Source: PaxForex Premium Analytics Portal, Fundamental Insight

The Japanese All Industry Activity Index for May decreased by 3.5% monthly. Forex traders can compare this to the Japanese All Industry Activity Index for April, which decreased by 7.6% monthly. The Final Japanese Leading Index for May was reported at 78.4, and the Final Japanese Coincident Index was reported at 73.4. Forex traders can compare this to the previous Japanese Leading Index for May, reported at 77.7 and to the previous Japanese Coincident Index, reported at 80.1.

The German IFO Business Climate Index for July was reported at 90.5. Economists predicted a figure of 89.3. Forex traders can compare this to the German IFO Business Climate Index for June, reported at 86.3. The German IFO Current Assessment Index for July was reported at 84.5. Economists predicted a figure of 85.0. Forex traders can compare this to the German IFO Current Assessment Index for June, reported at 81.3. The German IFO Expectations Index for July was reported at 97.0. Economists predicted a figure of 93.7. Forex traders can compare this to the German IFO Expectations Index for June, reported at 91.6.

Eurozone M3 Money Supply for June increased by 9.2% annualized. Economists predicted an increase of 9.3%. Forex traders can compare this to Eurozone M3 Money Supply for May, which increased by 8.9% annualized. Eurozone Private Sector Loans for June increased by 3.0% annualized and Loans to Non-Financial Corporations increased by 7.1% annualized. Forex traders can compare this to Eurozone Private Sector Loans for May, which increased by 3.0% annualized, and to Loans to Non-Financial Corporations, which increased by 7.3% annualized.

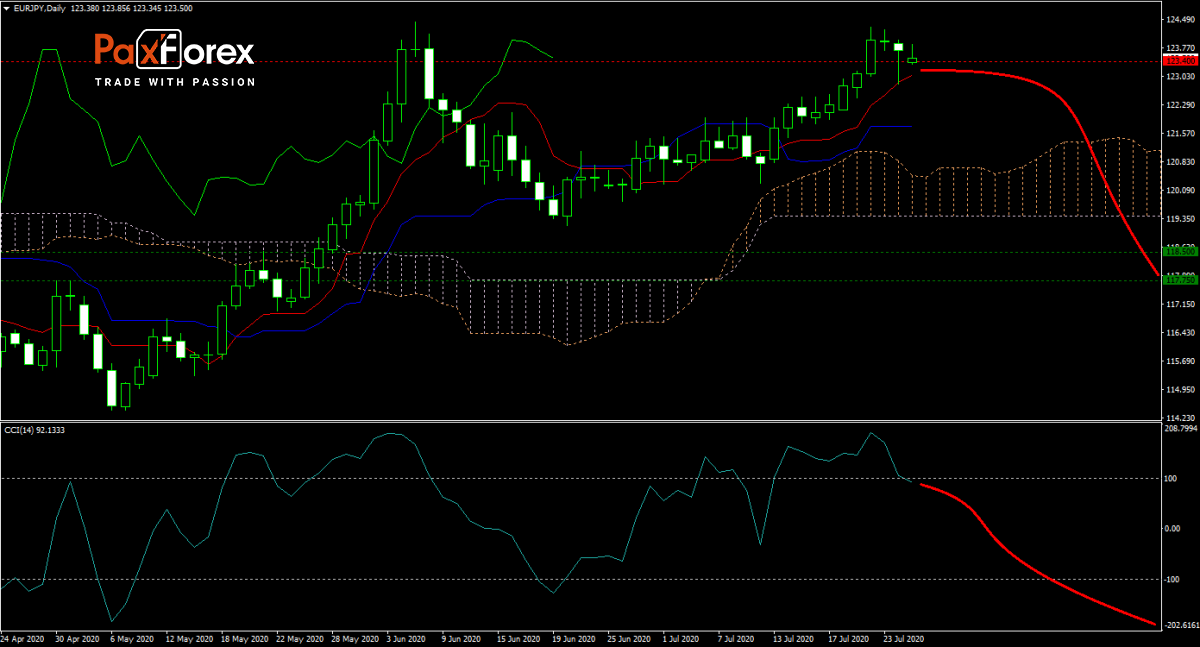

The forecast for the EUR/JPY is turning bearish with the global economy under ongoing stress from the Covid-19 pandemic. Daily infections are on the rise and could reach 300,000 this week for the first time. Chinese industrial profits soared in June, but data out of Japan and Singapore suggest a weakening trend. Initial jobless claims in the US rose last week, casting a shadow over the trend in the already depressed labor market. Price action is exposed to safe-haven demand, which is expected to drive this currency pair below its Ichimoku Kinko Hyo Cloud and into its next horizontal support area. Can bears force a sell-off this week? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the EURJPY remain inside the or breakdown below the 123.000 to 123.850 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 123.400

- Take Profit Zone: 117.750 – 118.500

- Stop Loss Level: 124.400

Should price action for the EURJPY breakout above 123.850 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 124.400

- Take Profit Zone: 125.200 – 125.600

- Stop Loss Level: 123.850

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.