The risk of default in Cyprus and a possibility of country’s out of the eurozone will be maintained for a long period of time, according to many experts.

Cyprus is facing serious economic consequences due to the damage to reputation of the financial sector. Unlikely this country will be able to keep the status of offshore financial center after that crisis. Note that the international rating agency Moody's earlier downgraded the three largest banks in Cyprus - Bank of Cyprus, Cyprus Popular Bank and Hellenic Bank. Indicator of confidence to credit institutions dropped from the position Saa2 to Saa3.

"The situation in Cyprus is still uncertain and the risks of loss of bank deposits continue to grow." Moody's officials said, adding that the government still does not have a clear vision of the necessary steps in economic field.

Prior to that, the agency Standard & Poor's downgraded the credit rating of Cyprus from CCC + to CCC with a negative forecast.

Depositors of Bank of Cyprus may lose 30% of the funds of their deposit that are equal or exceeding 100 thousand euros. Percent of loss on deposits in the second largest bank in the republic - Cyprus Popular Bank - likely to be even higher. By agreement with the EU, as a compensation for the recapitalization of the largest Cypriot bank, depositors will get a share in the Bank of Cyprus.

There is a danger that the actions of the leaders of the European Union, who decided on the example of Cyprus to prove their hardness in the fight for fiscal discipline and who asks the authorities of the island to take the most drastic measures, may be costly for other countries of the “European periphery."

Cyprus can "infect" other countries. Not only due to the fact that the business will lose money in the island. The threat of tax deposits already spooked investors of problematic countries, so the increasing number of the outflow of deposits from the entire "European periphery" can be expected.

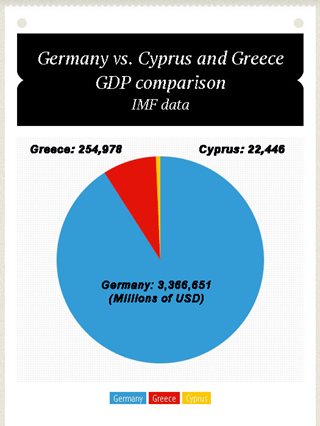

However, problems may arise in those countries which are now listed in the discharge of “good” ones. After all, before the Cypriot banks were forced to write off the loans granted to the Greeks, the financial system of Cyprus felt quite good. And now, German Chancellor Angela Merkel has publicly called it "dysfunctional" and "dead" on the grounds that the assets of the banking sector of the island is too large and exceeds the GDP in seven times. But in Luxembourg, for example, bank assets exceed the GDP in 20 times and everything is OK with that country.

The fact that German GDP is the highest in Europe (it is comparable only to the GDP of the UK) does not entitle Ms. Merkel the right to become a commander of the entire European Union and ignore different views with violating the sovereignty of other countries.

All those factors may have a negative affect on euro and European economy as a whole.