That’s one question which many would like to have answered. It is on everyone’s mind from the business community to the forex market. Previously the possibility of remaining in the customs union was a red line Prime Minister Theresa May and the pro-Brexit camp said they would not cross. Leaving the European Union was promoted as an act of freedom, and part of that freedom was to leave the EU customs union so that the UK can strike trade deals on their own which favor the British economy and not the German led EU.

As Brexit is now less than 12 month’s away and no clear Brexit deal is in sight, those red lines may come crumbling down. So far the EU as well as the UK have been mostly fortified on their positions and been playing a game of chicken. No side wants a hard Brexit and the business community is especially worried what will happen after the transition period post-Brexit will expire. Forex traders have grown increasingly bullish on the British Pound, suggesting that a favorable Brexit will be achieved.

Theresa May has to juggle a fragile majority in government which relies on her DUP allies. There are also enough rebels within her own party which could join with the Labour Party in order to back any deal she will bring back to Parliament. The Eurasia Group is confident that the UK will decide to remain in the customs union after the transition period as the managing director stated that ‘A U.K.-wide EU customs union is therefore now our base case once the transitional period ends, although this is a very close call. We expect a U-turn by the prime minister well ahead of the Tory conference.

A change in Brexit negotiations will have undoubtedly a big impact on the forex market. Many believe it will further boost the British Pound, but it could also sink the currency in the aftermath should such a change be announced. Open your PaxForex Trading Account today in order to take advantage of the profitable trading opportunities which lie ahead in the forex market.

Since PM May voted to remain in the EU, she is often perceived as not being fully behind the type of Brexit Foreign Secretary Boris Johnson or Trade Secretary Liam Fox promised. Since the Irish border issue remains a key unresolved problem in Brexit negotiations, May could use that as an excuse to push the UK to remain in the customs union as well as single market, but to be in control of the free movement of people. The EU previously said that the UK can’t cherry pick. Plenty of unresolved issues and potential U-turns mean that the British Pound is in for a sharp increase in volatility. Here are three trades to capture pips as a result of the expected price action gyrations.

Forex Profit Set-Up #1; Sell GBPUSD - H4 Time-Frame

While the overall trend for the British Pound remains bullish throughout 2018, there are some short-term trading opportunities to take profits from the GBP rally. The GBPUSD was just recently rejected by its horizontal resistance area and price action could be pushed down into its ascending support level. This would be healthy for the long-term up-trend in the GBPUSD and forex traders should now sell the rallies.

The CCI is trading in extreme overbought conditions above 100, but the expected minor correction will take it back down into neutral territory from where a further momentum analysis is required. Earn over 500 pips per month with the hard work of our expert analysts who bring you each trading day’s most lucrative fundamental forex trades at the PaxForex Daily Fundamental Analysis section.

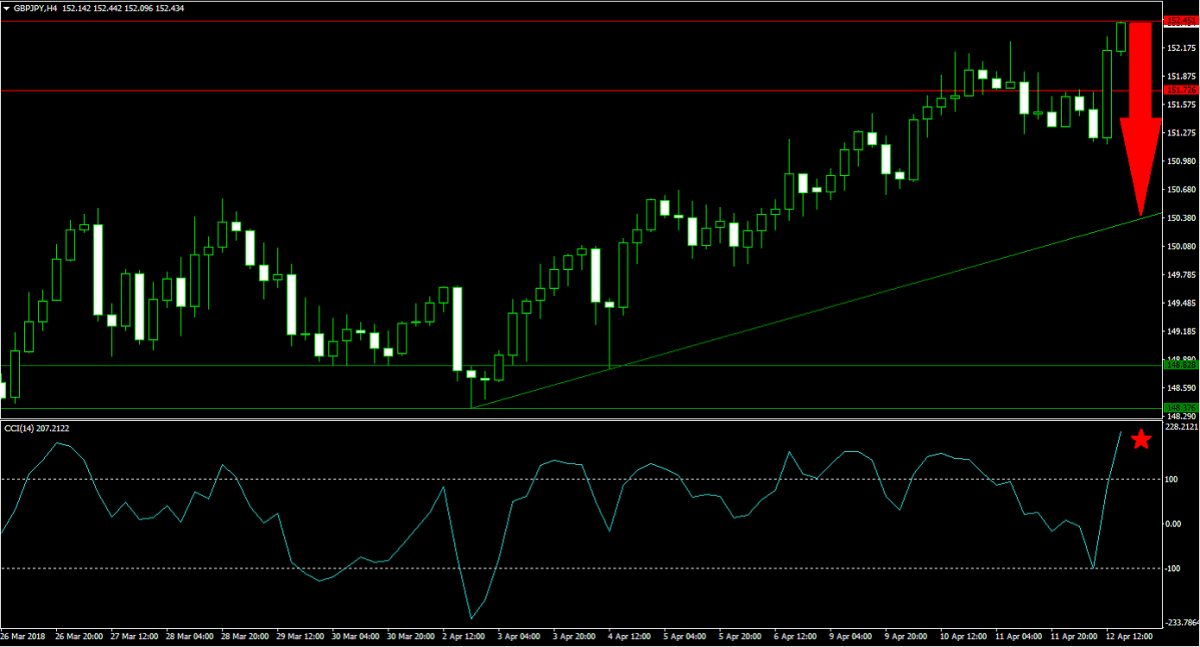

Forex Profit Set-Up #2; Sell GBPJPY - H4 Time-Frame

The GBPJPY has surged from its horizontal support area into its horizontal resistance area and is currently testing the upper band of it. The rapid surge in price action leaves this currency pair vulnerable to a short-term contraction. A push below its horizontal resistance area down into its ascending support level is expected. Forex traders are advised to spread their sell orders inside of its current horizontal resistance area.

The CCI has spiked into extreme overbought conditions and is trading well above the 100 mark. This technical indicator is set for a plunge amid the expected corrective move in the GBPJPY. Make sure to profit from the PaxForex Daily Forex Technical Analysis where the best technical trading set-ups are outlined every day.

Forex Profit Set-Up #3; Buy EURGBP - H4 Time-Frame

As the prospects for the Euro remain weak following a sharp move higher, a short-term spike on the back of short-covering should be accounted for. The EURGBP is currently testing the lower band of its horizontal support area from where a quick price action reversal is likely to materialize. Forex traders are advised to buy the dips as momentum may carry the EURGBP above its descending resistance level.

The CCI plunged together with price action is now trading deep in extreme oversold territory from where a bounce higher is expected. Download your PaxForex MT4 Trading Platform now and fund your trading account in order to add this currency pair to your portfolio before the next move to the upside will materialize.

To receive new articles instantly Subscribe to updates.