Many traders are attracted to the forex market because of its high liquidity, around-the-clock trading and the amount of leverage that is afforded to participants. On the other side stocks, particularly blue-chips, are generally used for longer-term buy-and-hold investments, where your return will be determined over weeks and months. The foreign exchange market is the world’s largest financial market offering traders a chance to get a piece of the 5 trillion dollars that are traded daily. Whereas the stock market trades reputable and profitable companies that over recent years, have tended to grow consistently.

The forex market is not tied to a geographic area, so even when one stock exchange closes, another is opening. This gives you round-the-clock opportunities for trading during the week. However, not all trading times are ideal. Just because the market is open does not mean it's active. In order to make money, you need to trade on an active market. The best trading times happen when the markets that relate to the currency you are trading overlap.

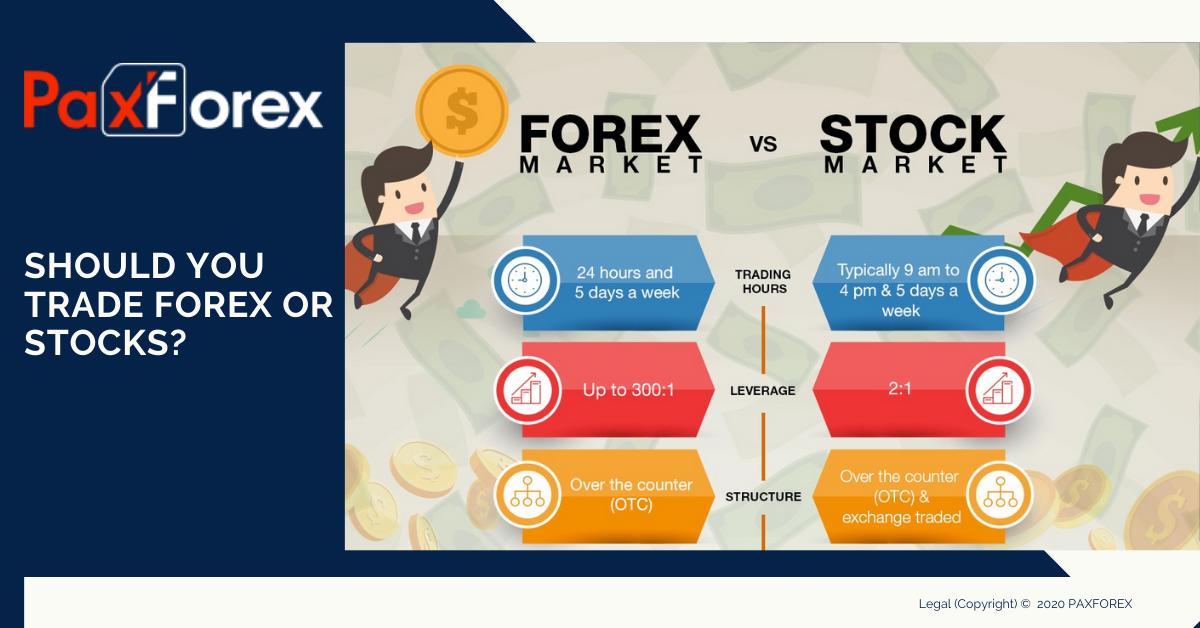

Unlike stocks, bonds, and options, forex markets are open around the clock between Monday and Friday. Each trading day is actually comprised of three trading days rolled into one because the Asian, European, and American markets overlap as they open and close throughout the day. As a result, you do not have to wait for markets to open, they are always open, leaving you free to trade whenever you like.

The consistency and stability of blue-chip stocks may be less risky for the long-term investor; however, the forex market can offer more volatility and therefore offers more opportunities to make profits. Its volatility and high liquidity provide short-term and day traders with advantageous conditions to make quick and easy profits. In addition, traders can make money irrespective of whether the currency pair is going up or down. This is because you can buy (go long) or sell (go short) each currency pair.

The internet and electronic trading have opened the doors to active traders and investors around the world to participate in a growing variety of markets. The decision to trade stocks, forex or futures contracts is often based on risk tolerance, account size, and convenience. If an active trader is not available during regular market hours to enter, exit or properly manage trades, stocks are not the best option. However, if an investor's market strategy is to buy and hold for the long term, generating steady growth and earning dividends, stocks are a practical choice.