The Japanese Monetary Base for March increased by 2.8% annualized, and the Monetary Base end of Period was reported at ¥509.8T. Forex traders can compare this to the Japanese Monetary Base for February, which increased by 3.6% annualized and to the Monetary Base end of Period, which was reported at ¥515.9T. Japanese Buying Foreign Bonds for the period ending March 27th was reported at -¥1.7B, and Japanese Buying Foreign Stocks was reported at ¥879.6B. Forex traders can compare this to Japanese Buying Foreign Bonds for the period ending March 20th, which was reported at -¥61.3B and to Japanese Buying Foreign Stocks, which was reported at ¥391.9B. Foreign Buying Japanese Bonds for the period ending March 27th was reported at -¥3,490.2B and Foreigners Buying Japanese Stocks was reported at -¥1,421.9B. Forex traders can compare this to Foreign Buying Japanese Bonds for the period ending March 20th, which was reported at -¥2,631.6B and to Foreigners Buying Japanese Stocks, which was reported at -¥1,474.7B.

The Swiss CPI for March increased by 0.1% monthly and decreased by 0.5% annualized. Economists predicted an increase of 0.1% and a decrease of 0.5%. Forex traders can compare this to the Swiss CPI for February, which increased by 0.1% monthly, and which decreased by 0.1% annualized. The Swiss Core CPI for March decreased by 0.1% annualized. Economists predicted a flat reading of 0.0%. Forex traders can compare this to the Swiss Core CPI for February, which increased by 0.2% annualized. The Swiss EU Harmonized CPI for March increased by 0.1%% monthly and decreased by 0.4% annualized. Economists predicted a flat reading of 0.0% and a decrease of 0.5%. Forex traders can compare this to the Swiss EU Harmonized CPI for February, which decreased by 0.1% monthly and 0.2% annualized.

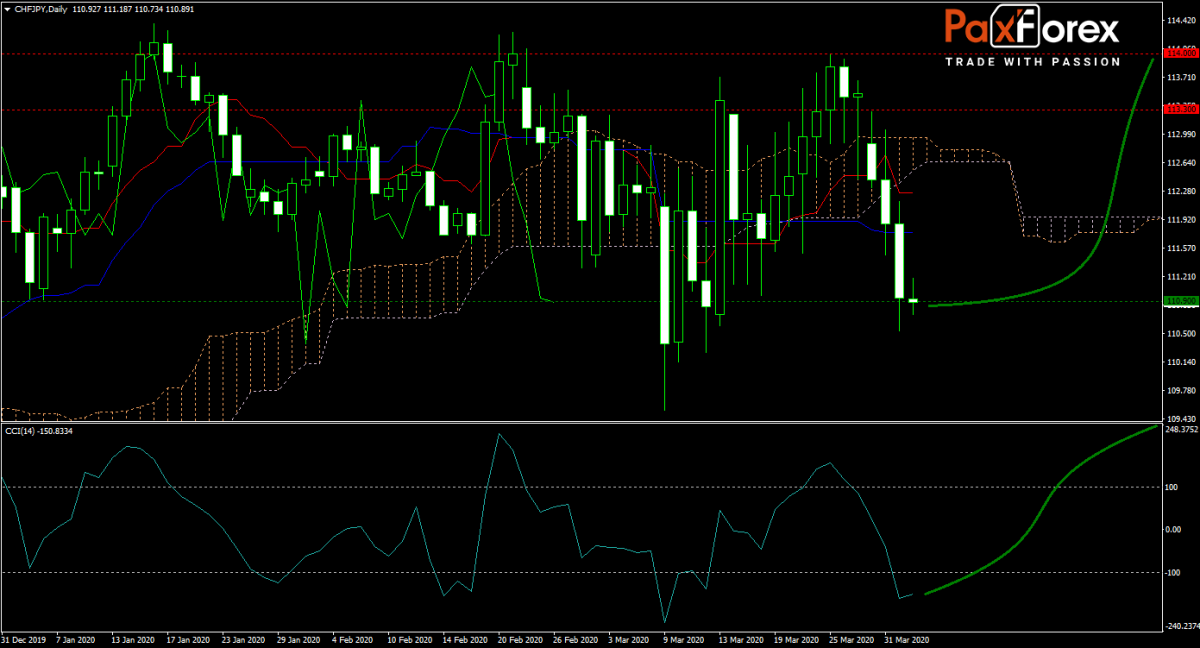

The CHF/JPY completed a breakdown below its horizontal resistance area, but selling pressure eased after this currency pair entered oversold territory. Both currencies are considered safe-haven assets and expected to remain in demand. It will keep price action confined to its trading range and the forecast has turned bullish. Will the existing pattern remain intact? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the CHF/JPY remain inside the or breakout above the 110.500 to 111.200 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 110.900

- Take Profit Zone: 113.300 – 114.000

- Stop Loss Level: 110.000

Should price action for the CHF/JPY breakdown below 110.500 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 110.000

- Take Profit Zone: 107.900 – 108.800

- Stop Loss Level: 110.500

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.