Will 2018 be the year the US Federal Reserve will finally deliver on their interest rate hikes according to their now infamous dot-plot chart? Since the introduction of quantitative easing and the reduction in US interest rates down to a range between 0.00% to 0.25% in December of 2008, there has been plenty of discussions on when to normalize the monetary environment. Over the past decade, savers and fiscally responsible citizens have been punished as money in the bank did not return anything. This resulted in a Japanese style monetary environment in order to promote borrowing, both domestically as well as internationally.

The de facto 0% interest rate environment in the US did just that and many foreign companies as well as governments took advantage of the interest free loans they could get in order to expand business and fund projects. The rest of the developed world lowered interest rates as well and the term free money was floating globally. This caused debt levels to swell to record levels with some estimates as high as $60 trillion. The Fed has been talking about a normalization, but has frequently missed to deliver. In December of 2015, the Fed increased interest rates from 0.25% to 0.50% which did little to address the growing issues.

A lot of Fed talk, meetings and dot-plot disappointments later, another 25 basis interest rate increase to 0.75% was announced in December of 2016. 2017 was the year many hailed at least 4 interest rate increase thanks to stable economic growth, a healthy labor market and solid corporate earnings. The pressure was on, but inflation remained subdued and many are surprised that wage inflation has not accelerated despite a tight labor market. The Fed did deliver three 25 basis point interest rate increase in March, June and in December which lifted interest rates to 1.50%. Everyone is now looking towards 2018 and what the Fed will do.

Take full advantage of trading opportunities which will open up as the US Dollar, the world’s reserve currency, is set for a spike in volatility in 2018. Open your PaxForex Trading Account today and learn how to earn over 500 pips and more every single month with the help of our expert analysts who cover the forex market from a fundamental as well as technical perspective. We do the work so you can enjoy the benefits of a successful forex portfolio.

The US government has announced tax cuts and spending increases at the same time the US Fed is set to further increase interest rates. This is a lethal combination from a fiscal standpoint, but with the next recession around the corner and the Fed arsenal of weapons to fight it almost depleted, it could become a race to bolster defenses. Some argue that it could be a little to late and that the Fed missed their window of opportunity. The most recent market turmoil may have bee the harbinger of what is to come in 2018. Regardless of the outcome, forex traders should be excited over the trading opportunities this will bring. This year's theme may be the US Dollar, the Fed and your forex portfolio.

Forex Profit Set-Up #1; Buy USDCAD - W1 Time-Frame

This currency pair is a great candidate for all traders who believe that the US Fed will deliver on interest rate increases. The USDCAD already completed a breakout above its horizontal support area and then tested the upper end of its range. This resulted in the formation of an ascending support level which is now applying upside pressure to this currency pair from a technical perspective. Fundamentally, a slowdown in the global economy or a recession will pressure the Canadian Dollar to the downside more than it will the US Dollar due to its dependence on the commodity sector. Forex traders are recommended to seek buying opportunities during pull-backs below the 1.2475 level.

The CCI confirmed the previous breakout as it performed a breakout of its own, above the -100 mark which took the USDCAD out of extreme oversold territory. This indicator is now approaching the 0 level and a move above it will result in a momentum shift from bearish to bullish and invite more buy orders. Make sure to follow the Daily Forex Technical Analysis posted by our expert analysts throughout each trading session.

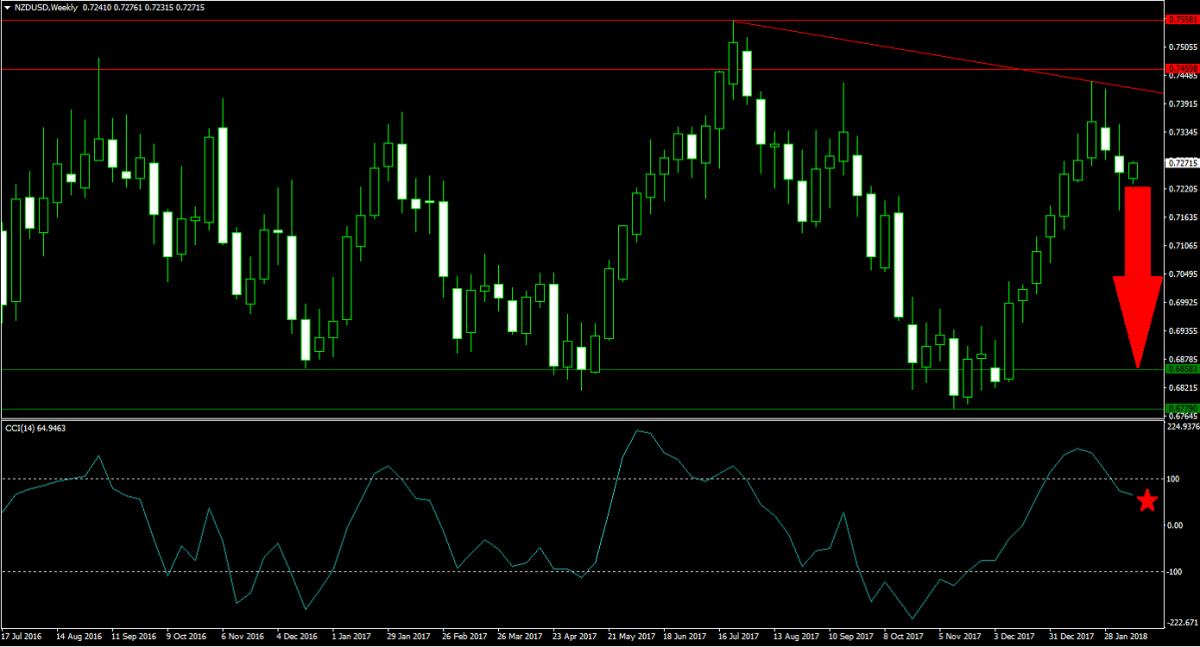

Forex Profit Set-Up #2; Sell NZDUSD - W1 Time-Frame

The NZDUSD offers a similar trading opportunity to the USDCAD described above, but this time with the US Dollar being the quote currency and not the base currency. This currency pair is under downside pressure from its descending resistance level which formed after a previous rally recorded a lower high. The NZDUSD corrected from its horizontal resistance area down into its horizontal support area and then recovered partially. This trade offer plenty of downside potential with limited upside risk and forex traders are advised to seek short entry opportunities between 0.7285 and 0.7390.

The CCI, a momentum indicator, already completed a breakdown below the 100 level which identifies extreme overbought conditions. A further push below the 0 mark is predicted which will confirm a momentum shift from bullish to bearish and result in an increase in selling pressure on the NZDUSD. The PaxForex Daily Fundamental Analysis highlights the trading session’s most profitable trading opportunities which will boost your earnings by over 500 pips every month.

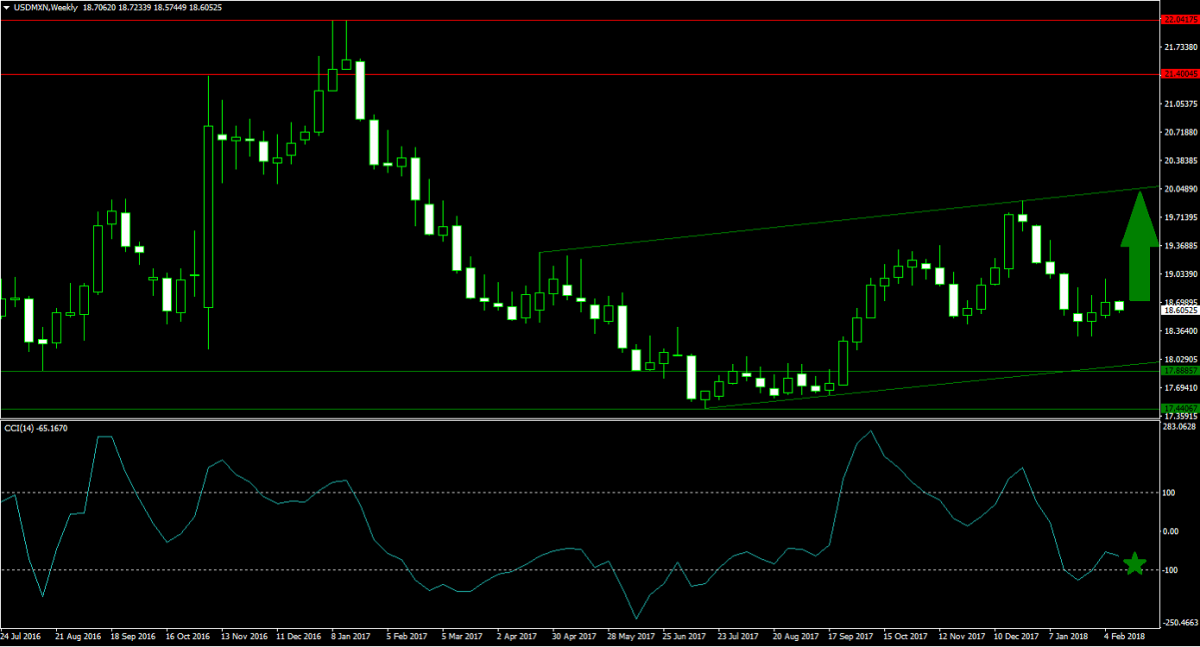

Forex Profit Set-Up #3; Buy USDMXN - W1 Time-Frame

The USDMXN received a lot of attention during the last US Presidential election, but after filtering out all the noise a clear bullish pattern in this currency pair is visible. After collapsing from its horizontal resistance area down into its horizontal support area, this currency started to drift higher inside of a bullish price channel. The up-trend is expected to continue until the USDMXN can challenge its horizontal resistance area once again. Forex traders should take advantage of dips in price action down to the ascending support level of it bullish price channel just above the 18.0300 level.

The CCI briefly dipped into extreme oversold territory below the -100 level, but has since recovered and is currently in an upward move which should take this indicator near the 0 level. A breakout above it is set to push the USDMXN to the upside as a result of a bullish momentum shift and an influx of new buy orders. Fund your PaxForex Trading Account today and add this trade to your portfolio before it accelerates to the upside.

To receive new articles instantly Subscribe to updates.