- What is Fibonacci?

- Forex Market Technical Analysis

- Chart Analysis on Forex

- Fibonacci Retracement Levels

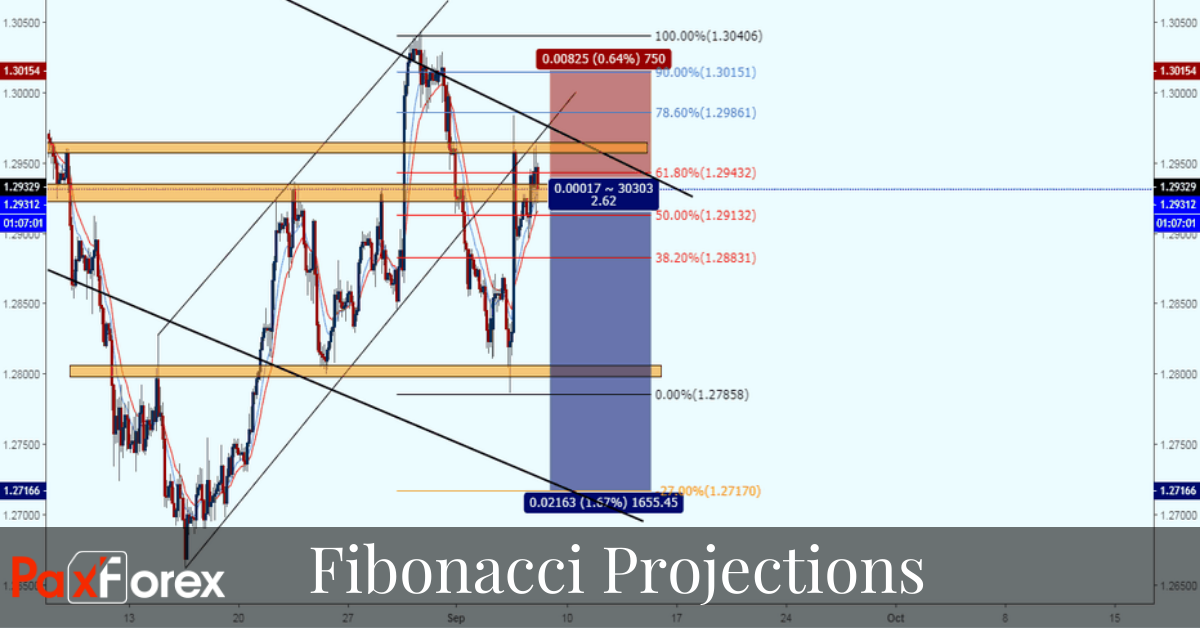

- Fibonacci Projections or Extension Levels

- The Fibonacci Fans Method

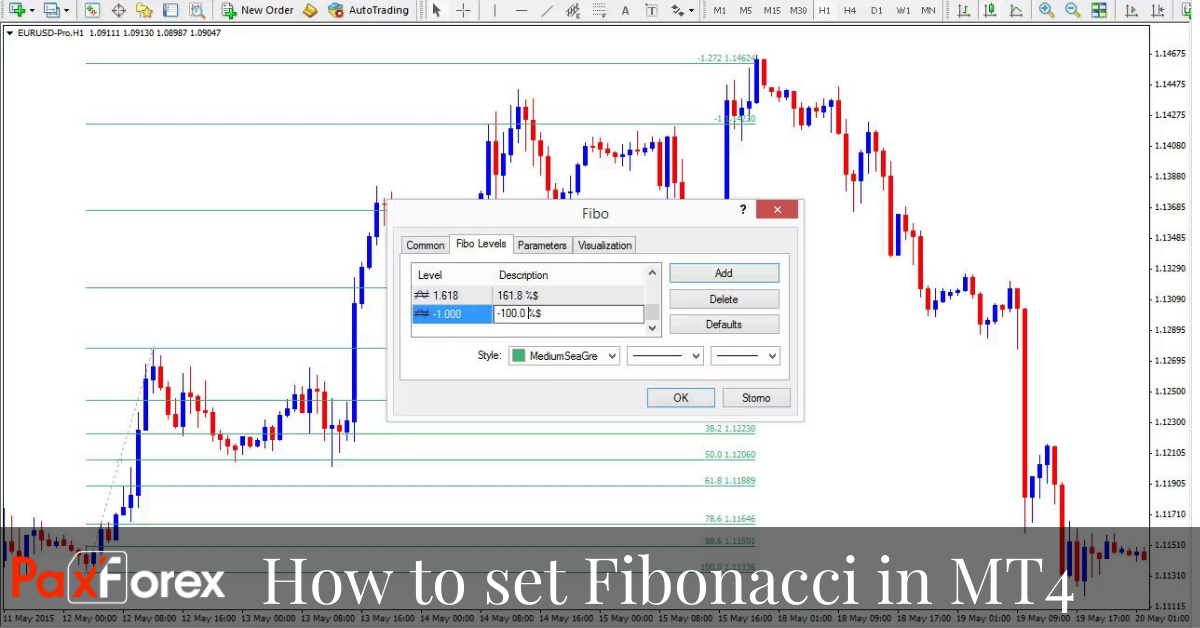

- How to Set Fibonacci in MT4

- Adding Fibonacci to Your Trading Strategy

- Pros and Cons of Fibonacci Trading

- Risk Free Fibonacci Trading

Many traders will agree that there is certain beauty to Forex market technical analysis. This can be explained by the fact that pretty much everything at the currency exchange market can be systemized and categorized through application of mathematical rules. One of these approaches is the Forex Fibonacci trading system - a perfect example of how 13th century science finds reflection in the modern trading world.

What is Fibonacci?

First, let’s take a quick stroll through the past to find out the origin of the Forex Fibonacci trading system. Leonardo Bonacci, also known as Leonardo Bigollo Pisano (Leonardo, the traveler from Pisa) was an Italian mathematician who lived through the end of 12th and the beginning of 13th centuries. The word Fibonacci means the Son of Bonacci and is most commonly used to refer to Leonardo Bonacci,

Bonacci became a part of history as a man, who introduced the Hindu-Arabic numeral system to the world and also came up with a revolutionary numerical sequence. The Fibonacci sequence was based on the numeral significance of rabbit’s population growth. Starting from 0 each number in the sequence is simply a sum of two previous numbers and it goes like this: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34 and so on.

The real discovery, however, were not the numbers themselves, but rather the relationships between the numbers. One of such relationships is widely known as golden ratio. In the Fibonacci sequence each number is roughly 1.618 times larger than the previous one. For example, 89 divided by 144 is 1.618. And the graphic expression of this number, which looks kind of like a spiral, has been discovered in nature, in space, in math and in many other areas of life.

Similarly, the Fibonacci sequence has made its way into Forex trading. The math behind the ancient scientist’s discovery is now widely used to calculate certain points at the market. Perhaps, the most popular way of implementing the sequence is finding the potential levels of support and resistance and with them - the most optimal spots for entries and exits.

Forex Market Technical Analysis

Before we go into the practical implementation of Fibonacci sequence at the currency exchange market, we should go over some of the basics of Forex market technical analysis. Technical analysis is a way of looking at the market data in order to try to predict its future behaviour. This type of analysis is based on two major theories: everything that happens at the market is repetitive and that the price value in the specific point of time carries all the necessary information about the valued asset.

This logic brought a whole variety of methods to analyze the market as well as a wide spread of supportive tools. Technical analysis is both effective and approachable, since virtually anyone can find a way to use it in their trades. The fundamental analysis, on the other hand, requires large amounts of training and preparation. It is best to focus on the technical aspects at first and leave the fundamental analytics to professionals.

Forex market technical analysis focuses primarily on the charts themselves. By looking at the trends, the patterns and comparing the data from the current market with the data from the past, traders are able to figure out an action plan for their upcoming trades, calculate the possible outcomes and implement the appropriate risk management techniques. As we have already discussed, there are a lot of strategies when it comes to technical analysis, but the main goal for all of them is to determine the points on the chart where the price will change its direction.

Chart Analysis on Forex

Currency price values do not move in straight lines. If you look closely at any chart you will see that the movement of the price is shaky, as if someone kept pulling it in the opposite directions. However, disregarding those miniature moves, there is always a certain direction of the price movement, which can be observed from a more distant view. Those directions are referred to as trends, and they appear when the majority of traders decide to act in a similar way.

The trends can be short and long, easy to predict and completely random. And the job of any technical market analyst is to find a way to determine how long a certain trend will last. To make this task easier, traders use technical indicators - add-ons to the trading platform, designed to discover, confirm and predict the trends. The indicators focus on the factors such as volatility, volume, past market data and mathematical rules, such as Fibonacci sequence.

The indicated data is then used to plan the trading process. This will include the steps, like: establishing the size of the trade, planning the moments for entry and exit, taking safety measures in case the situation gets out of hand and actually placing a trade. The entries, exits and risk management techniques largely depend on the price reversal points - virtual spot at the chart, where the price movement will change direction. The locations of the potential reversal spots are usually marked with horizontal lines across the entire chart, referred to as support and resistance levels.

If the price hits the support level it is supposed to bounce up and if it hits the level of resistance bounce down. In the scenarios, where the price continues moving past the pre-established levels, the appropriate measures need to be taken, including the calculation of new level coordinates.

And this is where the math comes in. Over the years, traders have proved that the important trading elements, such as support and resistance can be calculated through application of certain mathematical rules. Next, we are going to get into the technicalities of the calculation process that you can later use as part of your trading process.

Fibonacci Retracement Levels

Retracement is the process of price moving in the opposite direction from the trend, usually for a short period of time. Trader’s job is to determine how long the price will move in this direction. This is done by calculating the retracement levels, using the points on the chart where the price has bounces as the starting points.

In Fibonacci methods the calculation of the retracement levels is based on the previous move of the market. A trader would measure the size of the previous swing and then apply one of the Fibonacci ratios to calculate the size of the next retracement. The Fibonacci ratios include the following:

61.8 % is the ratio calculated by dividing a number in Fibonacci sequence by the number that follows after it, for example 89 divided by 144.

38.2 % is the ratio of the number in the sequence to a number that is a second following one, for example 89 divided by 233.

23.6 % is the ratio of the number in the sequence to the third one following after, for example 89 divided by 377.

By physically drawing these levels on the chart you can predict the potential points of retracement and reversal. There are also three other levels that are not calculated from the numbers within the sequence. These are calculated from the ratios, described above:

50 % is the ratio located between 61.8 and 38.2

76.4 % is the sum of a distance between 23.6 and 38.2 and 61.8.

100 % is not calculated, but found on the chart. It marks the point where the previous trend has started.

Using these six ratios to determine the points of entry and exit is very common, however they are mostly used to mark the entry points. One thing to keep in mind is that although the ratios will always stay the same, their exact locations on the chart will differ based on the specific data, expressed on the chart. This means that traders need to use calculation tools or perform manual calculation each time they wish to use Fibonacci retracement ratios as a part of their trading strategy.

Fibonacci Projections or Extension Levels

Apart from the retracement and reversal, traders also want to know exactly how long the retracement is going to last. The Fibonacci projections, also referred to as extension levels, are used in the scenario when the price movement surpasses the pre-established support and resistance levels and continues on moving. In those cases traders believe that the reversal or a small retracement will take place at one of the following points:

161.8 % is calculated by dividing a number in the Fibonacci sequence by the one before it. For example, 89 divided by 55.

261.8 % is calculated by dividing a number in the Fibonacci sequence by the one before the preceding one. For example, 89 divided by 34.

423.8 % is calculated by dividing a number in the sequence by the third preceding one. For example, 89 divided by 21.

These can be used as additional potential levels of support and resistance. The practice shows that the reversal nearly always correlates with these level percentages, giving enough ground for technical analysts to base their strategies. While the retracements levels often help to determine the entering point, Fibonacci projections are used to plan the exits. Knowing where your trade will stop is equally important to planning all the moves beforehand and entering the trading process, as it is the exit that allows us to evaluate the ultimate success of any move.

The Fibonacci Fans Method

Less popular than the previous two, the Fibonacci fans analytical method focuses around building diagonal lines on the chart to outline the potential levels of support and resistance. To create a Fibonacci fan, go through the following steps:

Choose a start-point trend you will use to build a fan from and mark its beginning and end

Add three horizontal lines at the 38.2, 50 and 61.8 Fibonacci levels in relation to that trend

Then add a vertical line, that crosses all three horizontal levels as well as the point on the chart, where the trend ended

At last draw three diagonal lines that start at the beginning of the trend and each of them goes through each of the crossing points between the horizontal Fibonacci levels and the vertical line

By drawing this fan, you can easier visualize the potential points of resistance and support and plan your next moves accordingly. This type of implementing Fibonacci sequence in trading is mostly used by long term traders, who want to see a bigger picture starting from an existing trend.

Before we go further, it is important to note that all of the above Fibonacci methods, including the retracements, the projections and the fans have to be calculated in relation to a trend. Depending on whether the price is moving upwards or downwards, all of the above will be calculated and drawn accordingly. And then based on your overall trading strategy, you will use the pre-indicated levels for placing your trades and planning your upcoming moves.

Now that we have a general understanding of how to use the Fibonacci sequence numbers to determine a number of ratios for profitable Forex trading, let’s move onto the implementation of the theory. More specifically we are going to discuss what tools and software can be used for successful trading with Fibonacci methods.

Fibonacci in MT4

The center base for all trading related tools is, of course, a trading platform. Choosing a comfortable to use and effective platform is the foundation of fruitful Forex trading experiences. For the purposes of keeping this post to the point, we will not go into all the characteristics of a good trading platform. But just as a brief overview, the right trading platform has to possess these three qualities:

User-friendly interface. The currency trading itself is a complex matter with many steps to it. However, this does not mean that the tools used in the process need to be complicated as well. Even the most highly functioning and sophisticated platform has to be easy to read and comprehend for all categories of traders. And it is also important to have an option to sort out and customize the platform features to your liking to make the analysis and trading as fast and as simple as possible.

A variety of functions. Despite the common misconception, the most type spent during trading is not actually trading. Analysis is a very large part of pretty much every move a trader makes. If you do not agree with this statement, go ahead and put in random parameters on your next trade and see where it takes you. Thought-through analysis almost always guaranteed a better outcome and having a selection of supporting tools can be extremely important during this process.

We have already briefly mentioned the technical analysis indicators, the additional algorithms built into the platform that calculate a variety of values to identify, confirm and predict trends on the chart. On top of that, there are multiple drawing tools that help traders better visualize their strategy, by marking certain price corridors as well as calculating levels of support and resistance. And from the perspective of today’s discussion, there are also several tools built specifically for calculations, based on Fibonacci sequence. We will discuss them a bit later on.

Accessibility. It goes without saying that a piece of software, designed to instantaneously accommodate thousands of traders and perform equally well around the clock, must be very expensive to create. However, the level of sophistication of the computer program should not really concern the majority of users as they come to the Forex market to make money, not to spend it. Most trustworthy brokers came up with the most optimal solution - they purchase the original version of the trading platform software along with a right to share access to it. This way, by signing up with the right broker, we can also get access to the most modern and effective trading platforms at no charge. Additionally, the broker would normally also take care of the familiarization process by providing handy studying materials on how to install and use the platform.

Based on the above criteria as well as a few others, we became faithful supporters of the Metatrader 4 trading platform. MT4 combines complex algorithms with user-friendly design effortlessly and makes online currency trading accessible to absolutely anyone, no matter what their level of computer knowledge is.

Additional good news for the Metatrader 4 users, is that many calculation methods have been built into the system and in most cases do not need to be additionally installed. The pre-established selection of Fibonacci tools will allow you to effortlessly achieve the necessary results with just a few clicks. Next we are going to discuss such tools in more detail and learn how to set Fibonacci in MT4.

How to Set Fibonacci in Mt4

We have already established that Fibonacci levels can be manually calculated and added to the chart using the drawing tools. This is a good option for those, who are just starting to trade using the Fibonacci trading system. Manually calculating the ratios and adding the elements to the chart can be a very good learning instrument. However, this does not need to be done every time. In fact, most professional traders rarely turn to manual calculation of Fibonacci ratios and levels at all, because it can be easily automated with a set of pre-designed tools.

The only thing you need to do manually, before using any of the MT4 Fibonacci tools, is to determine a trend from which everything is going to be calculated and measure it from the beginning to the end. After this you can go ahead and use one of the six included in the system tools. Each of the tools can be found under the Insert, Object, Fibonacci menu at the main taskbar of your MT4. These tools are:

Fibonacci Retracement (Lines, Levels). This is the most basic tool, manual implementation of which we have discussed earlier. Once you have selected this tool, you will need to point out where the chosen trend started. You can accomplish it by simply clicking on the spot at the chart where the trend in question began. A setting window will automatically pop up, asking you which of the pre-calculated ratios you want to use to mark your Fibonacci levels. The option will include: 0, 23.6, 38.2, 61.8, 78.6, 100 and 161.8. You can add them selectively by clicking the “add” button or simply choose the “default” option to get the preset view.

Fibonacci Time Zones. This tool is far less popular as it is built to fit a very specific task. Fibonacci time zones appear as vertical lines on the chart, located at unequal distances from each other. They operate by measuring the momentum of the previous price wave and using this data to predict the time of the upcoming trend’s formation. Unlike the lines, this tool cannot be used for placing any pending orders as it does not provide any guarantee on the entry and exit points, but rather assumes how long it might take before an opportunity for such points will occur.

Fibonacci Fan. As we have previously discussed above, the Fibonacci fan can be built both manually and automatically and appears in a form of three diagonal rays, going in the same direction as the trend. The fan is a great tool for dynamic stop losses - you can simply adjust parameters of your stop loss in accordance with the fan line, until you get the satisfactory result. When using this tool, pay close attention to the location of the fan, as it depends on whether the trend is upward or downward.

Fibonacci Arcs. The arcs are commonly used when the price movement can be described as flat, meaning that despite all the ups and downs it remains around the same region on the chart. You can use the Fibonacci arc to capture the retracement of a trend. They are usually presented in a form of three slightly bent lines, built on the 38.2, 50 and 61.8 points according to the trend. The lines might slightly widen and range out if the price moves away from the key points, however after some time you might need to restart the tool in alignment with the next trend.

Fibonacci Channel. This tool is an upgrade of the regular Fibonacci lines, as the price channels created through this method are angled in the direction of trend movement, not horizontal. These diagonal lines are ideal for determining the price targets and setting up the necessary take profits and stop losses in accordance with them. The Fibonacci channels are built using the coordinates of two extrema - the very first one and the second one located in the direction of the trend. This way, in the uptrend the bottom indicator builds around the minimum values, and in the downtrends - around the absolute maximums. That line becomes the level of resistance or support. To indicate the retracements, the trader needs to start stretching the width of the channel towards the trend’s movement.

Fibonacci Extensions (Expansion). The extensions are great for setting up the take profits as they are focused on the benchmarks in the trend’s moving direction. The tool marks three points that indicate two waves: the trend wave and the retracement wave. Refer to the above description if you would like to draw them manually. Extensions are very often used to set up take profits.

A major tip in terms of any of the Fibonacci sequence related tools is to add them to your quick access toolbar and speed up the process of adding the lines to the chart, which can come in especially handy during fast-pace strategies, such as scalping or day trading.

Adding Fibonacci to Your Trading Strategy

If you are thinking of adding the Fibonacci’s math into your trading strategy, there are two main things you can do. You can choose to use a predetermined strategy that has been designed around any of the Fibonacci tools or methods. Or you can use the described above tools to combine them with other methods and indicators and support your previously calculated opinions.

One of the strategies that involves using the Fibonacci levels also uses the MA (Moving Average) and MACD (Moving Average Convergence Divergence) indicators. This strategy normally includes the following parameters:

The following example is designed to meet the requirements of a sell order.

Select one of the major currency pairs, such as GBP/USD or USD/JPY

Use the time frames between H1 (one hour) and D1 (one day)

Start by adding a trend indicator and an oscillator to your current chart, with MA’s period set to 10 and MACD left at default

The price has to cross the MA upwards

MACD’s histogram crosses the line in the same direction

The grid of Fibonacci levels has to be covering the last indicated trend wave

Sell order is opened if the price crosses MA at the same time as the level rebounds or breaks in the desired direction

Take profit can be set at the next Fibonacci level

Stop loss is set at the previous level

Pros and Cons of Fibonacci Trading

With it seemingly being for everyone, Fibonacci analysis and trading methods will not necessarily work for every possible trading scenario. The definite upside is the method’s ability to adapt to the current conditions, disregarding how calm or volatile the market is. The calculations that are made using the Fibonacci method can be applied to any market scenario, which makes them virtually universal. On top of that, there are many uses for nearly each of the Fibonacci tools: from establishing the support and resistance levels on the chart to planning the exact moments of entry and exit.

One of the disadvantages, however, is that none of the Fibonacci tools are fully automated. If you are trading using the Bollinger Bands, for example, they appear on the chart based on the automatized calculations. But with Fibonacci, the trader has to discover the starting point prior to using the tools. This takes a certain amount of skill and practice and can usually be attempted by experienced traders, who have mastered other aspects of the Forex technical analysis.

No matter how experienced, trading on Forex is always associated with taking moderate to high risks. And this means that a right attitude and a certain set of skills should be obtained prior to starting the trading process. In the next short segment we will talk about practicing the Forex Fibonacci trading system in the risk and investment free environment, before implementing it to your live trading process.

Risk Free Fibonacci Trading

We do not miss a single opportunity to talk about the free demo account for Forex trading. Main reason for that is, of course, that we want our traders to be prepared for any possible situation at the market. And what can be a better way to do that, other than trading in the simulation mode, while using all the real live market data as well as all the latest MT4 tools.

Demonstration accounts are modeled exactly after the live trading accounts, which includes the exact Metatrader 4 set up, all the necessary tools and add-ons and the real time market info, such as precise price quotes. You can trade in demo for a number of reasons, including: learning to trade, practicing newly obtained techniques and skills, getting to know a new tool or a strategy, inventing your own trading method and educating others on the complex matter of the foreign currency exchange market.

You can start trading in demo without providing any supporting documents or investing any money. And since there is no money involved - there is also no risk. In case of pretty multilayered Fibonacci levels, giving them a go in demo can be a good idea for anyone, no matter how experienced. And once you feel like you have a good understanding of how everything works, feel free to switch to the actual trading account and implement all of your freshly perfected skills in real life. Practice always makes perfect, especially in Forex trading.

Fibonacci Analysis Forex: Final Thoughts

The first look at anything Fibonacci related can get you slightly confused. But the more you try it, both in demo and in the live account, the more structure you will see. Good thing about math is that even if it’s hard, with time and a certain level of dedication any problem can be conquered. After all, mathematics is not politics - there is usually a definite answer to every question. So, keep on learning and practicing the Fibonacci trading method and see with your own eyes how nearly 800 year old science can be very much relevant and helpful today.