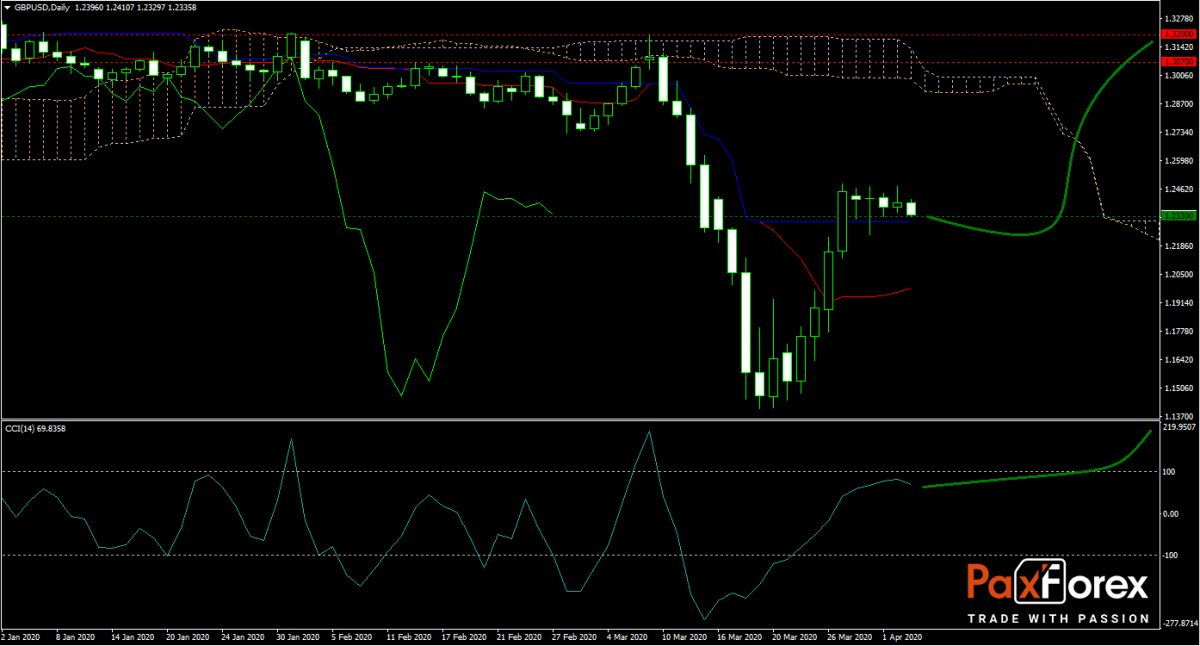

The GBP/USD forecast remains bullish following a strong reversal off of thirty-year lows. US initial jobless claims have surged to all-time highs, but they will not be reflected in today’s NFP report. A downside surprise in March payrolls is expected to inspire bulls to push ahead and back into its horizontal resistance area. Will economic data provide the spark for more gains in this currency pair? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the GBP/USD remain inside the or breakout above the 1.2240 to 1.2485 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.2330

- Take Profit Zone: 1.3070 – 1.3200

- Stop Loss Level: 1.2130

Should price action for the GBP/USD breakdown below 1.2240 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.2130

- Take Profit Zone: 1.1790 – 1.1945

- Stop Loss Level: 1.2240

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.