The Australian Trade Balance for April was reported at A$8,800M. Economists predicted a figure of A$7,500M. Forex traders can compare this to the Australian Trade Balance for March, which was reported at A$10,602M. Australian Retail Sales for April decreased by 17.7% monthly. Economists predicted a decrease of 17.9% monthly. Forex traders can compare this to Australian Retail Sales for March, which increased by 8.5% monthly.

Eurozone Retail Sales for April are predicted to decrease by 15.0% monthly and by 22.3% annualized. Forex traders can compare this to Eurozone Retail Sales for March, which decreased by 11.2% monthly and by 9.2% annualized. The ECB is predicted to keep its Interest Rate at 0.00%, its Deposit Facility Rate at -0.50%, and its Marginal Lending Facility Rate at 0.25%; this would equal no change in the ECB rate policy from the previous meeting.

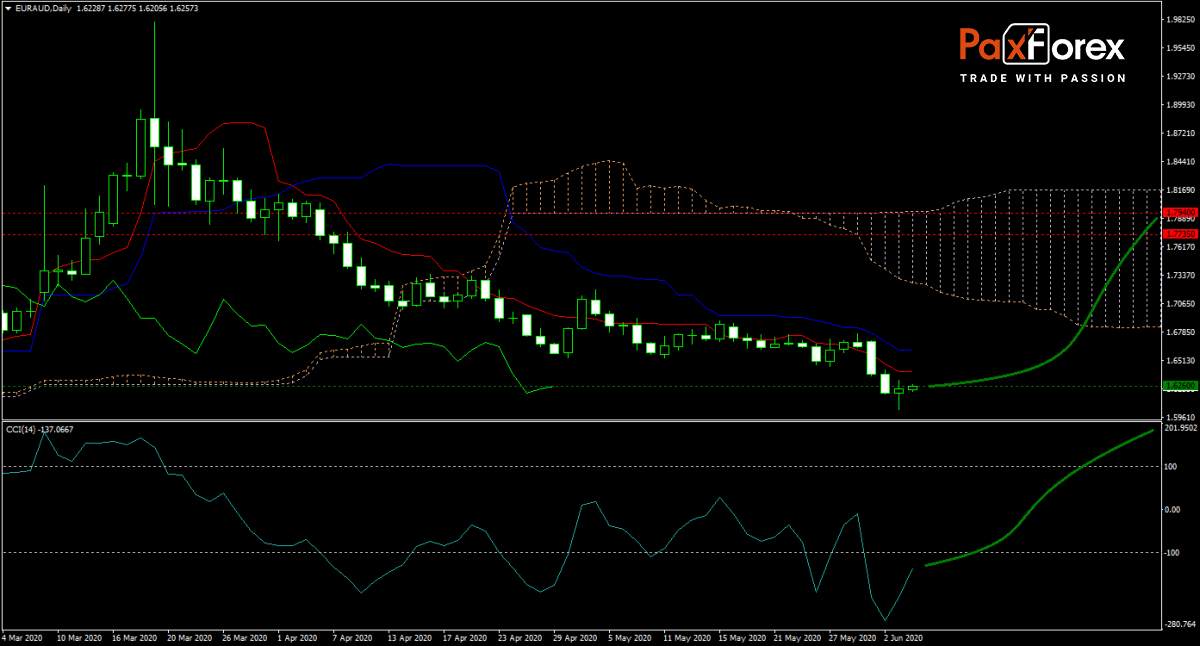

The EUR/AUD forecast is taking on a mildly bullish bias as the sell-off is losing momentum. Australian trade and retail sales data released this morning confirmed a slowing economy, and the government of Prime Minister Scott Morrison is on a collision course with China. While the Eurozone is faced with growing concerns, the short-term outlook favors a rally in this currency pair back into its Ichimoku Kinko Hyo Cloud. Will bulls be able to mount a stampede to the upside? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the EUR/AUD remain inside the or breakout above the 1.6030 to 1.6315 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.6260

- Take Profit Zone: 1.7735 – 1.7940

- Stop Loss Level: 1.5970

Should price action for the EUR/AUD breakdown below 1.6030 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.5970

- Take Profit Zone: 1.5800 – 1.5895

- Stop Loss Level: 1.6030

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.