Here is the key factor to keep in mind today for Australian Dollar trades:

- Australian Skilled Vacancies: The Australian labor market may be expanding, but it appears to be more on the unskilled labor front. Today’s report on Skilled Vacancies showed an increase of only 0.2% in February monthly which forex traders can compare to January’s downward revised increase of 0.4%. This is a bearish development for the Australian Dollar as skilled labor receives a much larger salary which can be used to spend and stimulate the economy while unskilled labor often just takes care of the necessities.

Here is the key factor to keep in mind today for US Dollar trades:

- US Durable Goods Orders: Economists expect durable goods orders to increase by 0.2% in February while durable goods orders excluding the volatile transportation sector are also expected to rise by 0.2%. Forex traders can compare this to January’s increase of 2.8% for durable goods orders and 0.0% for durable goods orders excluding transportation. Capital goods orders non-defense and excluding aircraft are expected to increase by 0.3% in February which compares to the 0.5% increase reported in January. Capital goods shipments non-defense and excluding aircraft are expected to increase by 0.3% as well which can be compared to January’s increase of only 0.1%. Today’s report on durable goods orders may just be strong enough to allow the US Dollar to finish the trading session higher.

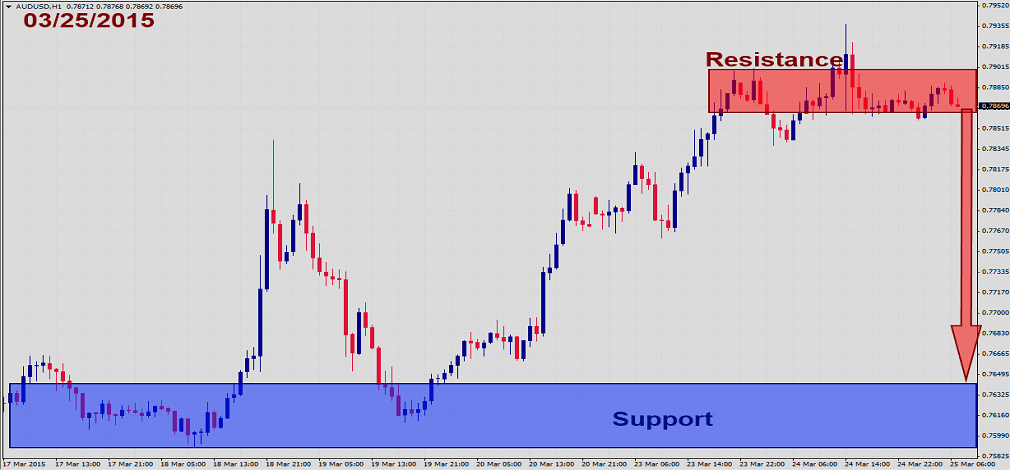

Should price action for the AUDUSD remain inside, or breakdown below, the 0.7850 to 0.7920 zone the following trade set-up is recommended:

- Timeframe: H1

- Recommendation: Short Position

- Entry Level: Short Position @ 0.7880

- Take Profit Zone: 0.7600 – 0.7650

- Stop Loss Level: 0.8000

Should price action for the AUDUSD breakout above 0.7920 the following trade set-up is recommended:

- Timeframe: H1

- Recommendation: Long Position

- Entry Level: Long Position @ 0.7950

- Take Profit Zone: 0.8000 – 0.8050

- Stop Loss Level: 0.7920

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.