With less than 80 days to go before the UK will leave the European Union, UK Prime Minister May is no closer to get her Brexit deal approved in Parliament. She lost a vote in the House of Commons yesterday in regards to the timetable following an expected defeat on her Brexit deal on January 15th 2019. After the defeat, James Slack, May’s spokesperson stated that “Our intention has always been to respond quickly and provide certainty on the way forward in the event we lose. That is what we will do.”

May’s team understands that she is losing ground and control of Brexit to Parliament. Yesterday’s loss followed Tuesday’s loss when the House of Commons defeated her no-deal Brexit preparation plan. With losses piling up and time running out, May has been busty drumming up support for her Brexit plan. She has met with opposition Labour party members, small group of conservative Tories as well as a larger cross-party group in order to win support for the January 15th Brexit vote.

While May could win over some Labour voters who would go against their own party and leadership Corbyn, it will not be enough to counter those in her own party who will vote against it. In order to get the votes from Labour, May would need to accept a customs union with the EU which would anger Brexiteers in her own party. Some Tory members lose patience with the pro-Brexit group. Paul Masterton, Tory MP, noted in Parliament yesterday that “Would it not be something if, when the history books are written, it emerged that it was owing to the arrogance and belligerence of the hardline Brexiteers in refusing to compromise that, rather than ending up with this imperfect Brexit, they ended up with no Brexit at all?”

Will Article 50 be extended if May loses the vote next week? The EU is currently standing by in order to see by how many votes she will lose before deciding on how to act. How will forex traders react to the British Pound throughout the next few weeks? Is a no deal Brexit priced in or will the British currency tumble? Open your PaxForex Trading Account now and prepare yourself for outstanding trading opportunities in 2019.

As May is losing control, opposition leader Corbyn is scheduled to give a speech next week on Thursday. It is rumored that he will call for a general election if May does indeed lose the vote as expected. He is expected to state that “If the government cannot pass its most important legislation, then there must be a general election at the earliest opportunity. A government that cannot get its business through the House of Commons is no government at all.” May has not given up hope yet and continues to offer concessions in order to win votes. UK PM May loses second vote in 24 Hours, but here are three forex trades which will keep your trading account on the profitable side.

Forex Profit Set-Up #1; Buy GBPUSD - D1 Time-Frame

Despite the negative news flow surrounding Brexit, forex traders are increasingly of the opinion that the outcome will be positive. This helped the GBPUSD recover from a brief plunge into the lower band of its horizontal support area. A quick intra-day reversal took price action back into its overall uptrend which is anticipated to extend until this currency pair will reach its secondary descending resistance level. Forex traders are advised to buy the dips in the GBPUSD down into its primary ascending support level.

The CCI dropped from extreme overbought conditions into extreme oversold territory and spiked back into extreme oversold levels. More upside is expected from this technical indicator as it remains below its highs and bullish momentum is increasing. Download your PaxForex MT4 Trading Platform and join our growing community of profitable forex traders.

Forex Profit Set-Up #2; Buy GBPCHF - D1 Time-Frame

Price action has stabilized after a sell-off took the GBPCHF just above the upper band of its horizontal support area. A minor sideways trend emerged which resulted in the decrease of bearish momentum. A short-covering rally is likely to follow which would allow this currency pair to partially retrace its previous corrective phase. A move into its next horizontal resistance level is expected and buying the dips in the GBPCHF down into the upper band of its horizontal support area is favored.

The CCI has already recovered from extreme oversold territory and bullish momentum is accumulating which is anticipated to result in a move above the 0 mark from where more buy orders are expected. Subscribe to the PaxForex Daily Forex Technical Analysis and never miss a technical trading recommendation posted by out expert analysts.

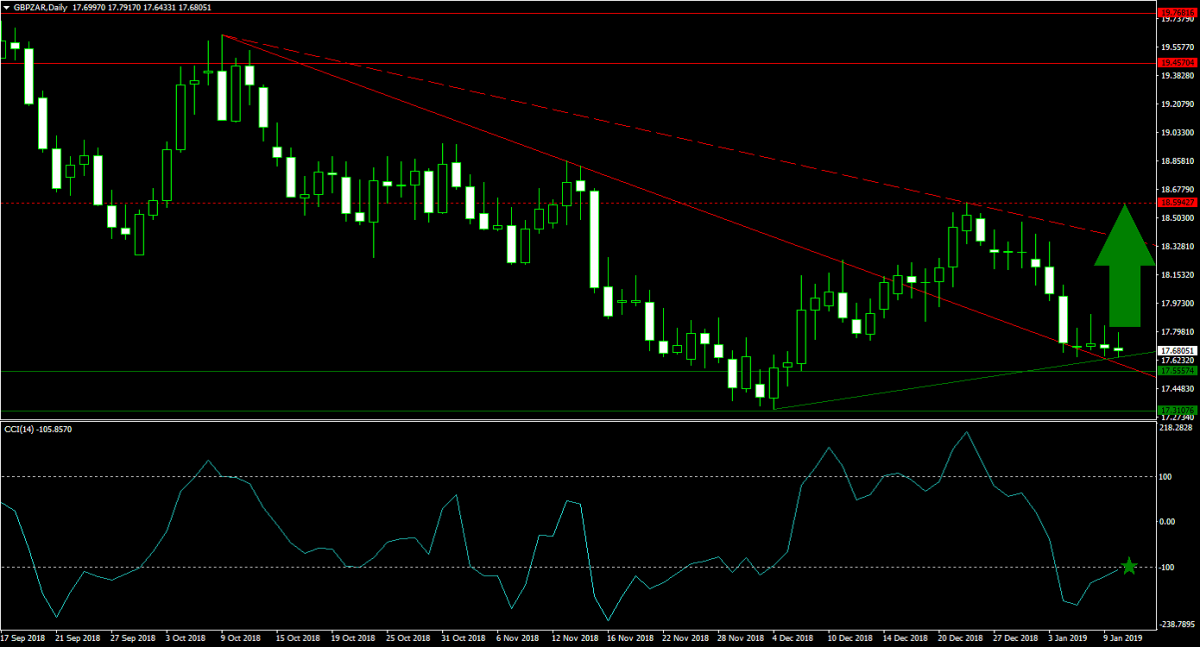

Forex Profit Set-Up #3; Buy GBPZAR - D1 Time-Frame

Following a faltered rally which took the GBPZAR from its horizontal support area into its horizontal resistance level, price action has stabilized at its primary ascending support level. Bearish pressures are fading as bullish sentiment is accelerating which is expected to guide price action to the upside. The GBPZAR is now anticipated to push above its secondary descending resistance level and back into its horizontal resistance level. Forex traders are recommended to seek buy entries at its primary ascending support level.

The CCI is trading in extreme oversold conditions, but enjoys an uptrend which is likely to result in a breakout. This momentum indicator is poised to extend its gains until it can move above the 0 level. Follow the PaxForex Daily Fundamental Analysis and let our expert analysts guide you through the forex market yielding over 500 pips in monthly profits.

To receive new articles instantly Subscribe to updates.