With hundreds of forex brokers to choose from, selecting the right one can be challenging and time-consuming. This represents an important decision because the type of forex broker chosen can affect both the quality of service you receive, as well as your transaction fees and dealing spreads. The first step you need to do to trade on the forex market is opening a trading account with a forex broker. Some brokers offer better trading conditions than others, and you need to know what to look for when choosing your first forex broker.

Trading in the forex market can be an especially challenging endeavor for an individual without access to and the support of a competent online forex broker. Therefore, it is imperative that a person serious about opening a forex trading account carefully evaluates and selects a suitable forex broker in order to maximize their trading results over the long term. A well-capitalized and reputable company is generally what one would look for when performing any forex broker comparison.

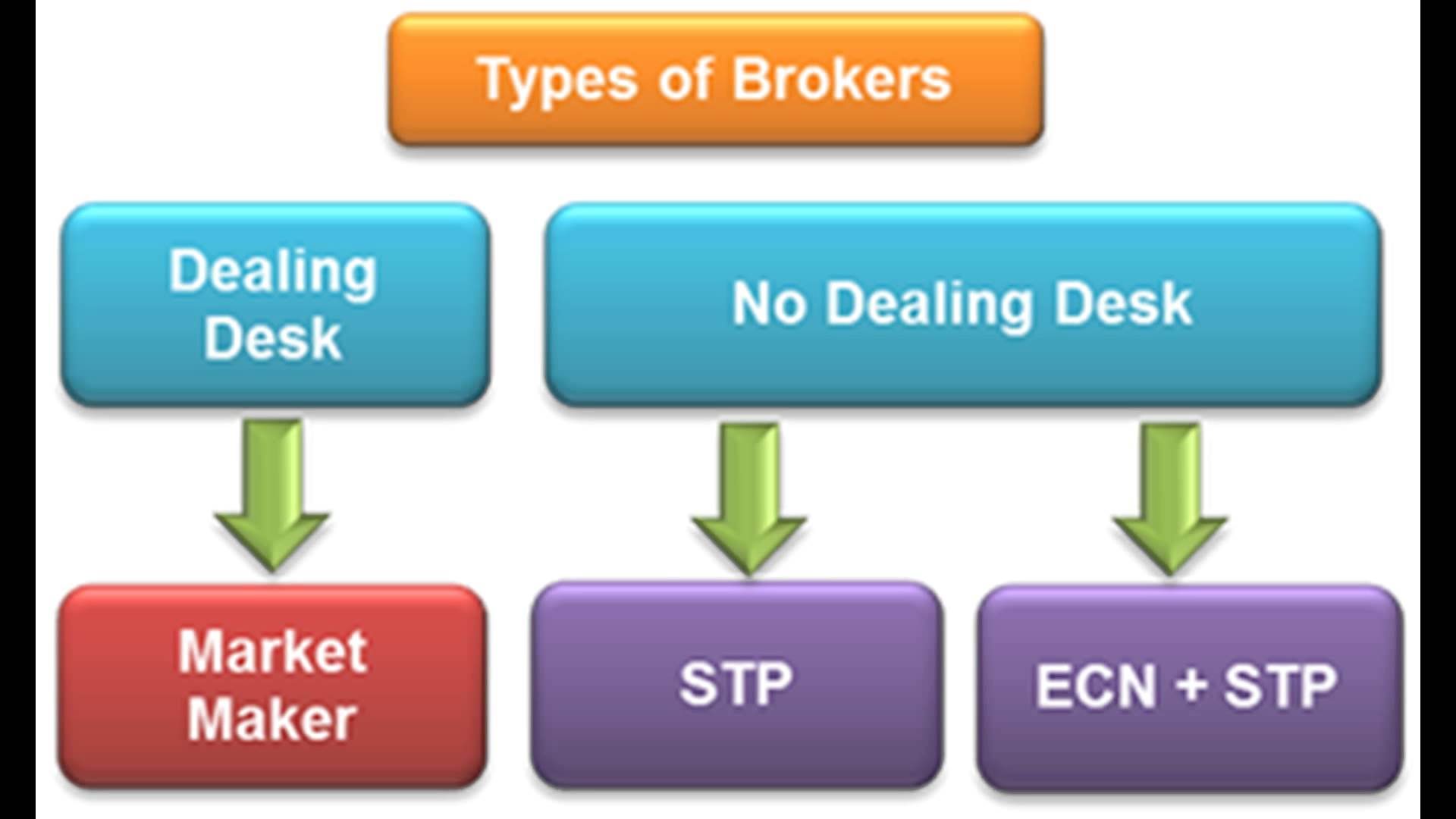

Even though up front all forex brokers provide the same basic service, behind the scenes things are not that simple. In fact, there are at least three major ways in which forex brokers operate, and the type of broker you choose can have a fundamental impact on your trading experience. When it comes to the key consideration of what type of forex broker to use with respect to what their forex quotations are based on, three main choices exist: no-dealing desk, market-making, and electronic communications network brokers. Each of these three different types of forex brokers has a different way of handling transactions and executing orders.

No Dealing Desk brokers provide their clients with access to the Interbank Market without the use of a Dealing Desk. Real NDD Brokers don’t require order confirmation and their transactions are executed immediately without delays. This works in favor of their clients, especially for those who are trading during news time. No Dealing Desk brokers are making money by widening bid/offer spread and/or by charging commissions. Some NDD forex brokers don’t charge any commissions and making money only by widening their offering spread. The advantage of NDD brokers is that they don’t have any conflict of interest with their clients. No Dealing Desk brokers are either ECN or STP, but some of them are both ECN and STP.

Forex brokers that are Market Makers literally create a market for their clients, meaning that all forex deals are conducted internally out of an inventory, either by finding a counterparty for each deal out of the pool of orders coming in from other clients or by the broker taking the counterparty themselves. On the other side, ECN broker connects traders directly with counterparties in the interbank market. The only role the broker plays in the transaction is creating the link between buyers and sellers... they do not set their own price rates or manage inventories in any way, as all the price rates are taken directly from the interbank market.

To receive new articles instantly Subscribe to updates.