Each currency has an interest rate attached to it, and the difference in interest rates for each currency pair you hold could result in a debit or credit being applied to your account each night. Rollover (or swap) is a way to increase profits or reduce losses, or being on the wrong side of it can cut into profits or add to losses. Rollover is an important concept in forex trading and one that you should be familiar with if you wish to use more advanced trading strategies. Simply put, rollover is the process of delaying the settlement date of an open trade position.

Rollover is an important concept in forex trading and one that you should be familiar with if you wish to use more advanced trading strategies. Each world currency has an interest rate connected to it. Since each forex trade involves two different currencies, it also involves two different interest rates. When you hold an open overnight position, interest is earned or charged depending on the interest rate difference between the two currencies you are holding. A swap, then, arises due to the overnight interest rates for each currency being different.

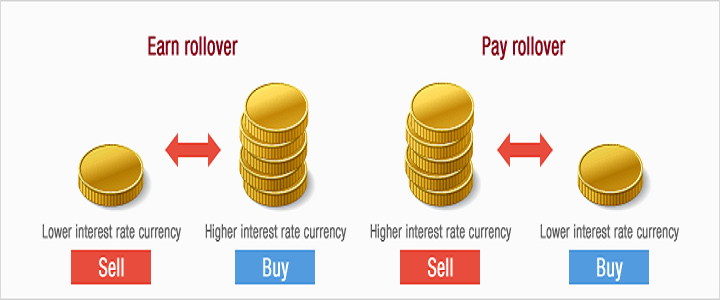

Depending on the interest rate differential, you may pay or receive interest fees, also known as rollover fees. This interest rate is called rollover because it occurs when an open position from one value date (settlement date) is rolled over into the next value date. Rollover transactions are carried out automatically by your broker if you hold an open position past the change in value date. Behind the scenes, the settlement occurs in two business days. Thus, if it is Monday before 5PM currencies are trading for value on Wednesday, after 5PM on Monday the trade date becomes Tuesday and they are traded for value on Thursday.

Swap operation is performed once a day, so the conditions of rollover are especially important for those who hold positions open for a considerable period of time, focusing not on intraday price fluctuations, but on more continuous movements, for clients who open strategic positions and trade on the trend on the basis of fundamental changes in the market. In addition, favorable swap conditions have a vital importance for clients using Carry Trade strategies. These strategies are based precisely on the interest rate differential between currencies, with borrowing in a currency with a lower rate and depositing in a currency with a higher rate.

Some forex brokers state that they only apply the interest rates of central banks, other say they reserve the right to modify them according to market conditions. But in reality, almost all brokers modify rollovers in their favor. In addition to making money through the spread, they make money with rollovers as well. All you need to do is compare the various rates offered by forex brokers to notice that they are all different and sometimes the two rates (for longs and shorts) are negative.

To receive new articles instantly Subscribe to updates.