The Spanish Markit Services PMI for April was reported at 30.8. Economists predicted a figure of 34.0. Forex traders can compare this to the Spanish Markit Services PMI for March, which was reported at 45.7. The Italian Markit/ADACI Manufacturing PMI for April was reported at 31.1. Economists predicted a figure of 30.0. Forex traders can compare this to the Italian Markit/ADACI Manufacturing PMI for March, which was reported at 40.3. The Final French Markit Manufacturing PMI for April was reported at 31.5. Economists predicted a figure of 31.5. Forex traders can compare this to the French Markit Manufacturing PMI for March, which was reported at 43.2.

The Final German Markit/BME Manufacturing PMI for April was reported at 34.5. Economists predicted a figure of 34.4. Forex traders can compare this to the German Markit/BME Manufacturing PMI for March, which was reported at 45.4. The Final Eurozone Markit Manufacturing PMI PMI for April was reported at 33.4. Economists predicted a figure of 33.6. Forex traders can compare this to the previous Eurozone Markit Manufacturing PMI for April, which was reported at 44.5.

Eurozone Sentix Investor Confidence for May was reported at -41.8. Economists predicted a figure of -33.5. Forex traders can compare this to Eurozone Sentix Investor Confidence for April, which was reported at -42.9. US Factory Orders for March are predicted to decrease by 9.8% monthly. Forex traders can compare this to US Factory Orders for April, which were reported flat at 0.0% monthly.

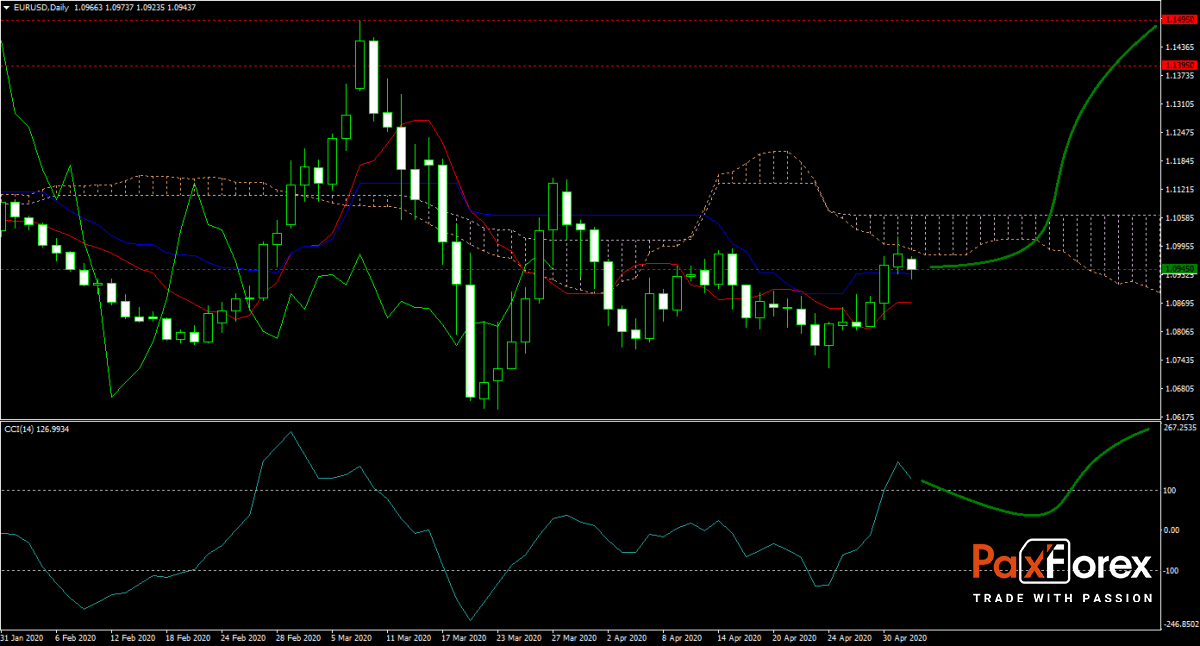

The EUR/USD forecast can cling to bullish momentum with US data causing forex traders to rotate out of the US Dollar. Today’s final Eurozone PMI data showed deep recessionary readings as factory orders out of the US are awaited. This currency pair approached its Senkou Span A and is now prepared to move into the Ichimoku Kinko Hyo cloud. Will today’s economic data confirm technicals and allow bulls to extend their stampede? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the EUR/USD remain inside the or breakout above the 1.0900 to 1.0975 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.0945

- Take Profit Zone: 1.1395 – 1.1495

- Stop Loss Level: 1.0890

Should price action for the EUR/USD breakdown below 1.0900 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.0875

- Take Profit Zone: 1.0690 – 1.0725

- Stop Loss Level: 1.0900

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.