It`s well-known that anyone who decides to take up the trading on the financial market (or any other activity that is totally new) will need to get acquainted with the very basics and practice as long as it takes. Of course, the vast majority of beginner traders would prefer to skip this stage and dive headfirst into trading neglecting to deeply understand how essential it is. For those who take trading seriously, there's no better way to hone skills than to start practicing on a demo account.

Even though everything you do on a demo account is virtual, the conditions will be similar to real ones with the only but – the funds are hypothetical as well as all the results.

What is a Forex Trading Demo Account?

Taking into account the fact that the forex is a decentralized market, most brokerage companies have their own price quotes delivered to their own trading platforms depending on liquidity providers. Some of these trading platforms are copyrighted and have their own specific features as well as advantages and disadvantages. Hence rather than letting all the potential clients risk real capital and being unsatisfied while learning the “ins” and “outs” of their trading platforms and getting used to trading conditions, demonstrative accounts give them an opportunity to familiarize themselves with the platform`s layout without any risk.

Most brokerage companies provide their clients with free forex trading demo accounts so they get a simulated trading experience and have an idea of how the financial market works. Basically, the forex demo account is a training account designed for those who want to obtain the skill and knowledge before opening real trades.

Overall, such training accounts may offer trading novices a perfect way to learn about how to trade Forex, as long as to avoid trading errors that might bring them bad trading habits.

The Purpose of Demo Accounts

Basically, the forex demo account is created for 3 main reasons. The first one is for the new traders to learn some basic but crucial concepts as long positions, short positions, take profit, etc. The second reason is testing out the trading platform of the broker chosen. And the third one is especially for experienced traders to experiment with the new trading strategy or method and adjust it according to results received.

Where to Get a Free Forex Demo Account

PaxForex is not an exception and here you can get a free unlimited forex demo account for your training with any amount you request. This is actually great since you can trade demo with the same capital you want to deposit to your live account, this will help you to avoid unnecessary confusion and will rid you of false expectations.

First, use this link https://cabinet.paxforex.org/registration/demo to create a demo account.

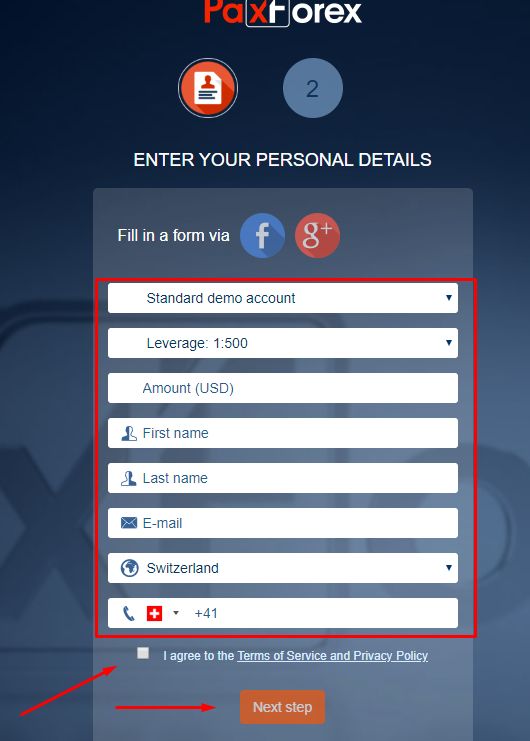

There is a registration form where you need to choose the type of account (Cen/Mini/Standard), leverage (100/200/300/400/500) and write the amount desired. Then you have to fill in your personal information, tick on “I agree to…” and click on “Next Step”.

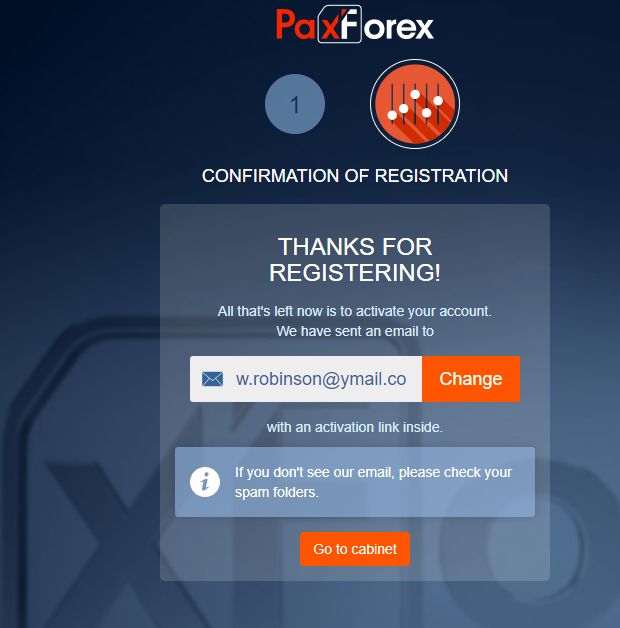

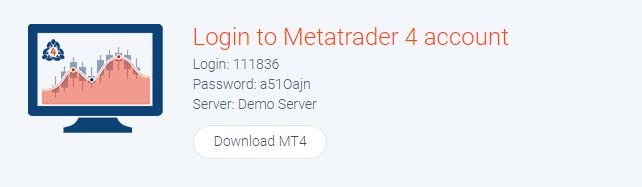

Now you will get the pop-up window of successful registration with further instructions.

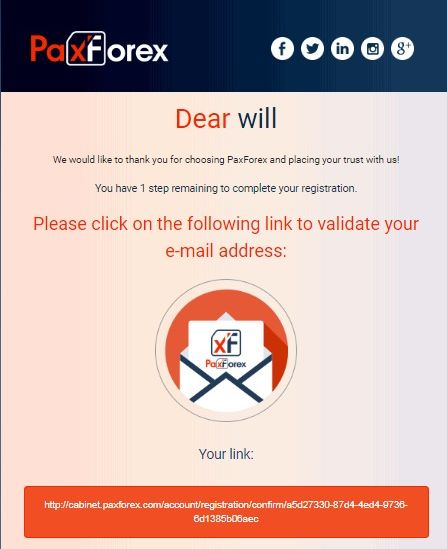

Then go to your email`s inbox and open an email from PaxForex and activate your account by validating the email address. To do that click on the link in the red bar.

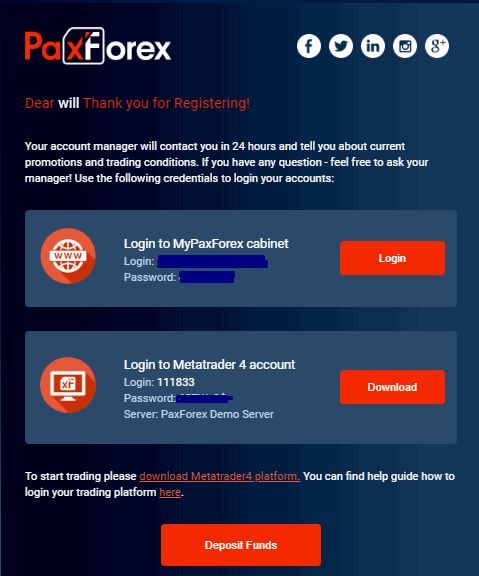

Once you`ve done, you will another email with the login details to MyPaxForex cabinet and to the MetaTrader4 demo account. There is also a link to where you can download the trading terminal.

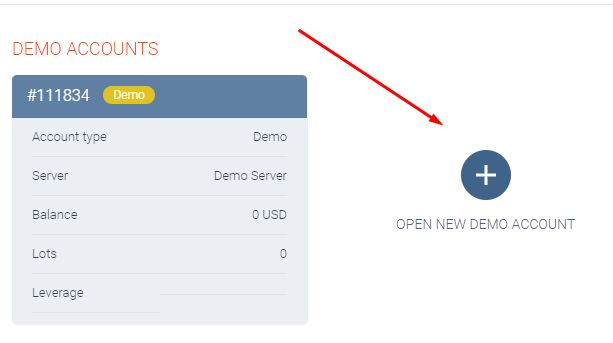

We draw your attention to the fact that you are able to open as many demo accounts as you want in your cabinet, so you can practice with different amounts and leverage.

After you set the leverage and the amount, credentials for this new account will appear in your cabinet, make sure you save it somewhere not to lose.

Now you are all set to explore the trading platform and to test whatever trading ideas or strategies you might have.

What Should You Go Through on a Forex Demo Account?

As we`ve mentioned above, a demo trading account is created to demonstrate the trading platform and the usage of its functions.

Accordingly, the layout and various features will be the same, on demo and on a real account. To properly assess a demo trading platform and to get ready for the live trading you must open at least a few dozen trades on the platform.

By doing so, you will be able to perfectly understand what is what and what this or that button does.

In other words, you will be able to answer the below-mentioned questions:

How to place limit and stop orders

How to set Stop Loss and Take Profit

What a lot of sizes you can trade with

Whether the trading platform gives you all the necessary tools for you to collect all the necessary information to make a conscious and considered decision

What spread you want to trade with - variable or fixed one

Real vs. Demo account

Although forex demo accounts are able to provide traders with numerous benefits, they do have their own set of limitations.

Foremost of all, forex demo accounts are not able to provide their users with the same emotional intensity when compared to trading with a real money account. One of the hardest things that a trader has to learn when trading forex is keeping their emotions in check. The possible absence of emotional involvement when no real money traded, so to say, there is no skin in the game, may create unrealistically positive trading conditions in demo trading that is not found in real trading when the trader’s account money is actually on the line.

Trading with a demo account for a substantial period can also lead to traders picking up new habits which can be extremely difficult to break once a trader starts to trade with a real money account. In fact, bad trading habits among beginner traders are one of the primary causes of their failure.

Another obvious limitation of the forex demo account is the fact that no matter how well you are doing on a demo account, you still won’t be able to generate any trading profits until you start trading live with a real money account.

A trader’s failure to develop the trading plan has no real consequences. As a result, a trader may incur bad discipline-related habits that can cost money when trading live.

Traders might be tempted to overtrade or inadequately estimate risk when trading on a practice account. It can then have serious negative outcomes when they move to a real account.

Why Are Practice Accounts So Important for Beginners?

Hence, it is crucial for beginner traders that they take advantage of the forex demo account as a learning tool as well as a platform for strategy testing. The beginner trader must use the demo account to help him learn how to operate the trading platform effectively.

He must also use it to learn the foundations of trading and use that knowledge to further build on his trading strengths. In short, the demo account provides beginner traders with the necessary experience to help them learn how to limit their trading losses as well as to learn how to control their fears and greed.

It’s a great way to learn about a broker, by running through the sign-up process, checking out the broker’s resources and even potentially speaking to them through live chat or over the phone.

Trading virtual capital excludes the psychological component of trading, because of that, it cannot precisely evaluate a person’s trading abilities. Notwithstanding, virtual trading can have great advantages when testing the execution of a trading method and also for trader learning objectives.

7 Hints for Prosperous Forex Practice Account Use

For a forex demo account to be of any worth, you must treat it like a real account. By having such a mindset, this will help to expedite your passage from a practice account to a real account at a later stage.

Nonetheless, to help you get more out of your forex demo account, below are 7 hints on how to maximize the use of the forex demo account.

Familiarize yourself with the platform’s peculiarities e.g. indicators and charts. Novice traders frequently in their determination to get started trading as soon as possible often disregard familiarize themselves with all the numerous peculiarities of the trading platform. Rather than making the identical blunders, use the demo account to learn as much as possible of the capacities of the trading platform. Commit enough time so you will be able to understand how the trading platform functions and use its capacities to your trading success.

Experimenting With the Orders Types. In a totally risk-free trading environment provided on the demo account, test out all the trading orders that are supported by the trading platform. Try each order and see what is the best time to place them. For instance, in terms of risk management, the foremost orders used are the “Take Profit” and “Stop Loss” orders. To use these orders efficiently, see how to determine the best levels to set these trading orders.

Picking the Proper Leverage Level. Some brokers offer a leverage level as high as 1:500, one might be tempted to overtrade. Rather than taking on useless risks, use the demo account to ascertain the right leverage level for your particular trading manner. Identifying the precise leverage level to use is a good risk management tactic particularly when the market is very volatile.

Assets Choice. Most forex brokers offer their traders a wide range of currency pairs as well as various CFDs to trade with. The risk of having too many assets to trade with is based on losing focus. Instead, learn to concentrate your energy and attention on a few pairs and learn how to master trading them using the demo account.

Defining the Correct Lot Size. Although the standard lot size in forex trading is 100,000 units, most forex brokers offer different trading account types that have diverse lot sizes that their clients can trade with. For example, the Cent account has a lot size of 1000 units whereas the Mini account lets clients trade with a minimum lot size of 100,000 units. Use the demo account to decide what is the perfect lot size that you should trade with.

Trading Strategy Improvement. It`s well-known that for you order to succeed in forex trading (or in anything else, actually), you necessitate to have a strategy. Since each trader is individual and has different goals/capital/risk appetite. That`s why what is suitable for you may not correspond to your neighbor`s needs. So, try as many as needed until you find the best strategy and improve it.

Psychological Aspect. However, it`s very challenging to achieve the mastery of emotions with a demo account, the best way to do that is still on demo for you are not risking your real money. You may be absolutely cool after sustaining a huge loss in a practice account but might become completely upset over a tiny loss in your live account. For you to learn how to bottle up your emotions the demo trading should be treated like it`s a real one. Consequently, as we`ve mentioned before, trade with the same amount you can afford. That is if you are going to open a live account with $5,000, don't trade a demo account that has $100,000. In such a way you get a feeling of real trading. Pay close attention to how you react to certain situations and learn to keep them in check. Remember that the demo account should reflect your real circumstances as much as possible. Imagine the capital is real, and don't do things you wouldn't do on a live account.

If you grab yourself and go through this practicing stage you will be able to absorb a whole lot of useful information and will master the essential trading skills. Though demo trading success may not guarantee real trading success, it will help you to dramatically reduce the chances of failure.