The RBA surprised markets with a 25 basis points interest rate cut during the Asian trading session to 0.50%. This took its benchmark rate to an all-time low, but the central bank didn’t rule out further cuts. The Australian Dollar remained resilient despite the cut. The Australian ANZ Roy Morgan Weekly Consumer Confidence Index for the week of March 1st was reported at 104.8. Forex traders can compare this to the Australian ANZ Roy Morgan Weekly Consumer Confidence Index for the week of February 23rd, which was reported at 108.3.

Australian Building Approvals for January decreased by 15.3% monthly and by 11.3% annualized. Economists predicted an increase of 1.0% monthly and 1.9% annualized. Forex traders can compare this to Australian Building Approvals for December, which increased by 3.9% monthly and by 7.2% annualized. The Swiss GDP for the fourth-quarter increased by 0.3% quarterly and by 1.5% annualized. Economists predicted an increase of 0.2% quarterly and of 1.3% annualized. Forex traders can compare this to the Swiss GDP for the third quarter, which increased by 0.4% quarterly and by 1.1% annualized.

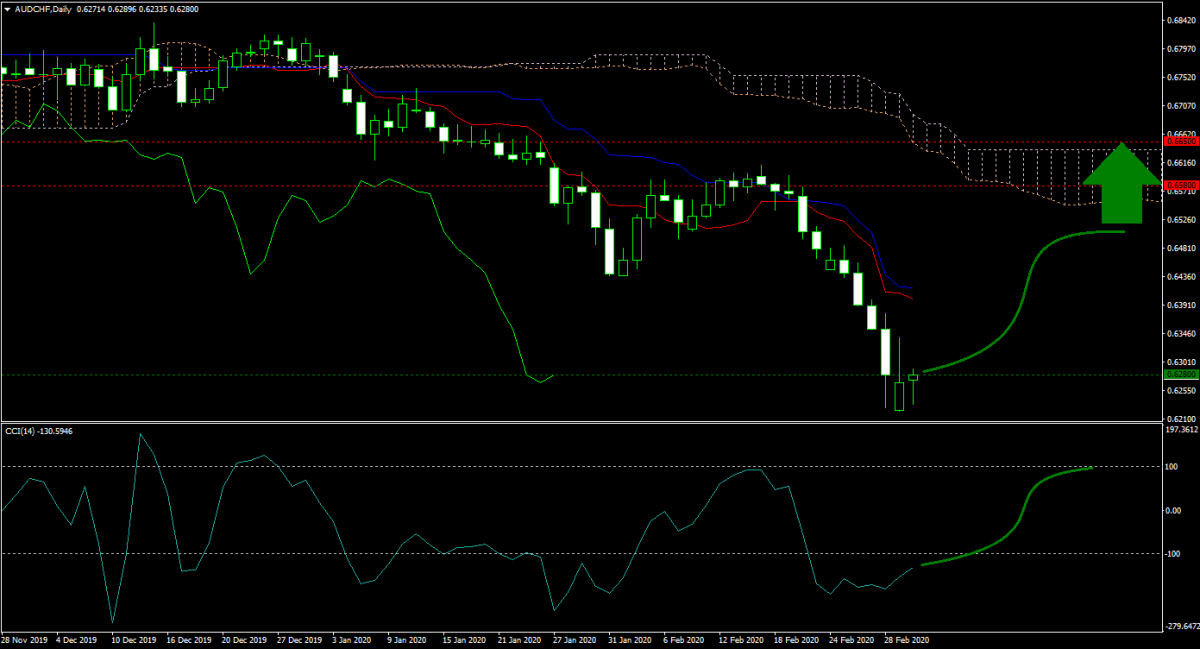

The AUD/CHF forecast turned bullish after this currency pair remained inside of its horizontal support area. Expectations for more easing by the RBA have eased after banks vowed to support monetary easing, lowering borrowing costs for consumers and businesses. Will bulls attempt to pressure price action to a breakout or will bears attempt a breakdown? The CCI indicates a recovery, which is anticipated to result in a counter-trend rally in this currency pair.

Should price action for the AUD/CHF remain inside the or breakout above the 0.6225 to 0.6300 zone the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Long Position

- Entry Level: Long Position @ 0.6280

- Take Profit Zone: 0.6580 – 0.6650

- Stop Loss Level: 0.6180

Should price action for the AUD/CHF breakdown below 0.6225 the following trade set-up is recommended:

- Timeframe: D1

- Recommendation: Short Position

- Entry Level: Short Position @ 0.6180

- Take Profit Zone: 0.5985 – 0.6025

- Stop Loss Level: 0.6225

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio. Subscribe to the PaxForex Daily Fundamental Analysis and earn over 5,000 pips per month.