The German GfK Consumer Confidence Survey for May was reported at -23.4. Economists predicted a figure of -1.8. Forex traders can compare this to the German GfK Consumer Confidence Survey for April, which was reported at 2.7. The Preliminary French Markit Manufacturing PMI for April is predicted at 37.5. Forex traders can compare this to the French Markit Manufacturing PMI for March, which was reported at 43.2. The Preliminary French Markit Services PMI for April is predicted at 25.0. Forex traders can compare this to the French Markit Services PMI for March, which was reported at 27.4. The Preliminary French Markit Composite PMI for April was reported at 25.3. Forex traders can compare this to the French Markit Composite PMI for March, which was reported at 28.9.

The Preliminary German Markit Manufacturing PMI for April is predicted at 39.0. Forex traders can compare this to the German Markit Manufacturing PMI for March, which was reported at 45.4. The Preliminary German Markit Services PMI for April is predicted at 28.1. Forex traders can compare this to the German Markit Services PMI for March, which was reported at 31.7. The Preliminary German Markit Composite PMI for April is predicted at 28.8. Forex traders can compare this to the German Markit Composite PMI for March, which was reported at 35.0.

The Preliminary Eurozone Markit Manufacturing PMI for April is predicted at 38.0. Forex traders can compare this to the Eurozone Markit Manufacturing PMI for March, which was reported at 44.5. The Preliminary Eurozone Markit Services PMI for April is predicted at 23.5. Forex traders can compare this to the Eurozone Markit Services PMI for March, which was reported at 26.4. The Preliminary Eurozone Markit Composite PMI for April is predicted at 25.9. Forex traders can compare this to the Eurozone Markit Composite PMI for March, which was reported at 29.7.

US Initial Jobless Claims for the week of April 18th are predicted at 4,500K and US Continuing Claims for the week of April 11th are predicted at 17,271K. Forex traders can compare this to US Initial Jobless Claims for the week of April 11th, which were reported at 5,245K and to US Continuing Claims for the week of April 4th, which were reported at 11,976K.

The Preliminary US Markit Manufacturing PMI for April is predicted at 36.0. Forex traders can compare this to the US Markit Manufacturing PMI for March, which was reported at 48.5. The Preliminary US Markit Services PMI for April is predicted at 31.3. Forex traders can compare this to the US Markit Services PMI for March, which was reported at 39.8. The Preliminary US Markit Composite PMI for April is predicted at 32.5. Forex traders can compare this to the US Markit Composite PMI for March, which was reported at 40.9.

US New Home Sales for March are predicted to decrease by -16.0% monthly to 643K new homes. Forex traders can compare this to US New Home Sales for February, which decreased by 4.4% monthly to 765K new homes. The US Kansas City Fed Manufacturing Activity Index for April is predicted at -34. Forex traders can compare this to the US Kansas City Fed Manufacturing Activity Index for March, which was reported at -17.

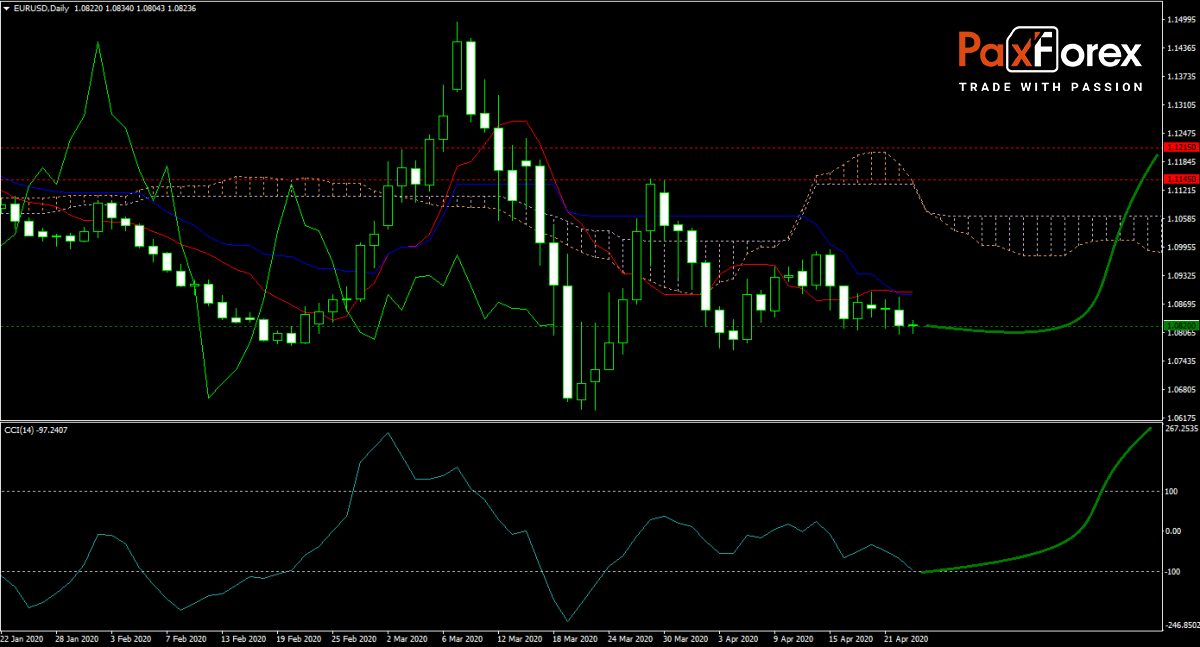

The EUR/USD forecast holds on to a mildly bullish bias. Today’s PMI data out of France, Germany, and the Eurozone will be critical for price action during the European morning session. Economist predict a deeper slide into recessionary levels. US initial jobless claims this afternoon will provide another catalyst for price action. How will today’s data have session impact the trend? Will bulls push the EUR/USD above the Tenkan-sen? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the EUR/USD remain inside the or breakout above the 1.0770 to 1.0890 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.0820

- Take Profit Zone: 1.1145 – 1.1215

- Stop Loss Level: 1.0725

Should price action for the EUR/USD breakdown below 1.0770 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.0725

- Take Profit Zone: 1.0585 – 1.0635

- Stop Loss Level: 1.0770

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.