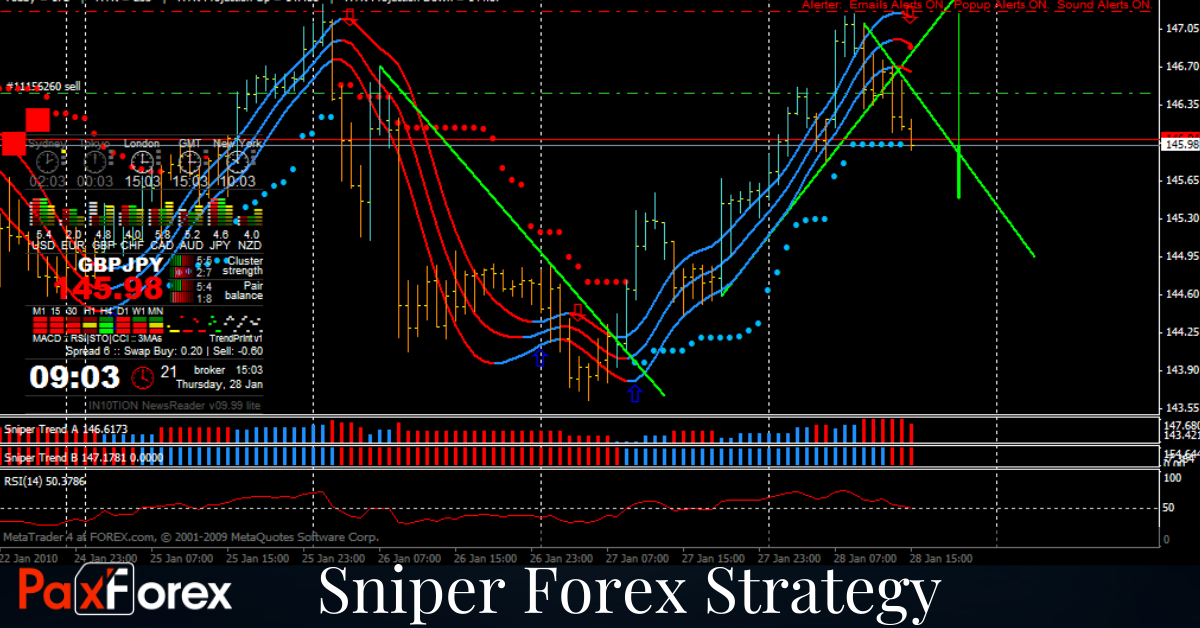

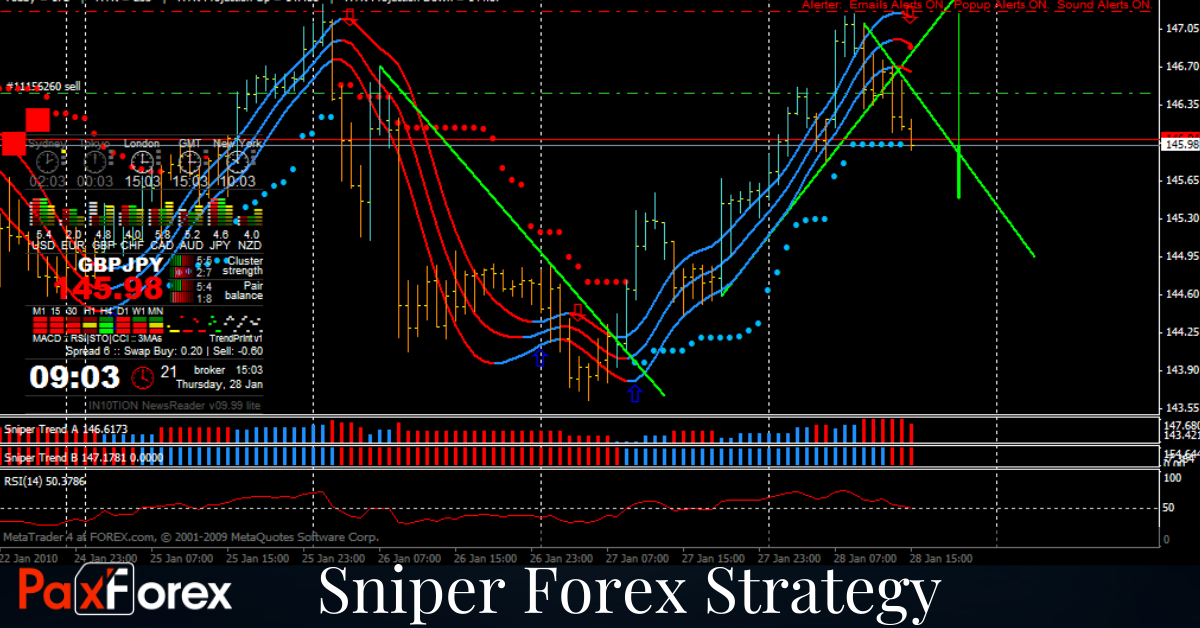

The "Sniper" strategy is always in the zone of increased attention of traders - both beginners and experienced ones. The intraday strategy got its name for accurate market entry. So why did the Forex sniper strategy gain popularity?

- The strategy is suitable for all currency assets.

- It is used on 5-minute charts, so you can open many positions during the day and get more profit.

- The strategy can be used with the least risk if you follow the rules of work (postulates) for a sniper.

Sniper is an intraday Forex strategy, but it doesn't imply frequent entries - you should wait for the signal with the maximum probability of success. Trading is carried out only on the trend until the change of direction in the global trend. We will consider the opening of positions on the timeframes not lower than M5, although the author allows entry even on M1.

The strategy works steadily on medium volatile assets. Timeframe: for entering M5-M15, for controlling an open position - M30-H1, for analyzing the global trend H4-D1. It is recommended to trade no more than two different assets simultaneously.

The standard entry to the position is performed after:

- breakdown, rollback, and fixation of the price at the first impulse level;

- a false breakdown and rollback to the first impulsive level;

- breakdown of the consolidation zone and price exit from the trade channel.

The author's version of the Sniper does not have clear recommendations for closing a position. Most often, trades are fixed by Stop Loss and Take Profit or the usual capital management logic is applied, for example, when reaching min/max yesterday or key levels. Closing levels can be used for new entrances when all necessary conditions are met, e.g. to roll back from power levels.

We start the trading day with market analysis before the European session:

- define the main points of the strategy: consolidation zones, impulse and reversal levels;

- the analysis is performed consistently on all timeframes from M5 to H4;

- we take into operation only signals near significant levels in the direction of the main trend;

- open positions can be accompanied by a trailing stop.

Note that the system does not allow trading without SL and TP.

Summary

The Sniper system requires attention and patience Some disadvantages can be considered the necessity of constant monitoring of the price chart and opening of trades manually, as pending orders are rarely used in the system.

The rules of the Sniper strategy are rather strict, they can be called postulates and it is not recommended to change them. However, many traders, including those with sufficient experience, begin to adjust the rules "for themselves", experiment with Stop Loss/Take Profit and, as a rule, find themselves in a loss. However, a serious argument in favor of the Sniper is the profit, which can be obtained from the first 5-10 trades executed strictly according to the methodology.

The Sniper strategy is non-indicatory. However, we consider the statement "no indicators" in the sense that in this strategy the usual indicators are not used for making trade decisions. For the confirmation of signals, no one forbids to use any convenient for you Forex instruments until there is a confident "vision" of trading situations.

Of course, each point of the strategy is repeatedly verified by real trading and lost deposits. New versions of the Sniper system are constantly being released, adapted to the modern market and your main task is to strictly follow the recommendations.

We are one of the fastest growing Forex Brokers in the Market. Trade with PaxForex to get the full Forex Trading experience which is based on...

- The Reliability on all Assets in the Market

- Trusted Worldwide for over a Decade

- Live Multi-Lingual Online Support 24/5