Cypriot lawmakers rejected the forced depositor’s participation into the required financial bailout of Cyprus. The initial time of the vote was Monday at 1500 hours which was canceled as President Anastasiades amended the terms in order to legally steal less from deposits below €100,000 while stealing much more from deposits above €100,000. Initially it was reported that Anastasiades had the minimum required votes of 29 in order to make the proposal a law.

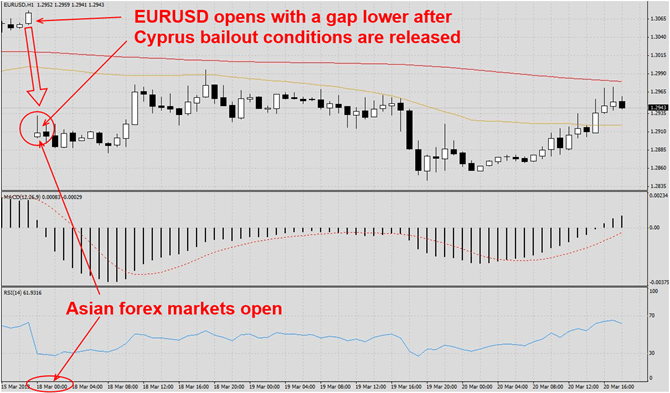

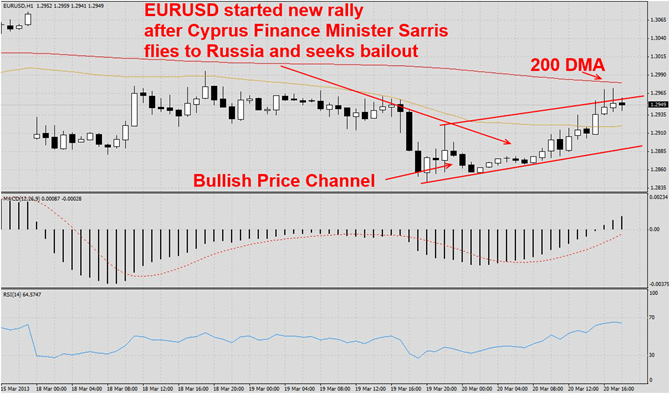

The initial agreement was reached this past weekend and forex markets did not have a chance to react to the first report that Cyprus will force depositors to participate in the bailout. Asian forex markets opened in Asia and every currency pair which was associated with the Euro, either as a base currency or quote currency, opened with a sharp gap as visible in the EURUSD chart below.

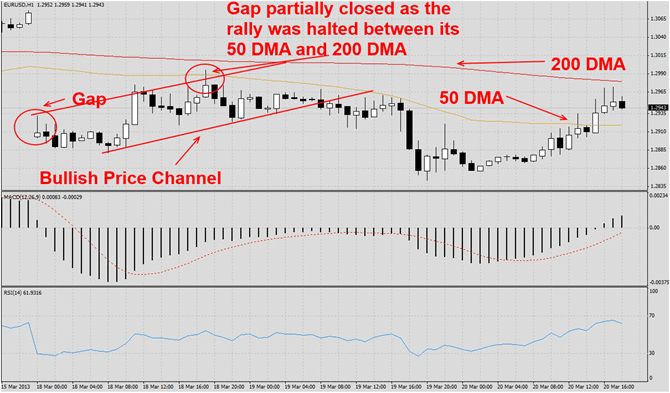

Plenty of stop loss as well as take profit orders have been triggered during the gap. Plenty of times gaps tend to close and offer forex traders a nice opportunity to enter trades. Keep in mind that not every gap will close and sometimes the trend initiated by the gap will continue. In the Cyprus case the EURUSD gap partially closed as the rally was halted between its 50 DMA and 200 DMA as visible in the chart below.

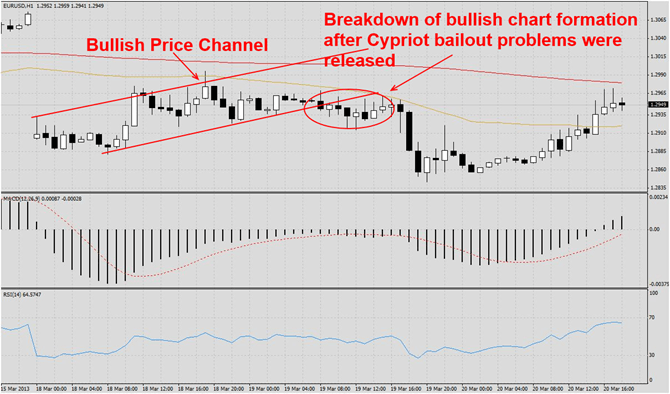

Monday’s trading session closed around support levels created by the ascending support line of this forex pair’s bullish price channel which was formed after the EURUSD opened with a gap. Cypriot lawmakers were supposed to vote Monday at 1500 hours. Rumors of more complications were leaked and the pair broke down from its bullish chart formation which set new lows for the pair amid uncertainty about Cyprus and the impacts on the Eurozone. Profit taking added to the sell-off as visible on the chart below.

Germany applauded the deal while Russia was angered by the unfair treatment of its deposits in Cyprus. The Kremlin noted that Cyprus started to play a dangerous game and treated foreign deposits unfair. It is not a secret that almost no Cypriot has deposits above €100,000 which means the proposed forced depositors participation was aimed at legally stealing money from wealthy foreign depositors.

Russian deposits account for over €25 Billion of total deposit in Cyprus and Putin’s government allowed a €2.5 Billion loan to Cyprus in order to financially restructure its financial system and get back on track. Some of the foreign deposits are associated with crime cartels and money laundering and Germany insisted on Russian participation in the bailout as there is plenty of Russian capital in the system.

Russia is not part of the Eurozone and refused unless it received heavy concessions which were refused by the Eurozone. In return Russia welcomed the forced bailout by EU taxpayers of it businesses and oligarchs and help all cards in its hand. Cyprus, most likely under pressure from Brussels, Frankfurt and Paris, created this scheme to steal the money from all foreign depositors and especially Russia which would have caused a political breakdown of Europe.

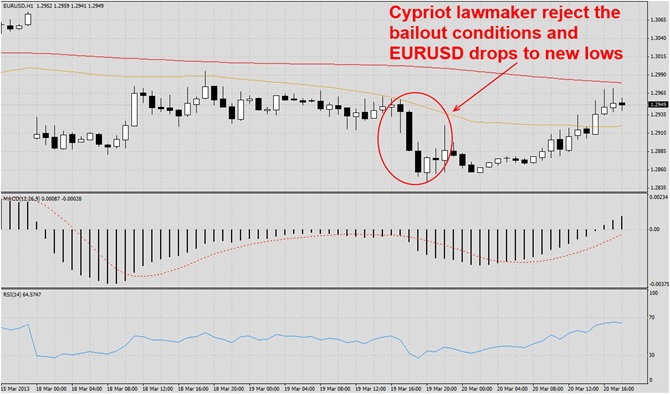

Cypriot lawmakers rejected the proposal on Tuesday and Cypriot Finance Minster Sarris missed the vote as he headed to Russia in order to discuss a bailout from Russia. The Euro dropped initially to new lows as visible in the chart below as Eurozone Finance Ministers from Austria as well as Germany threatened that the ECB will not participate in the bailout unless the Cypriot government will pass the law and force foreign money to be tied up in the bailout.

Cypriot lawmakers rejected the measure with 36 votes against it, 19 abstentions and no votes for the measure. Initially President Anastasiades was thought to have 29 votes for the bailout conditions. Frankfurt as well as Paris are angered, Brussels in a stalemate and Cyprus is on the search for an alternative source of funding as it needs to raise €5.8 Billion in order to receive a €10 Billion bailout.

Cyprus understands that it cannot anger Moscow as it would be the end of the small island nation and President Anastasiades met with political party leaders in order to create a Plan B on how to raise the €5.8 Billion. The ECB was criticized by the global community and Germany is in the crosshairs as they brokered the idea in order to get back at foreign depositors. This move by Berlin will have consequences as Moscow will not forget this betrayal.

For the time being the EURUSD has rallied as Cyprus seeks alternative financing without angering Russia as visible in the chart below.

Cyprus is caught in the middle of a potential bailout bidding war as it is part of the EU and the Eurozone on one side and depends heavily on Russia on the other side. Negotiations will continue and Cyprus will try to find a compromise in order to please both sides. An old saying states that you can’t dance on two dances at the same time and Cyprus needs to be aware of what is in its best interest.

Russia is willing to help, but not under conditions imposed by the Eurozone. Cyprus will definitely remain in the EU, but their Eurozone membership may be in jeopardy which is also not in Russia’s interest as Cyprus gives Russia unprecedented access to the Eurozone. Expect a bailout with Russian participation which looks good in front of the media with heavy concession in favor of the Kremlin which will come out the clear winner of this situation.

The Eurozone worries will be re-ignited regardless of the outcome of the Cyprus situation which will ignite the spark for a global sell-off in equity markets.