Source: PaxForex Premium Analytics Portal, Fundamental Insight

The German GfK Consumer Confidence Survey for October was reported at -1.6. Economists predicted a figure of -1.0. Forex traders can compare this to the German GfK Consumer Confidence Survey for September, reported at -1.7. The final Spanish GDP for the second quarter is predicted to decrease by 18.5% quarterly and by 22.1% annualized. Forex traders can compare this to the previous Spanish GDP for the second quarter, which decreased by 18.5% quarterly and by 22.1% annualized.

The Preliminary French Markit Manufacturing PMI for September is predicted at 50.5. Forex traders can compare this to the French Markit Manufacturing PMI for August, reported at 49.8. The Preliminary French Markit Services PMI for September is predicted at 51.5. Forex traders can compare this to the French Markit Services PMI for August, reported at 51.5. The Preliminary French Markit Composite PMI for September was reported at 51.9. Forex traders can compare this to the French Markit Composite PMI for August, reported at 51.6.

The Preliminary German Markit Manufacturing PMI for September is predicted at 52.5. Forex traders can compare this to the German Markit Manufacturing PMI for August, reported at 52.2. The Preliminary German Markit Services PMI for September is predicted at 53.0. Forex traders can compare this to the German Markit Services PMI for August, reported at 52.5. The Preliminary German Markit Composite PMI for September is predicted at 54.1. Forex traders can compare this to the German Markit Composite PMI for August, reported at 54.4.

The Preliminary Eurozone Markit Manufacturing PMI for September is predicted at 51.9. Forex traders can compare this to the Eurozone Markit Manufacturing PMI for August, reported at 51.7. The Preliminary Eurozone Markit Services PMI for September is predicted at 50.5. Forex traders can compare this to the Eurozone Markit Services PMI for August, reported at 50.5. The Preliminary Eurozone Markit Composite PMI for September is predicted at 51.7. Forex traders can compare this to the Eurozone Markit Composite PMI for August, reported at 51.9.

The Preliminary UK Markit Manufacturing PMI for September is predicted at 54.1. Forex traders can compare this to the UK Markit Manufacturing PMI for August, reported at 55.2. The Preliminary UK Markit Services PMI for September is predicted at 56.0. Forex traders can compare this to the UK Markit Services PMI for August, reported at 58.8. The Preliminary UK Markit Composite PMI for September is predicted at 56.3. Forex traders can compare this to the UK Markit Composite PMI for August, reported at 59.1.

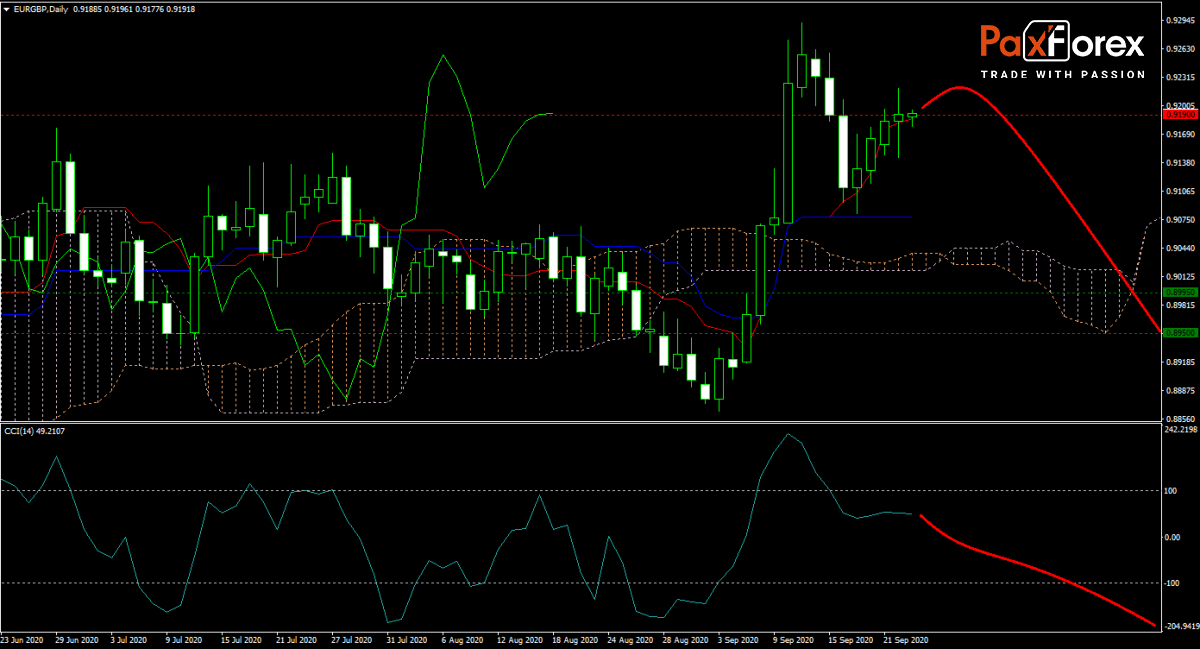

The forecast for the EUR/GBP remains bearish after price action reversed roughly half of its previous sell-off. With the World Health Organization warning Europe over the rise in Covid-19 infections, together with the likelihood of no deal with the UK on trade, the prospects for the Euro are dim. Will today’s PMI data offer bears the ammunition to force a retreat in this currency pair? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the EUR/GBP remain inside the or breakdown below the 0.9170 to 0.9220 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 0.9190

- Take Profit Zone: 0.8950 – 0.8995

- Stop Loss Level: 0.9270

Should price action for the EUR/GBP breakout above 0.9220 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 0.9270

- Take Profit Zone: 0.9390 – 0.9500

- Stop Loss Level: 0.9220

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.