Australian TD Securities Inflation for March increased by 0.2% monthly and by 1.5% annualized. Forex traders can compare this to Australian TD Securities Inflation for February, which decreased by 0.1% monthly and which increased by 1.6% annualized. German Factory Orders for February decreased by 1.4% monthly and increased 1.5% annualized. Economists predicted a decrease of 2.5% and 0.2%. Forex traders can compare this to German Factory Orders for January, which increased by 4.8% monthly, and which decreased by 0.8% annualized. The German Markit Construction PMI for March was reported at 42.0. Forex traders can compare this to the German Markit Construction PMI for February, which was reported at 55.8. Eurozone Sentix Investor Confidence for April is predicted at -37.5. Forex traders can compare this to Eurozone Sentix Investor Confidence for March, which was reported at -17.1.

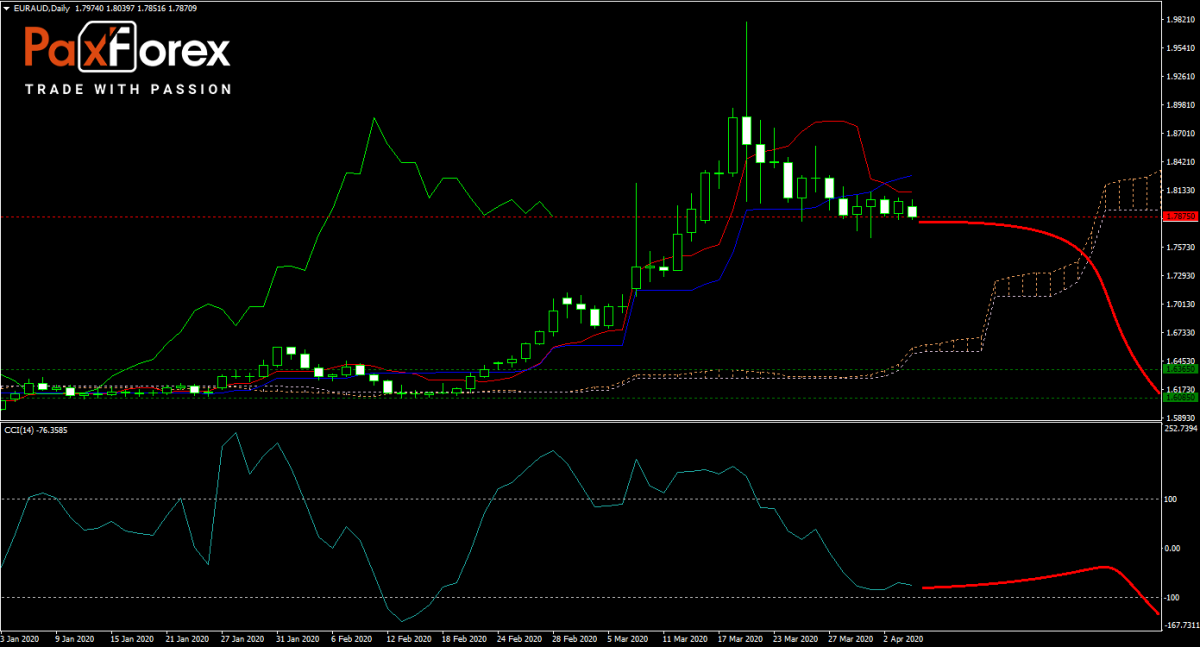

The EUR/AUD is expected to continue its correction following a price spike. Eurozone economic data remains worse than economists predict, as Covid-19 is forcing major parts of economies to shut down. More selling is expected with the forecast for this currency pair taking a bearish turn. Will today’s data give bears the incentive to accelerate to the downside? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the EUR/AUD remain inside the or breakdown below the 1.7735 to 1.8120 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 1.7875

- Take Profit Zone: 1.6085 – 1.6365

- Stop Loss Level: 1.8250

Should price action for the EUR/AUD breakout above 1.8120 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 1.8250

- Take Profit Zone: 1.8745 – 1.8855

- Stop Loss Level: 1.8120

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.