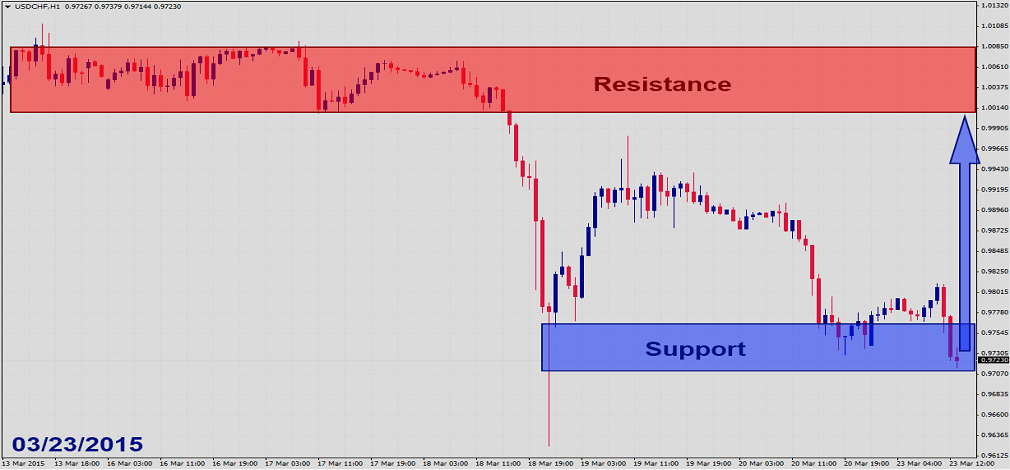

Here are the key factors to keep in mind today for US Dollar trades: US GDP: Forex traders will get a second look at the fourth-quarter GDP figure. The initial report showed an increase of 2.2% which missed expectations for an increase closer to 3.0%. Now economists expect the new report to show that the US GDP expanded by 2.4% in the fourth-quarter. Personal consumption is expected to come in at 4.4%. This can be compared to the previous level of 4.2%. The Core Personal Consumption Expenditure Index is expected to remain unchanged at 1.1%...

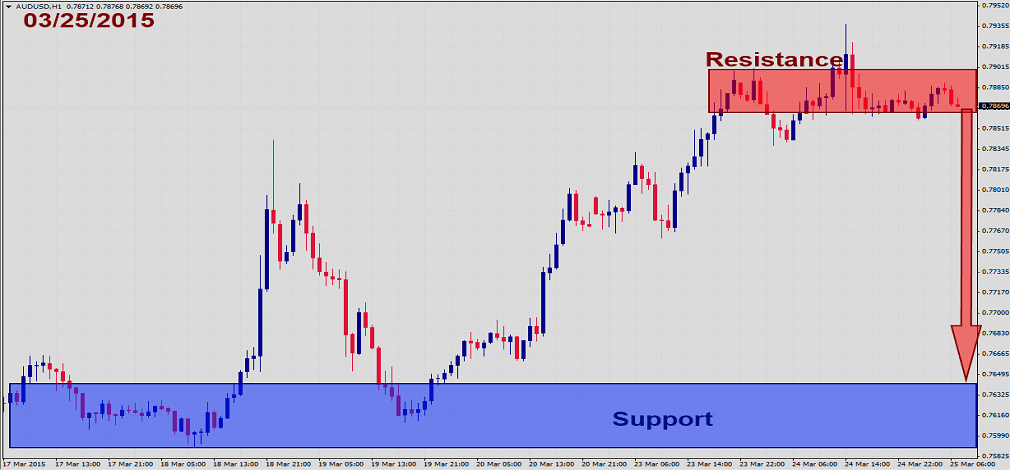

Here is the key factor to keep in mind today for Australian Dollar trades: Australian Skilled Vacancies: The Australian labor market may be expanding, but it appears to be more on the unskilled labor front. Today’s report on Skilled Vacancies showed an increase of only 0.2% in February monthly which forex traders can compare to January’s downward revised increase of 0.4%. This is a bearish development for the Australian Dollar as skilled labor receives a much larger salary which can be used to spend and stimulate the economy while...

Here is the key factor to keep in mind today for US Dollar trades: US Existing Home Sales: The housing market is a key part of the US economy as a healthy housing market makes consumers feel wealthy and therefore stimulates consumer spending, which has contracting over the past few months. Economists expect today’s existing home sales report to show an increase of 2.0% to 4.92 million homes in February. While this data point may spur some buying in the US Dollar after the release, if it is taken into context with the 4.9% plunge reported...

Here is the key factor to keep in mind today for British Pound trades: UK Public Sector Net Borrowing: The UK government borrowed slightly less money than economists expected for February. Public sector net borrowing was reported at £6.2 billion for February; expectations called for an increase of £7.7 billion. Excluding banking public sector net borrowing was reported at £6.9 billion which can be compared to estimates for borrowing at £8.4 billion. The central government borrowed £3.5 billion. The data was strong enough to power the...

Here are the key factors to keep in mind today for British Pound trades: UK Employment Report: Economists expect the annualized three-month period which ended in January to show the addition of 130,000 jobs and that the ILO unemployment rate decreased to 5.6%. Forex traders can compare this with the addition of 103,000 jobs in December where the unemployment rate was 5.7%. Average weekly earnings are expected to increase by 2.2% and average weekly earnings excluding bonuses are expected to increase by 1.8%. This can be compared to the 2.1...