The Australian ANZ Roy Morgan Weekly Consumer Confidence Index for the week of March 29th was reported at 65.3. Forex traders can compare this to the Australian ANZ Roy Morgan Weekly Consumer Confidence Index for the week of March 22nd, which was reported at 72.2. Australian Private Sector Credit for February increased by 0.3% monthly and by 2.6% annualized. Economists predicted an increase of 0.3% monthly and 2.6% annualized. Forex traders can compare this to Australian Private Sector Credit for January, which increased by 0.3% monthly and by 2.5% annualized.

The Chinese Non-Manufacturing PMI for March was reported at 52.3 and the Chinese Manufacturing PMI at 52.0. Economists predicted a figure of 42.0 and 44.8. Forex traders can compare this to the Chinese Non-Manufacturing PMI for February, which was reported at 29.6 and to the Chinese Manufacturing PMI, which was reported at 35.7. The Chinese Composite PMI for March was reported at 53.0. Forex traders can compare this to the Chinese Composite PMI for February, which was reported at 28.9.

The US S&P/Case-Shiller Composite 20 for January is predicted to increase by 0.40% monthly and by 3.9% annualized. Forex traders can compare this to the US S&P/Case-Shiller Composite 20 for December, which increased by 0.43% monthly and by 2.85% annualized. The US Chicago PMI for March is predicted at 40.0. Forex traders can compare this to the US Chicago PMI for February, which was reported at 49.0. US Consumer Confidence for March is predicted at 112.0. Forex traders can compare this to US Consumer Confidence for February, which was reported at 130.7.

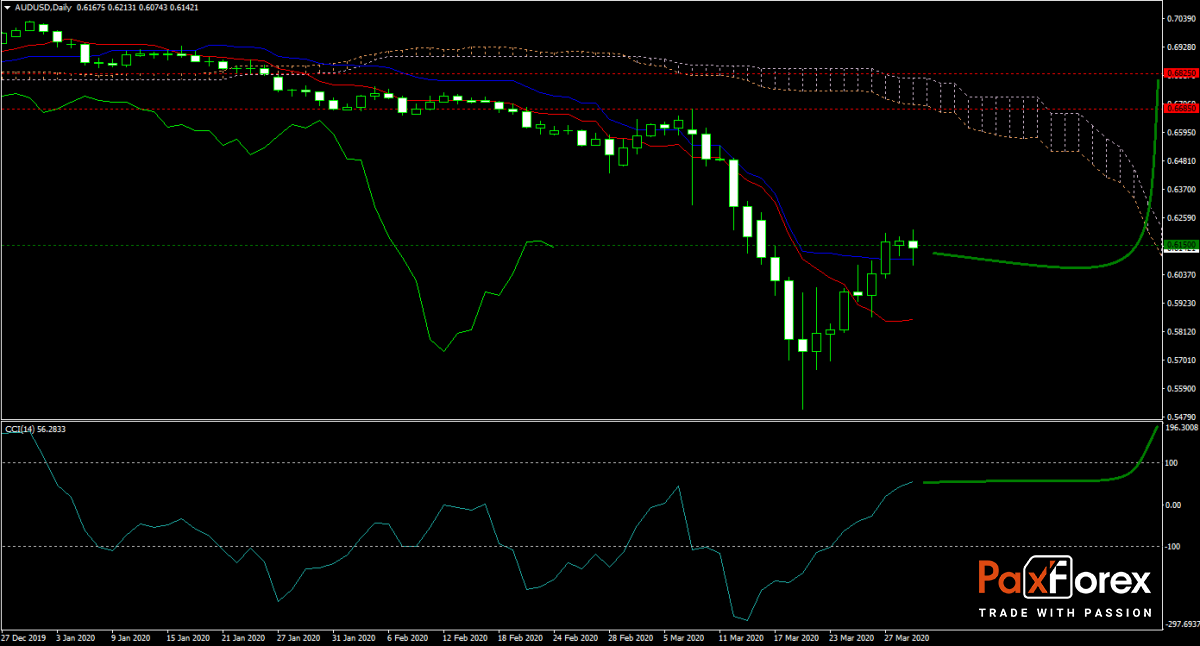

The AUD/USD forecast has turned bullish after the recovery from a quick contraction below the psychological 0.6000 level. Australia is trying to remain at the forefront of the economic slowdown, preparing for recovery, and limiting the debt load. The US Federal Reserve is running the printing press 24/7, devaluing its currency long-term. Will bulls be able to keep the rally alive? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the AUD/USD remain inside the or breakout above the 0.6090 to 0.6200 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 0.6150

- Take Profit Zone: 0.6685 – 0.6825

- Stop Loss Level: 0.6030

Should price action for the AUD/USD breakdown below 0.6090 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 0.6030

- Take Profit Zone: 0.5810 – 0.5855

- Stop Loss Level: 0.6090

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.