Here is the key factor to keep in mind today for US Dollar trades:

- US Existing Home Sales: The housing market is a key part of the US economy as a healthy housing market makes consumers feel wealthy and therefore stimulates consumer spending, which has contracting over the past few months. Economists expect today’s existing home sales report to show an increase of 2.0% to 4.92 million homes in February. While this data point may spur some buying in the US Dollar after the release, if it is taken into context with the 4.9% plunge reported in January to 4.82 million homes the scenario looks bearish. The US housing market has been contracting so far in 2015, but the US Dollar could close the trading session higher as a result which will push the USDCHF away from oversold territory.

Here is the key factor to keep in mind today for Swiss Franc trades:

- Swiss Money Supply (M3): Swiss Money Supply (M3) rose 2.3% in February annualized which was a good enough level to result in a stronger Swiss Franc. Forex traders can compare this figure to January’s downward revised increase of 2.9%. Given the absence of other economic reports released during the European trading sessions the gains in the Swiss Franc were increased.

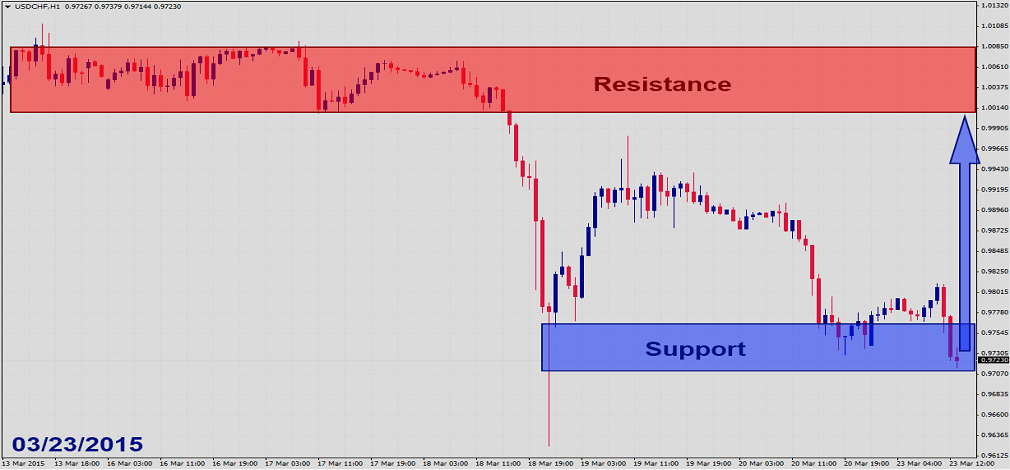

Should price action for the USDCHF remain inside the 0.9700 to 0.9730 zone or breakout above it the following trade set-up is recommended:

- Timeframe: H1

- Recommendation: Long Position

- Entry Level: Long Position @ 0.9720

- Take Profit Zone: 1.0000 – 1.0100

- Stop Loss Level: 0.9600

Should price action for the USDCHF breakdown below 0.9720 the following trade set-up is recommended:

- Timeframe: H1

- Recommendation: Short Position

- Entry Level: Short Position @ 0.9690

- Take Profit Zone: 0.9550 – 0.9600

- Stop Loss Level: 0.9720

Open your PaxForex Trading Account now and add this currency pair to your forex portfolio.