We will give you an overview of events which unfolded between the fourth-quarter of 2008 as the global financial crisis unfolded until the most recent Cypriot bailout story and how they have impacted the EURUSD currency pair. The EURUSD has witnessed wide swings as it remains under severe influence from the Eurozone debt contagion which has a grip on continental Europe while the U.S. Dollar is under influence by the Fed. The EURUSD is the most traded and most liquid currency pair and puts the world’s biggest economy, the EU, against the world’s second biggest economy, the U.S.

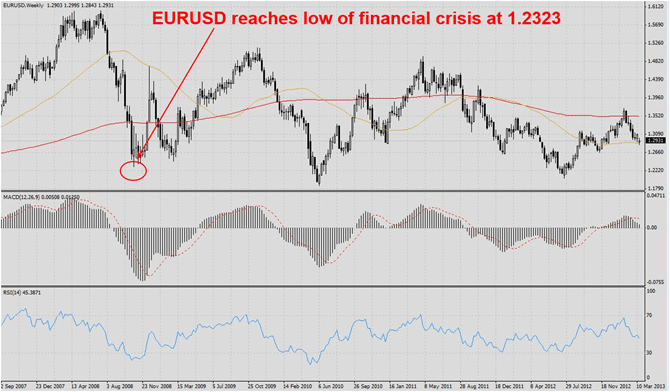

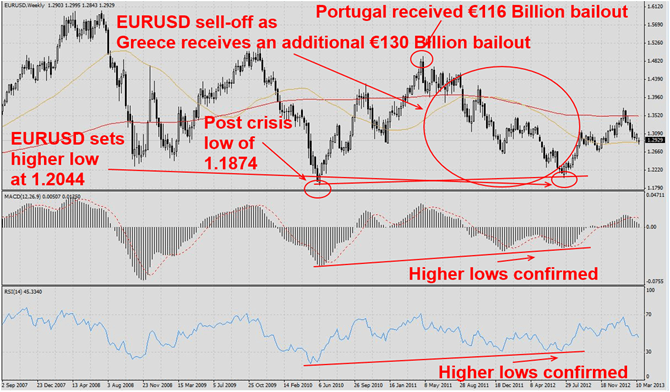

During the fourth-quarter of 2008 as the global financial crisis started to take its toll in the global economy after U.S. investment banking giants Bear Sterns as well as Lehman Brothers failed global financial markets were dragged lower and saw their values cut in half. The week which started October 26th 2008 the EURUSD fell to a low of 1.2323 as visible in the chart below.

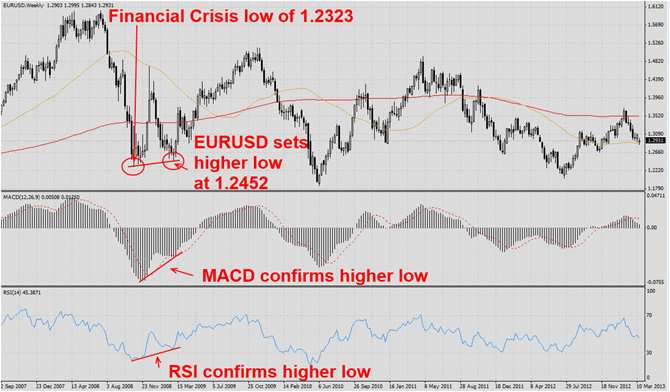

At the start of 2009 the EURUSD, the most traded and most liquid currency pair, has launched a massive rally due to USD weakness after the financial crisis unraveled and took its victims. The Eurozone was viewed as a safe haven while being very liquid as the EU economy is the largest economy in the world. The EURUSD opened 2009 at 1.3901 and was pushed all the way down to a low of 1.2452 during the first week of March as the effects from the fourth-quarter of 2008 were driving global price action. The important factor was that EURUSD currency pair set a higher low as visible in the chart below.

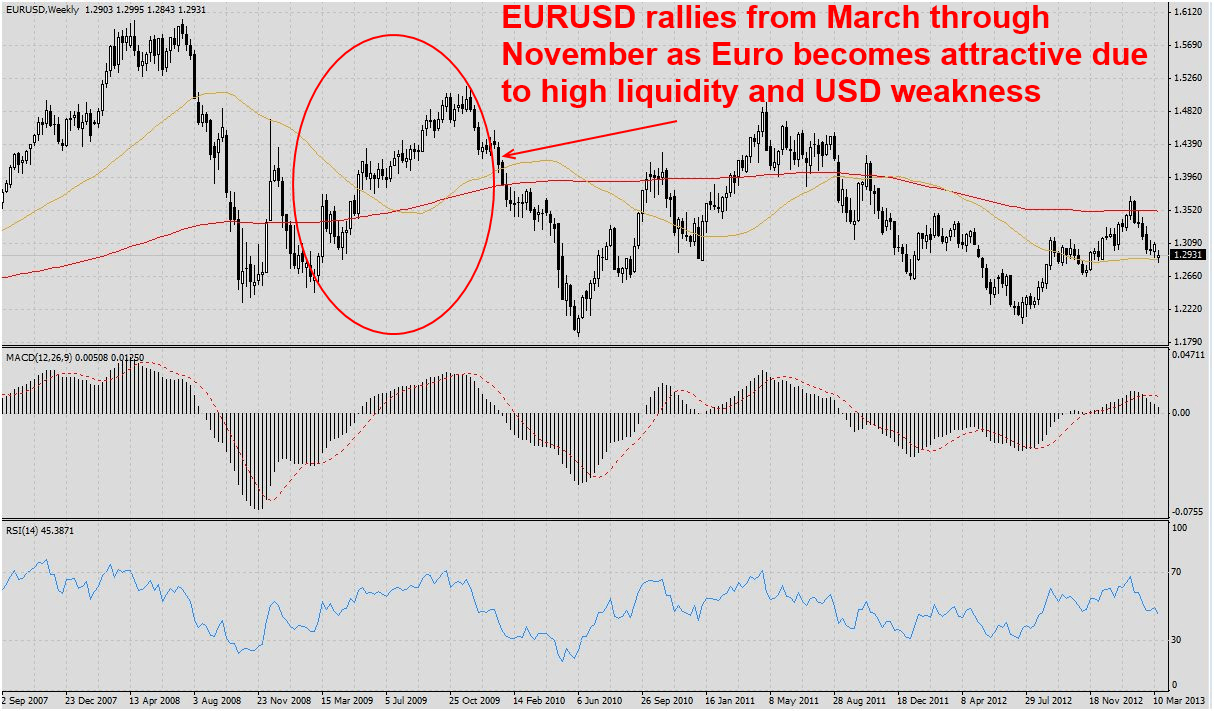

In March market participants sought bargains and it became evident that the world did not end. Massive amount of capital which was withdrawn until then needed to be put to work as central banks essentially slashed interest rates down to almost zero or on the case of the U.S. Fed down to zero which together with twin deficits pressured the USD even lower and the ECB had rather high interest rates in comparison to its counter-parts which fueled a rally in the EURUSD forex pair as visible in the chart below.

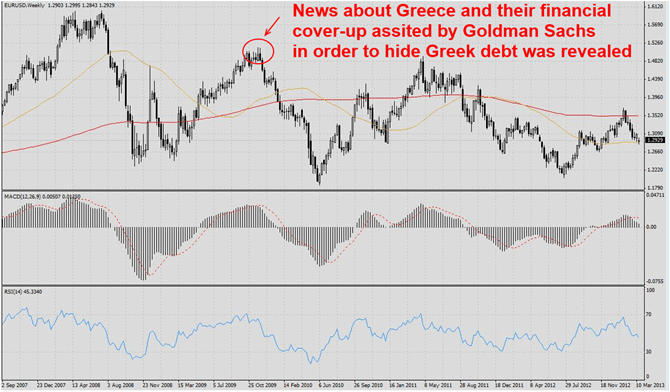

In the week which started November 22nd of 2009 it was revealed that Greece manipulated its finances in order to hide its massive debt load. Greece was assisted in its cover-up by Goldman Sachs which helped with the financial engineering. The EURUSD reached a high of 1.5149 in the week which started November 22nd 2009 prior to the Greek news as visible in the chart below.

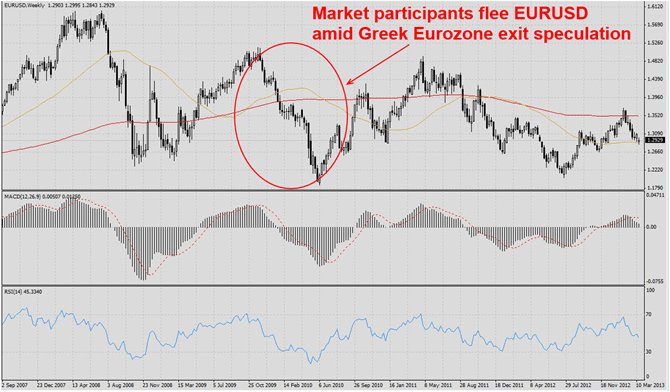

The EURUSD started to sell-off despite continued weakness in the U.S. and severe mismanagement by the Fed under the helm of Ben Bernanke. Investors around the globe who flocked to the EURUSD as it was viewed as a safe haven exited their long positions. The problems caused heavy speculation that Greece may be forced to leave the Eurozone and the unknown impacts caused a collapse in the EURUSD forex pair which reached a new low of 1.1874 in the week which started June 6th 2010 as visible in the chart below.

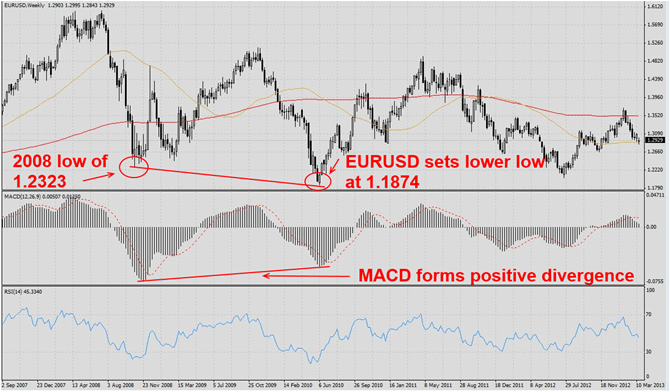

The low was a lower low than the previous one set in 2008, but several technical indicators formed a positive divergence which hinted at a rally from a technical perspective in the EURUSD and market participants took this as a chance to enter this currency pair together with hopes of a solution which would allow Greece to restructure and remain in the Eurozone. On April 23rd 2010 Greece received a €45 Billion bailout with severe austerity measures as restrictions. The bailout caused investors to push the currency pair to its low of 1.1874 and the positive divergence formed as visible in the chart below.

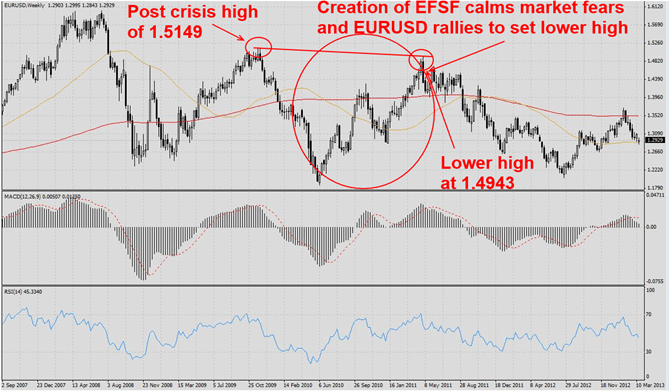

In May the Eurozone creates the European Financial Stability Facility or EFSF in order to handle contagion from the Greek fiasco. Keep in mind Ireland was bailed out before, but on a much smaller scale and there was no cover-up involved on the part of the Irish government. Market participants grew confident and the EURUSD rallied from its new lows at 1.1874 and reached a lower high of 1.4943 in the week which started May 1st 2011 as visible in the chart below.

During the first week of May 2011 the EU, ECB and IMF agreed to a €116 Billion bailout of Portugal which set the EURUSD currency pair back into a tailspin as it became evident that the crisis was not solved and the debt contagion spiraled out of control. Greece received a second bailout of €130 Billion and the EURUSD was sold off heavily until it reached a higher low of 1.2044 in the week which started July 22nd as visible in the chart below.

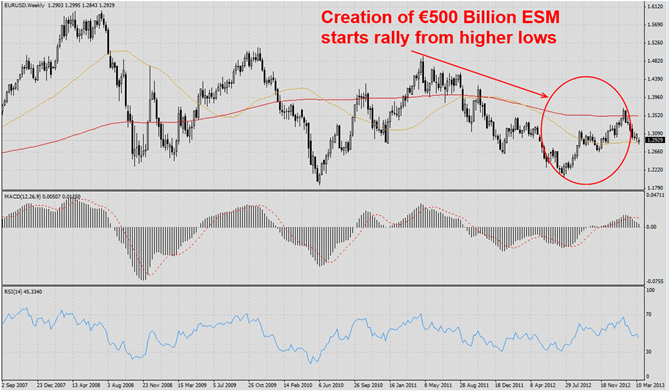

During 2012 Spain as well as Italy were in the cross hairs as their debt levels spiraled out of control and fears of a full bailout added to the EURUSD sell-off as visible in the chart above. Neither country has requested a bailout, but is on the brink of being forced into one. Italy is currently without a government while Spain may be the first one to deplete what funds are left in the EFSM.

EU leadership announced the creation of a €500 Billion European Stability Mechanism or ESM which are tied to heavy austerity programs similar to the ones forced onto Greece and therefore ensure no recipient will be able to launch a sustainable economic recovery. The confirmed higher lows as well as the creation of the ESM and once again renewed hope of a permanent solution allowed market participants to long the EURUSD as visible in the chart below.

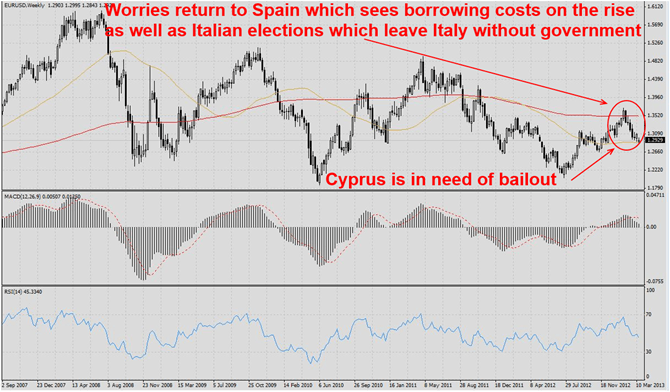

The EURUSD currency pairs rallies above its 200 DMA and in the week which started January 27th 2013 the EURUSD sets a lower high of 1.3710. Spain returns to the forefront of Eurozone worries, while Italian elections left the country without a government. The EURUSD starts to correct after it failed to remain above its 200 DMA and last weekend news about a Cypriot bailout added to selling pressure as visible in the chart below.

Cyprus remains a developing story and the ECB gave Cyprus a deadline of next Monday in order to cough up €5.8 Billion in order to receive a €10 Billion bailout. After Monday the ECB will withdraw emergency funding from Cyprus which could force a total collapse of the Cypriot financial system and Eurozone exit. The Cypriot government works on a Plan B after Russia did not agree on terms in order to give Cyprus a second bailout worth €5Billion. Russia already made a loan available of €2.5 Billion in order for Cyprus to restructure financially. The EURUSD remained resilient for now, but the situation may change on Monday after talks break down.

You may be interested in the following articles:

Greece

- News in Greece: EU’s ‘horror stories’ have determined the outcome of elections

- Greece asks about time-out

- Elections in Greece could become a referendum on Euro

- Greece should exit the Eurozone by 2013

- Greece welcomes another cut in its ratings

Spain

- Spanish crisis: EU will provide financial aid

- Spain just ensured they will not recover anytime soon

- Can Spain avoid begging for money a second time?

- Will Spain crush the party, again?

- Spain’s Budget focused on Spending Cuts

- EU has allocated 30 billion for the salvation of Spanish banks

- Rajoy versus Monti

- Rajoy versus Bond Market

Italy

- Mario Draghi: First Step in the Right Direction or Empty Promise?

- What will Draghi do?

- Draghi attempt to charm Germany

- Monti announces resignation

- Visco Claims Italy does not need ECB

- How should Italian elections impact your forex strategy?

Eurozone

- EU summit opens in Brussels

- EU moves closer to banking union

- ECB and its Bond Buying Bonanza

- Germany backs ECB bond purchases

- Eurozone crisis may spiral out of control before end of week

- German High Court Ensures Eurozone Collapse

- European Union Leaders Meet Again

- Eurozone Double Dip Recession

- Eurozone contraction, where will the Euro Exchange rate go?

Cyprus