It is easy to forget about Brexit this month, with plenty of other events grabbing the headlines. Many are also getting tired of the twists and turns Brexit has taken and welcome the distractions away from Brexit headline after Brexit headline. As the Trump-Kim Summit ended with the signature of both leaders on a ‘comprehensive document’ and undisclosed details, forex traders didn’t show any reaction as price action remained calm. The FIFA World Cup in Russia may offer another distraction from Brexit, but June holds a key EU summit at the end of the month and the stakes are high.

British Prime Minister May scored a minor victory against pro-EU rebels in her own party late last night. The rebels want to keep the UK inside the EU’s custom union which would be a major betrayal to Brexit backers. While the vote would have been more symbolic than binding, it has been postponed until next month which gives PM May breathing room to focus on a much more important issue. The House of Lords, the unelected chamber in UK parliament, added a clause known as the ‘meaningful vote’ which would give Parliament the power to reject the Brexit deal May would present after negotiating it this fall in Brussels. This would be unprecedented and the final vote will be held at 3pm in London today.

PM May is now fighting and pleading with members of Parliament in an attempt to unite her party behind her. This would present a much stronger negotiating platform for her and her team. May stated that ‘We must think about the message Parliament will send to the European Union this week. I am trying to negotiate the best deal for Britain.’ A defeat on this front could see pro-Brexit ministers pushing for a replacement. This would also be bad news for the pro-EU rebels as the next PM would most certainly be a hard-line Brexiteer less willing to compromise.

Will there be a new Brexit compromise? A front page banner in the Sun newspaper reads ‘You have a choice... Great Britain or Great Betrayal’, and the pressure is on for the rebels to get in line. Forex traders are cautious with the British Pound until after the vote this afternoon. Will the British currency mount a strong rally following its corrective phase? Open your PaxForex Trading Account now and position yourself in the profitable direction with the hard work of our expert analysts.

There are some positive signs for May as some rebels suggested that they would not try to weaken her position amid fears of her replacement being a hard-line Brexit supporter. Today’s vote will deliver a very important piece to the Brexit puzzle. Another sign of optimism is the new custom union compromise which is backed by Brexit Secretary Davis and has support from both sides of the camp. Brexit Minister Steve Baker added ‘We believe that our party is going to unite in the national interest. That would mean rejecting the amendment we have been given on the meaningful vote.’ Here are three Brexit forex trades which every trader should have in their portfolio now.

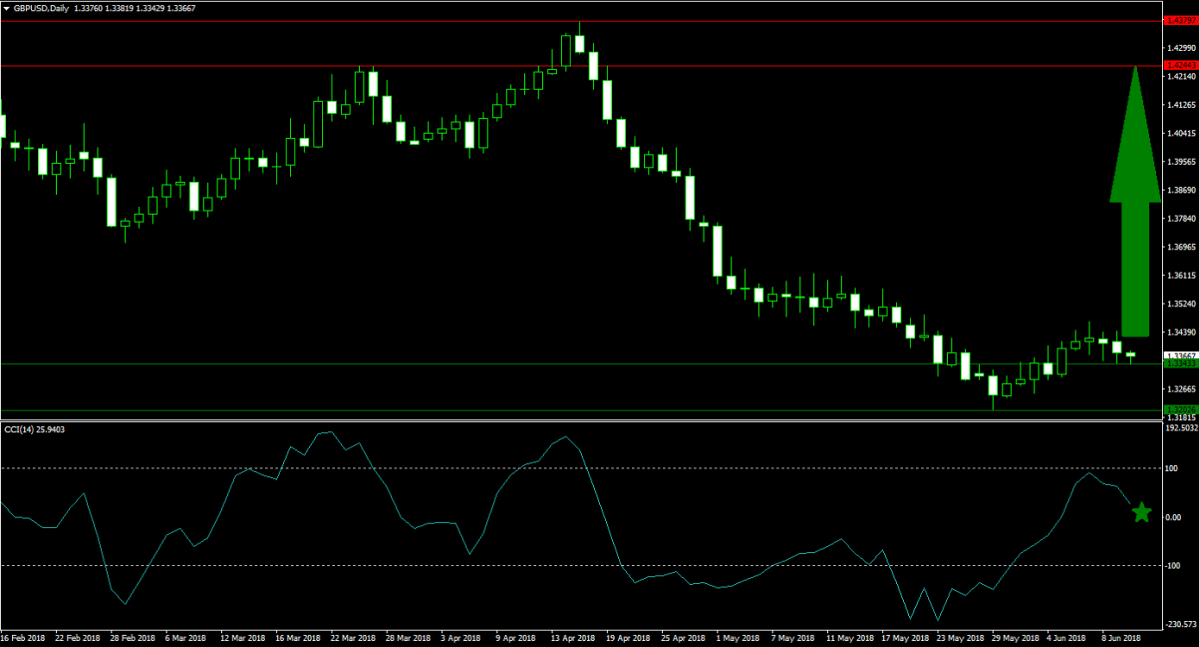

Forex Profit Set-Up #1; Buy GBPUSD - D1 Time-Frame

The GBPUSD was forced into a correction as the twin forces of potential Brexit defeats and a seven-week US Dollar rally overcame the preceding strength of the British Pound. As the US Dollar is now on the verge of reversing its own rally and price action in the GBPUSD is trading at solid support levels, forex traders should position themselves for a sharp acceleration in this currency pair. Placing buy orders above and below the upper band of its horizontal support area is recommended.

The CCI has recovered from extreme oversold conditions and spiked higher confirming the breakout above support levels which resulted in a bullish sentiment change. Download the PaxForex MT4 Trading Platform today and buy this currency pair before it will enjoy a strong rally fueled by short-covering mixed with new buy orders.

Forex Profit Set-Up #2; Sell EURGBP - D1 Time-Frame

Following a steady advance in the British Pound against the Euro, which hinted and continues to hint at a favorable Brexit outcome for the UK, price action took a breather and a sideways trend emerged. The EURGBP now drifted slightly higher into its descending resistance level from where a new sell-off on the back of profit taking is anticipated. Forex traders are advised to spread their sell orders from current levels into its descending resistance level.

The CCI, a momentum indicator, advanced into extreme overbought territory and is already trading away from its highs in a sign of weakening bullish sentiment. A breakdown below the 100 level is set to ignite a sell-off in the EURGBP. Subscribe to the PaxForex Daily Fundamental Analysis and earn over 500 pips from our fundamental trading set-ups delivered fresh every day from our analytics desk.

Forex Profit Set-Up #3; Buy GBPJPY - D1 Time-Frame

As the Trump-Kim Summit was labeled a success, the Japanese Yen is on the retreat and coupled with a slew of economic disappointments the trend is set to continue. The GBPJPY already completed a breakout above its horizontal support area and is expected to extend its advance until it can challenge its horizontal resistance area following a breakout above its descending resistance level. Forex traders are recommended to buy the dips in the GBPJPY in order to take advantage of the attractive upside in this currency pair.

The CCI has advanced and confirmed the breakout above its horizontal support level. Given the sharp increase in bullish sentiment, this technical indicator is expected to advance further until it will reach its previous high. Follow the PaxForex Daily Forex Technical Analysis and receive the most profitable technical trading set-ups. Our expert analysts work hard so that you can profit easy.

To receive new articles instantly Subscribe to updates.