Source: PaxForex Premium Analytics Portal, Fundamental Insight

Australian HIA New Home Sales for July increased by 87.2% monthly. Forex traders can compare this to Australian HIA New Home Sales for June, which decreased by 4.2% monthly. Australian Consumer Inflation Expectations for July increased by 3.2% annualized. Forex traders can compare this to Australian Consumer Inflation Expectations for June, which increased by 3.3% annualized.

The Australian Employment Change for June was reported at 210.8K. Economists predicted a figure of 112.5K. Forex traders can compare this to the Australian Employment Change for May, reported at -227.7K. The Unemployment Rate for June was reported at 7.4%. Economists predicted a reading of 7.4%. Forex traders can compare this to the Unemployment Rate for May, reported at 7.1%. The Labor Force Participation Rate for June was reported at 64.0%. Economists predicted a reading of 63.6%. Forex traders can compare this to the Labor Force Participation Rate for May, reported at 62.9%.

US Initial Jobless Claims for the week of July 11th are predicted at 1,250K, and US Continuing Claims for the week of July 4th are predicted at 17,600K. Forex traders can compare this to US Initial Jobless Claims for the week of July 4th, which reported at 1,314K, and to US Continuing Claims for the week of June 27th, which reported at 18,062K. The Philadelphia Fed Manufacturing Index for July is predicted at 20.0. Forex traders can compare this to the Philadelphia Fed Manufacturing Index for June, reported at 27.5.

US Advanced Retail Sales for June are predicted to increase by 5.0% monthly, and Retail Sales Less Autos are predicted to increase by 5.0% monthly. Forex traders can compare this to US Advanced Retail Sales for May, which increased by 17.7% monthly and to Retail Sales Less Autos, which increased by 12.4% monthly. Retail Sales Less Autos and Gas for June are predicted to increase by 4.2% monthly, and Retail Sales Control Group are predicted to increase by 3.6% monthly. Forex traders can compare this to Retail Sales Less Autos and Gas for May, which increased by 12.4% monthly and to Retail Sales Control Group, which increased by 11.0% monthly.

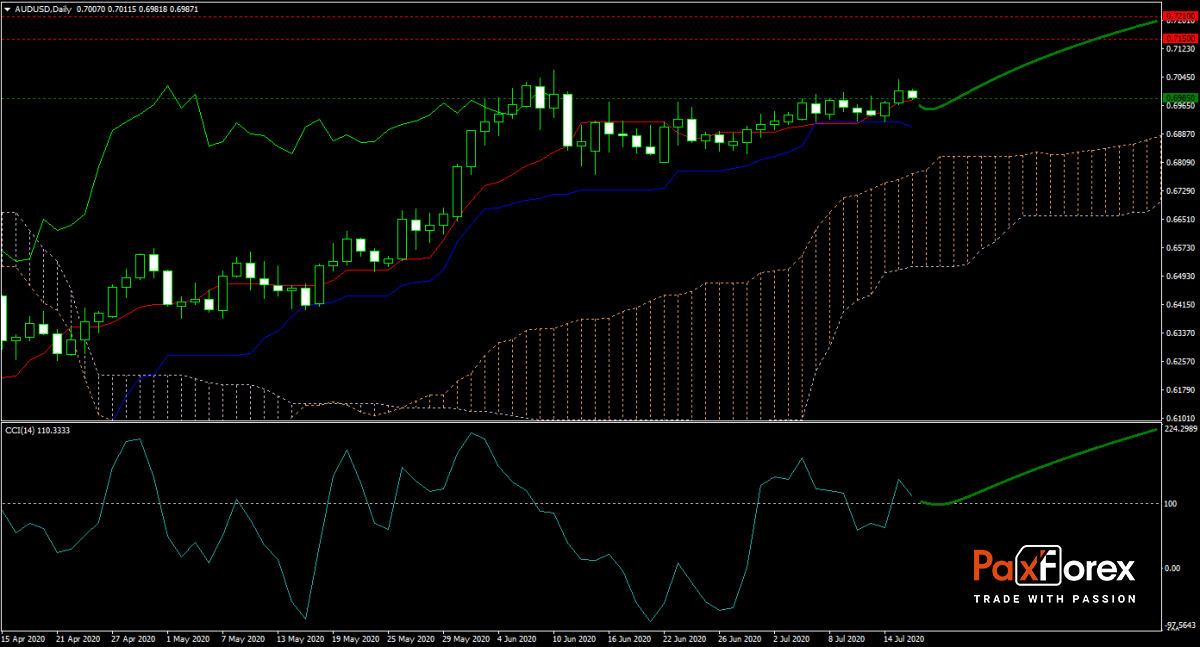

The forecast for the AUD/USD remains bullish after the employment report out of Australia for June came in above expectations. Better than expected Chinese economic data adds a catalyst to the Australian Dollar. Today’s initial jobless claims and retail sales out of the US, are eagerly anticipated. Price action is trading above its Kijun-sen and Tenkan-sen with an upward sloping Ichimoku Kinko Hyo Cloud. Will bulls drive this currency pair into its next horizontal resistance area? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the AUD/USD remain inside the or breakout above the 0.6970 to 0.7035 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 0.6985

- Take Profit Zone: 0.7150 – 0.7210

- Stop Loss Level: 0.6910

Should price action for the AUD/USD breakdown below 0.6970 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 0.6910

- Take Profit Zone: 0.6775 – 0.6835

- Stop Loss Level: 0.6970

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.