Up until a few days ago, many were wondering if a trade war between the US and China would be avoided or if it would commence. Now the battle lines have been drawn as the Trump administration targeted $50 billion worth of Chinese imports, primarily non-consumer related items such as machinery, which would be subject to a 25% tariff. US President Trump threatened more tariffs if China was to retaliate. China did just that and imposed 25% tariffs on $50 billion worth of US imports which will hurt many American farmers.

President Trump made good on his threat and asked the US Trade Representative’s Office to create a list worth $200 billion of Chinese imports which would be subject to a 10% tariff. China didn’t waste any time and promised to retaliate in kind. The Ministry of Commerce in Beijing stated that 'If the U.S. loses its senses and publishes such a list, China will have to take comprehensive quantitative and qualitative measures and retaliate forcefully.’ Trump asked the USTR to identify an additional $200 billion worth of Chinese imports on top of the $200 if China plans to retaliate and noted that 'The United States will no longer be taken advantage of on trade by China and other countries in the world'.

According to 2017 trade data, the US imported $505 billion worth of goods from China and exported only $130 billion which gave the US a trade deficit of $375 billion with China. This represents the largest deficit the US carries with any of its trading partners. The IMF cited the trade war as one of the biggest risks to the global economy. Many US allies, such as Japan, South Korea and Taiwan, will feel the impact of this trade war and become collateral damage. The reason being that many components are imported by China from its Asian neighbours in order to produce the goods which are then exported to the US.

Is your forex account prepared for the deepening of trade tensions between the US and China? Do you have the trades needed which will allow you to benefit from price action volatility? Forex traders are expected to make many adjustments to their portfolios as currencies are often used in parallel with trade wars in order to increase the impact. Open your PaxForex Trading Account now and position your assets to be able to profit from the US-China trade war fallout.

The top US diplomat, Secretary of State Pompeo, increased the sour mood by claiming that 'Chinese leaders over these past few weeks have been claiming openness and globalization, but it’s a joke. Let’s be clear. It’s the most predatory economic government that operates against the rest of the world today. This is a problem that’s long overdue in being tackled.' While China imports a lot less than the US, it will retaliate by using other measures. It has plenty of weapons in its arsenal to inflict the same economic damage the US attempts, with the potential of much more. China is the biggest buyer of US Treasuries and therefore the biggest creditor to US Inc. Here are three forex trades to pip your account from the US-China trade war fallout.

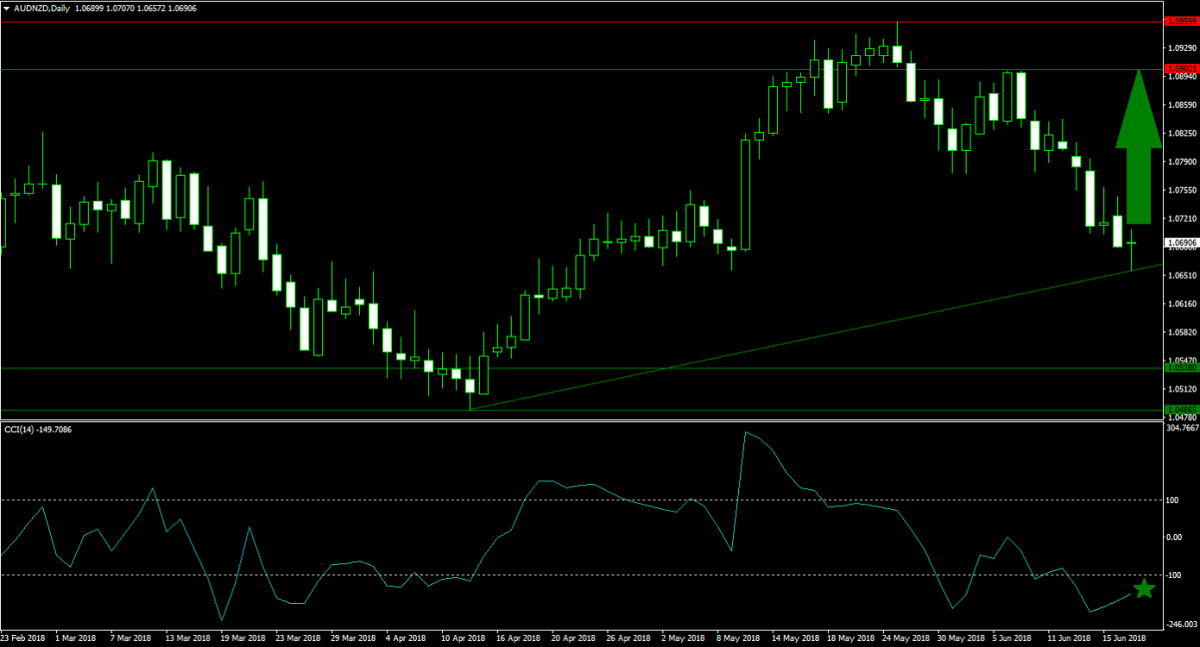

Forex Profit Set-Up #1; Buy AUDNZD - D1 Time-Frame

A lot of economies are set to feel the fallout from the US-China trade war. Commodity exporters Australian and New Zealand will feel a direct negative impact which will pressure their respective currencies to the downside. The Australian Dollar, due to its size, should outperform the New Zealand Dollar. Forex traders are advised to enter their buy orders in the AUDNZD alongside the ascending support level which is set to guide price action into its next horizontal resistance area.

The CCI is trading in extreme oversold territory, but started to advance from its lows. A breakout above the -100 mark is expected to attract more buy orders and increase bullish pressures. Subscribe to the PaxForex Daily Forex Technical Analysis and receive the most profitable technical trading set-ups each day. Earn alongside our expert analysts!

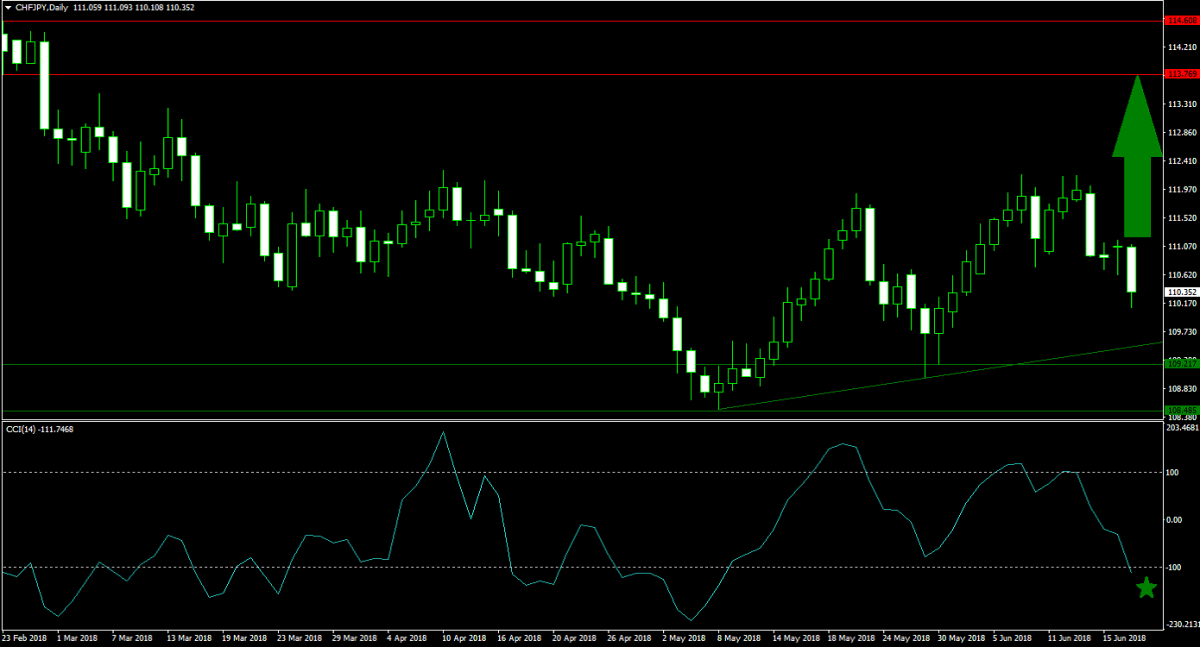

Forex Profit Set-Up #2; Buy CHFJPY - D1 Time-Frame

As the trade war is set to play out over the next few weeks and uncertainty is at elevated levels, forex traders tend to lock to safe haven currencies. The Swiss Franc is positioned to outperform the Japanese Yen, as Japan is in the crossfire of the trade war. Price action in the CHFJPY is on track to challenge its ascending support level. Forex traders should be positioned for a short-covering rally and therefore place their buy orders just above and below its ascending support level.

The CCI descended into extreme oversold conditions, lower than its previous low but well off its previous low. A spike in this technical indicator is likely to follow the anticipated reversal in price action. Download your PaxForex MT4 Trading Platform today and enter this trade before price action will explode to the upside.

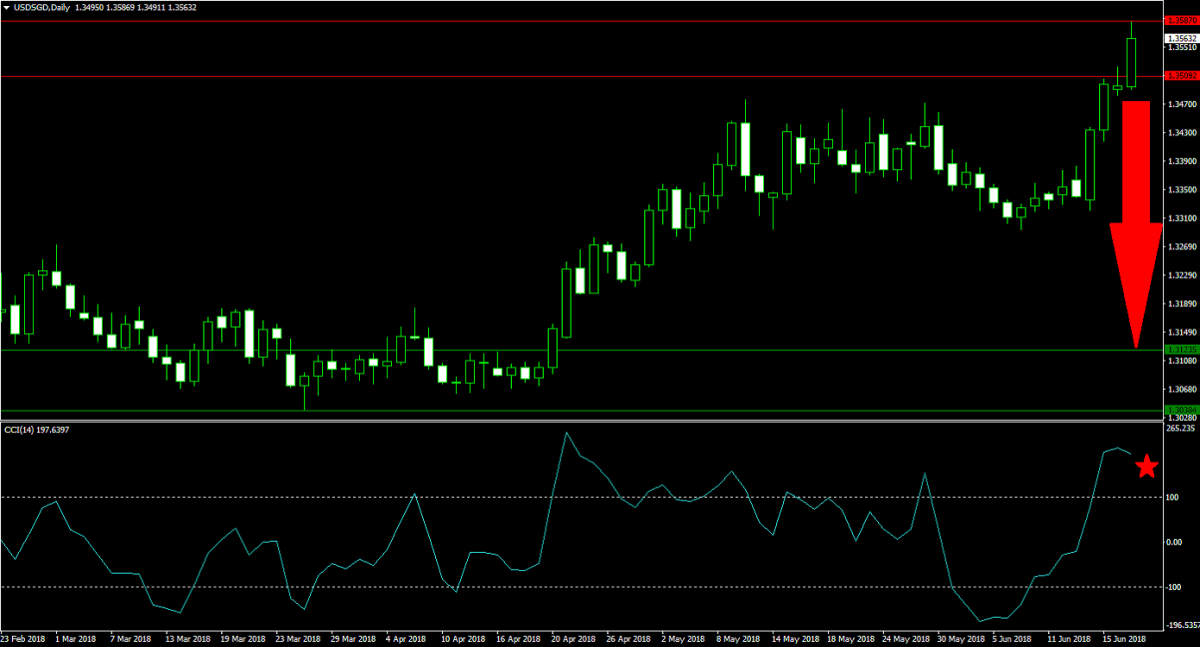

Forex Profit Set-Up #3; Sell USDSGD - D1 Time-Frame

The US Dollar is likely to feel a negative impact, especially when China has to implement asymmetric measures in order to fulfil its pledge to match tariffs. Following the sharp advance in the USDSGD which took this currency pair to the upper band of its horizontal resistance area, price action is ripe for a a counter-trend correction on the back of profit taking. Forex traders are recommended to spread their sell orders inside of its horizontal resistance area.

The CCI advanced deep into extreme overbought territory and into unsustainable levels. A breakdown below 100 is expected to result in the addition of new sell positions and drive price action to the downside. Follow the PaxForex Daily Fundamental Analysis in order to remain up-to-date with all fundamental trades which you need to have in your portfolio. Let our expert analysts guide your account through the forex market with a profitable outcome.

To receive new articles instantly Subscribe to updates.