Source: PaxForex Premium Analytics Portal, Fundamental Insight

Australian NAB Business Conditions for June were reported at -7 and Australian NAB Business Confidence at 1. Forex traders can compare this to NAB Business Conditions for May, reported at -24 and to Australian NAB Business Confidence, reported at -20. The preliminary Singapore GDP for the second quarter decreased by 41.2% quarterly and by 12.6% annualized. Economists predicted a decrease of 37.4% and 10.5% annualized. Forex traders can compare this to the Singapore GDP for the first quarter, which decreased by 3.3% quarterly and by 0.3% annualized.

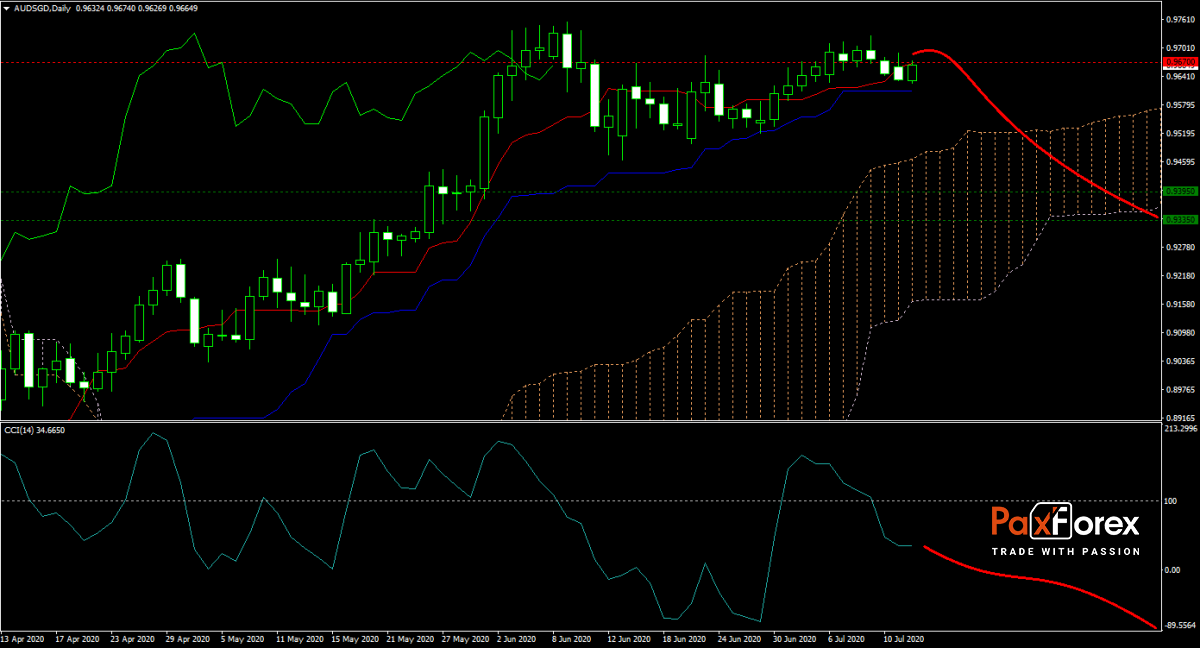

The AUD/SGD outlook remains bearish despite the higher than expected GDP contraction out of Singapore. Following the election results, the Singaporean government is expected to accelerate changes to existing economic policies to ensure adjustments will allow the city-state to prosper. Price action is located between the Kijun-sen and Tenkan-sen, above the Ichimoku Kinko Hyo Cloud. Bears are expected to push for a correction into its horizontal support area, presently engulfing the Span B of the cloud. Is a sell-off possible? Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.

Should price action for the AUD/SGD remain inside the or breakdown below the 0.9640 to 0.9690 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 0.9700

- Take Profit Zone: 0.9335 – 0.9395

- Stop Loss Level: 0.9760

Should price action for the AUD/SGD breakout above 0.9700 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 0.9760

- Take Profit Zone: 0.9900 – 0.9960

- Stop Loss Level: 0.9700

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.