Some of the biggest appeals for cryptocurrency enthusiasts is the decentralized nature of the ecosystem, privacy and anonymity of the sector. Regulators have little space in this equation, but ultimately even hardliners in cryptocurrency need to find a way to accept some sort of regulation. The reason being is that if cryptocurrencies should be accepted as an alternative to other payment options, it will not happen without regulation. In general, regulators have so far reacted less favorable to cryptocurrencies and denied applications to make the sector more mainstream.

I understand both camps in the cryptocurrency space; those who prefer to remain unregulated and those who would like more regulations. In order to increase the acceptance of cryptocurrencies, and therefore the price per coin, a light regulatory framework needs to be established. Regulators as well as the cryptocurrency crowd needs to work on finding a compromise which safeguards the founding principles of coins and ensures that scams are avoided as best as possible. This will definitely be a delicate task, but 2019 could be the year that regulators reach out and try to come to an understanding.

With less than two weeks into the new year, Thailand has been busy as the Thai Securities and Exchange Commission granted four licenses, rejected two and is reviewing one. With the two rejections, the SEC noted that “The application rejection this time does not invalidate their right to apply for a digital asset business licence in the future as long as the application criteria are met.” This shows much more openness towards the space and is definitely a positive development.

The European Banking Authority (EBA) is trying to get the same regulatory approach across the European continent, a task which may be too much to handle as there are big disagreements on how to handle cryptocurrencies. The EBA stated that “Typically crypto-assets fall outside the scope of EU financial services regulation. Moreover, divergent approaches to the regulation of these activities are emerging across the EU. These factors give rise to potential issues, including regarding consumer protection, operational resilience, and the level playing field.”

The Financial Action Task Force (FATF) is worried about existing laws as their view is they are too weak and inefficient. FATF President Marshall Billingslea added “By June, we will issue additional instructions on the standards and how we expect them to be enforced.” The Director of the Strategy and Reform Department of the Ukrainian central bank (NBU), Mikhail Vidyakin, stated that overregulation is preventing crypto development and favors a clear regulatory framework in order to find a working compromise. While plenty of work is required and 2019 represents a great year to progress, overall the fundamental news flow is much brighter already than all of last year.

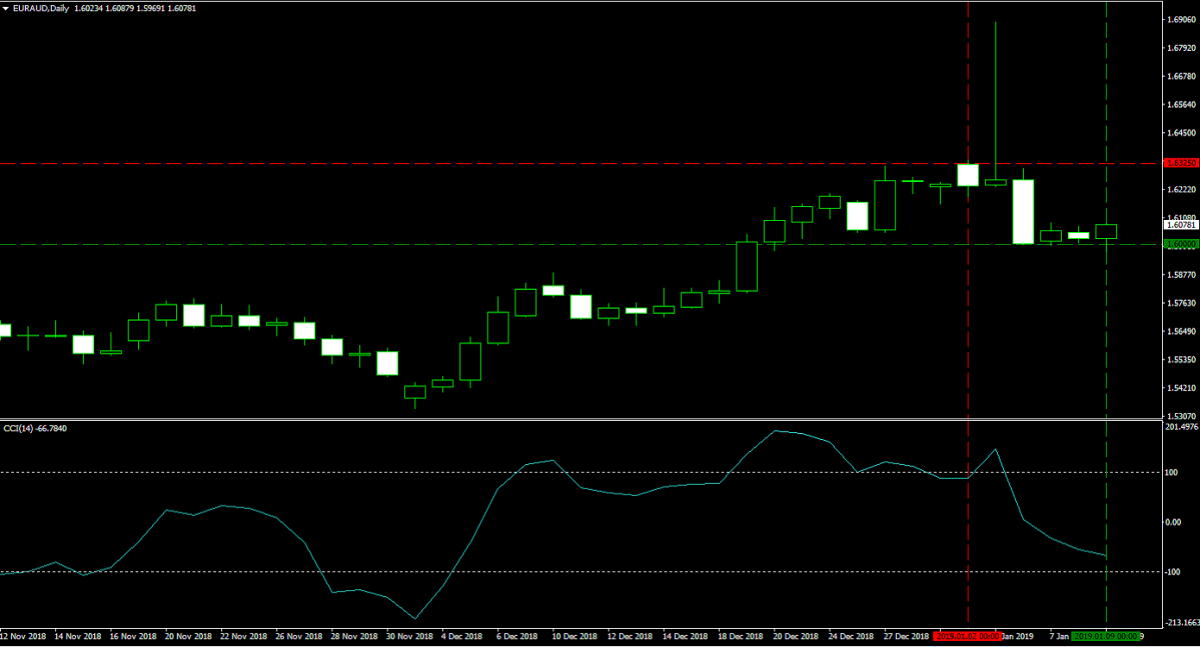

Before taking a look at my cryptocurrency portfolio, let me update you on my forex account as we had the “Japanese Yen Flash Crash” which resulted in a nice profit boost for my PaxForex trading account. I let the volatility of the flash crash, which also impacted the Australian Dollar, ride out and my adjusted stop loss was triggered today, January 9th 2019, at 1.6000. This resulted in a profit of 325 pips or $113,513. The image below shows my completed trade.

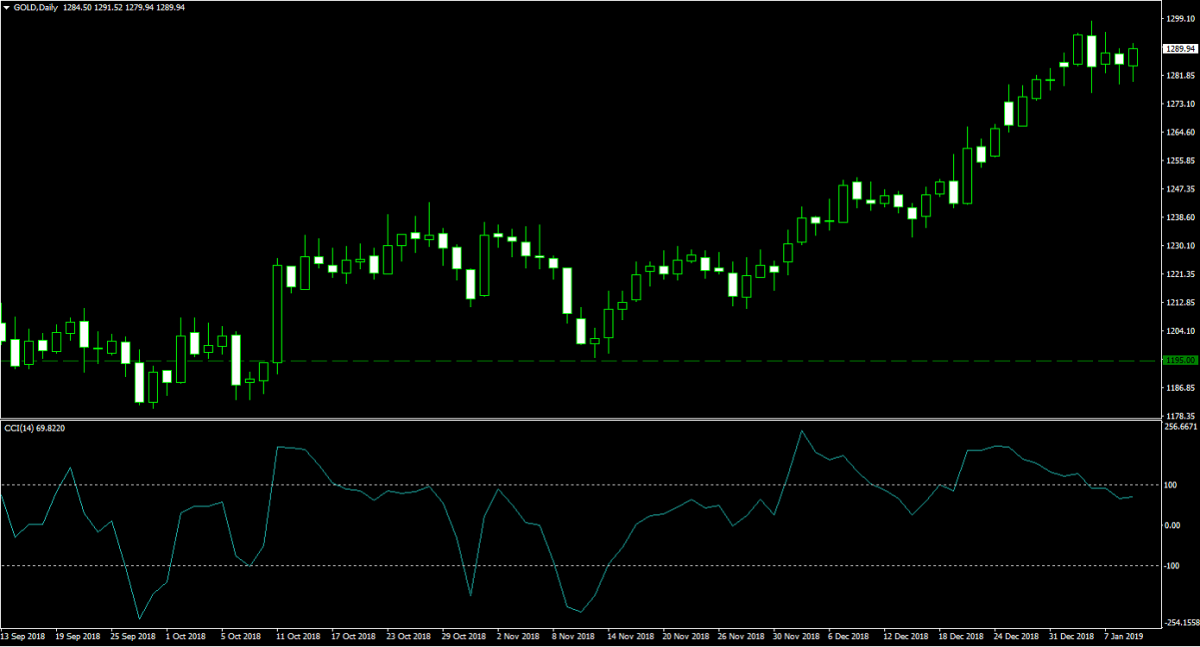

Gold continues to push higher, but some of the bullishness is currently fading. I do expect choppy trading ahead, but I will hold onto my 100 lots which I bought at $1,195.00 for a margin requirement of $123,179 and a pip value of $100. We flirted with the $1,300.00 level last week and currently hover just below it. The image below shows my entry into this trade and how it developed since then.

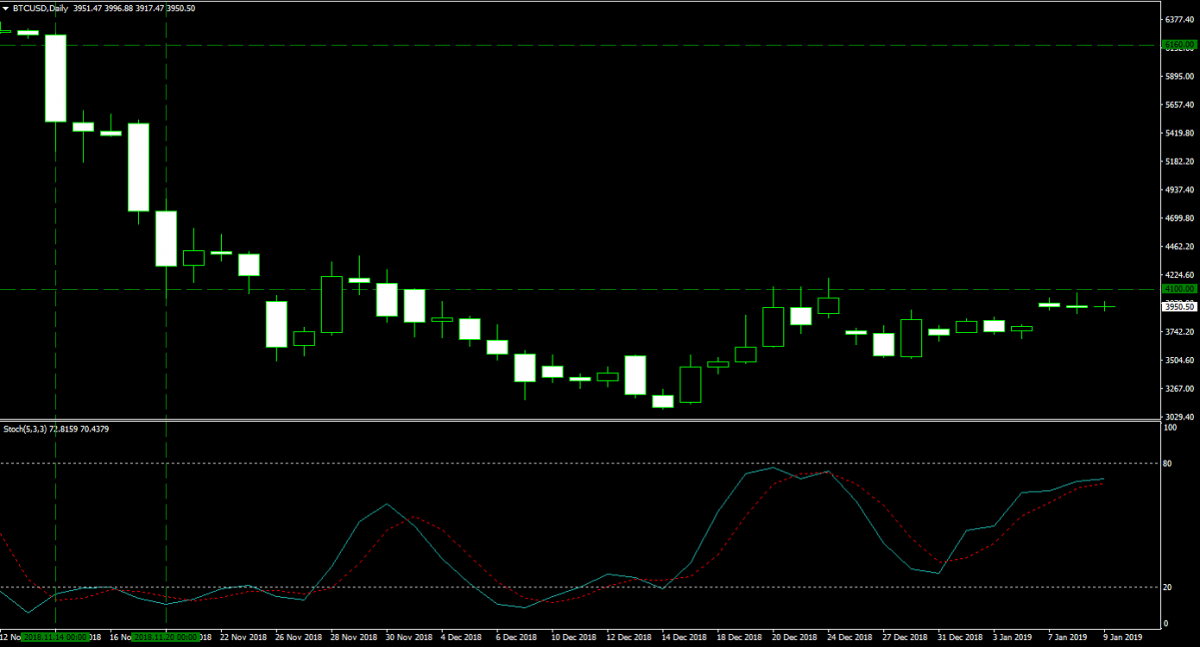

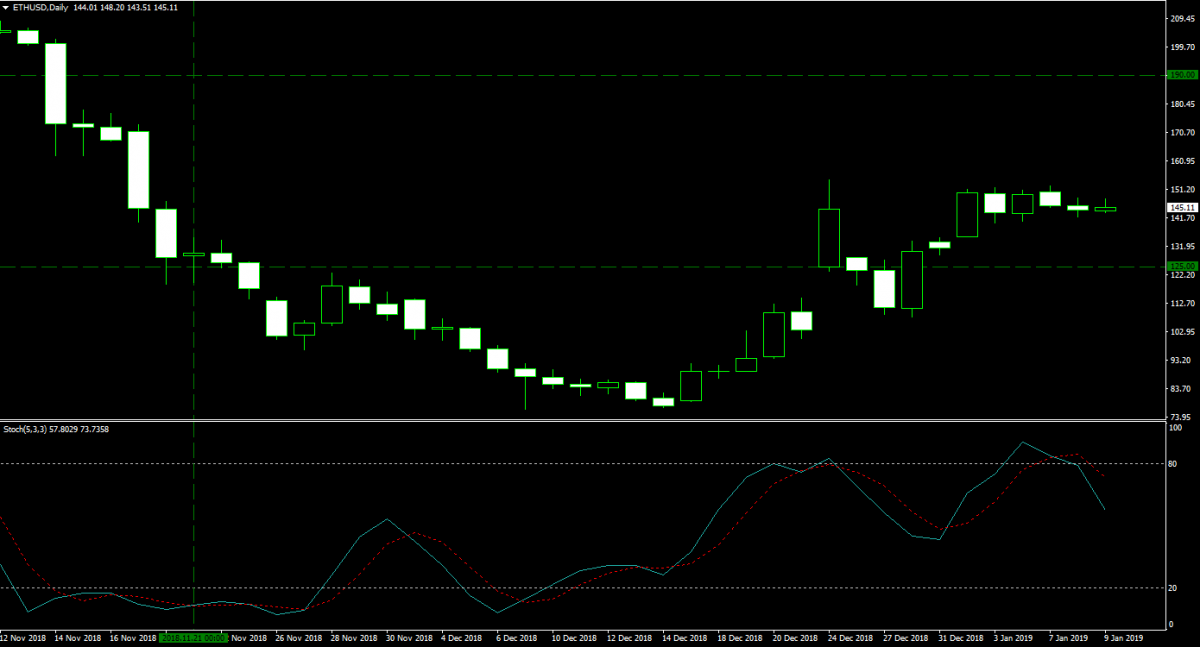

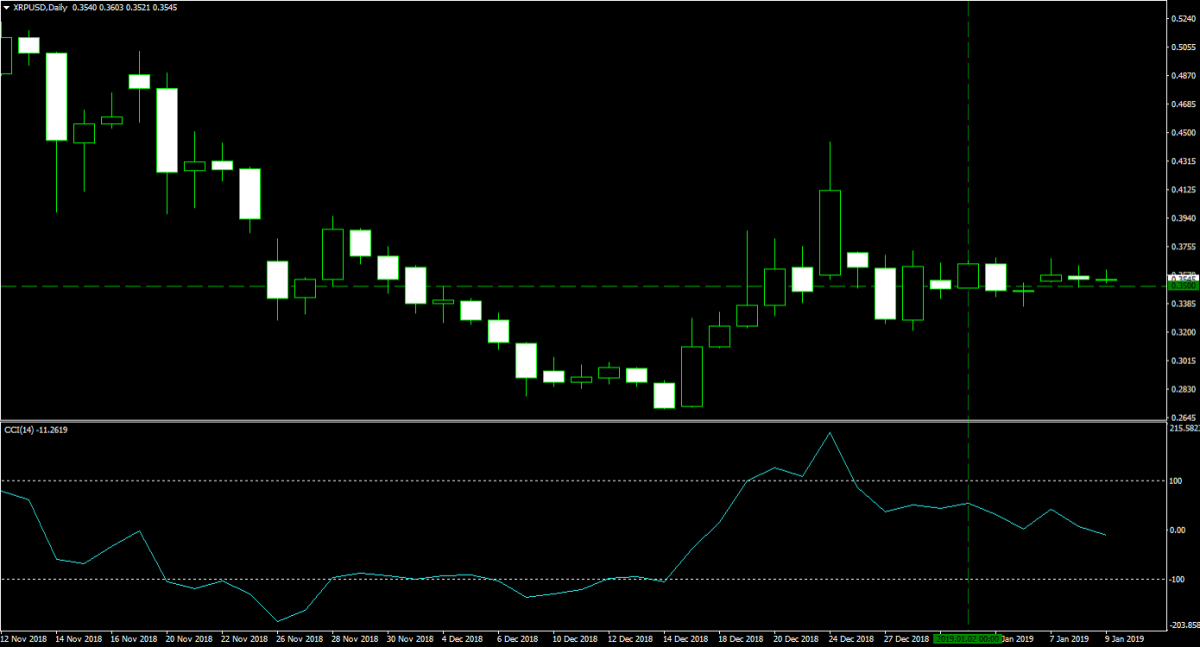

Last week I added Ripple to my cryptocurrency portfolio and you can read about it at “Bitcoin - Forex Combo Strategy: Cryptocurrency Volume Alert”. I currently have 100 Bitcoins with an average entry price of $5,130. Price action is currently struggling at the $4,000 level, but I do expect a breakout. Ethereum is at a more advanced stage of its recovery which bodes well for my 1,500 Ethers which carry an average entry price of $171.67. Price action is currently trading just below $150, but a push above it is likely to get us back into the $200 range. I added my 300,000 Ripple at a price of $0.3500 and price action has been stable since my entry. The three images below show my cryptocurrency portfolio.

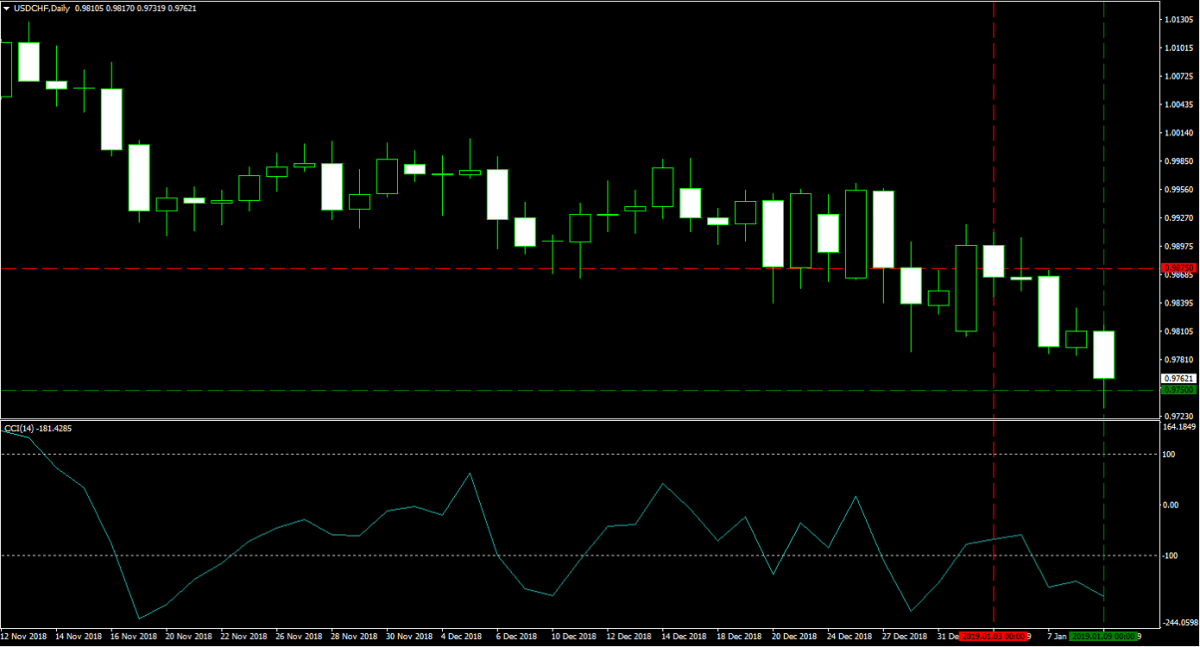

This week marks the first full trading week of 2019 and we are off to a great start. On January 3rd 2019 I sold 75 lots in the USDCHF at 0.9875. The margin requirement was $15,000 and each pip was worth $768.03. The original trade recommendation can be found at “USDCHF Fundamental Analysis – January 3rd 2019”. This position was closed today, January 9th 2019, at 0.9750 as my adjusted stop loss order was triggered. I booked a profit of 125 pips or $96,004. The image below shows my completed trade.

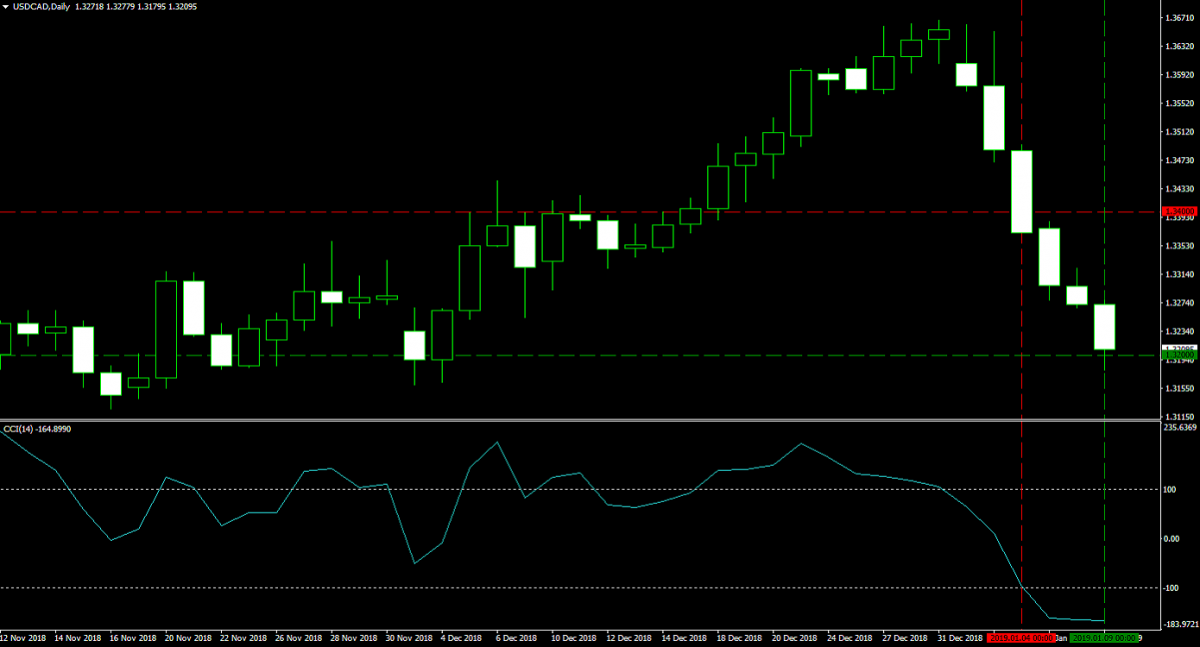

On January 4th 2019 I took a short position in the USDCAD according to this trading recommendation “USDCAD Fundamental Analysis – January 4th 2019”. I shorted 75 lots at 1.3400 for a margin requirement of $15,000 with a pip value of $567.44. This trade was closed earlier today at 1.3200 as my stop loss order was triggered. The result was a profit of 200 pips or $113,488. You can see my trade in the image below.

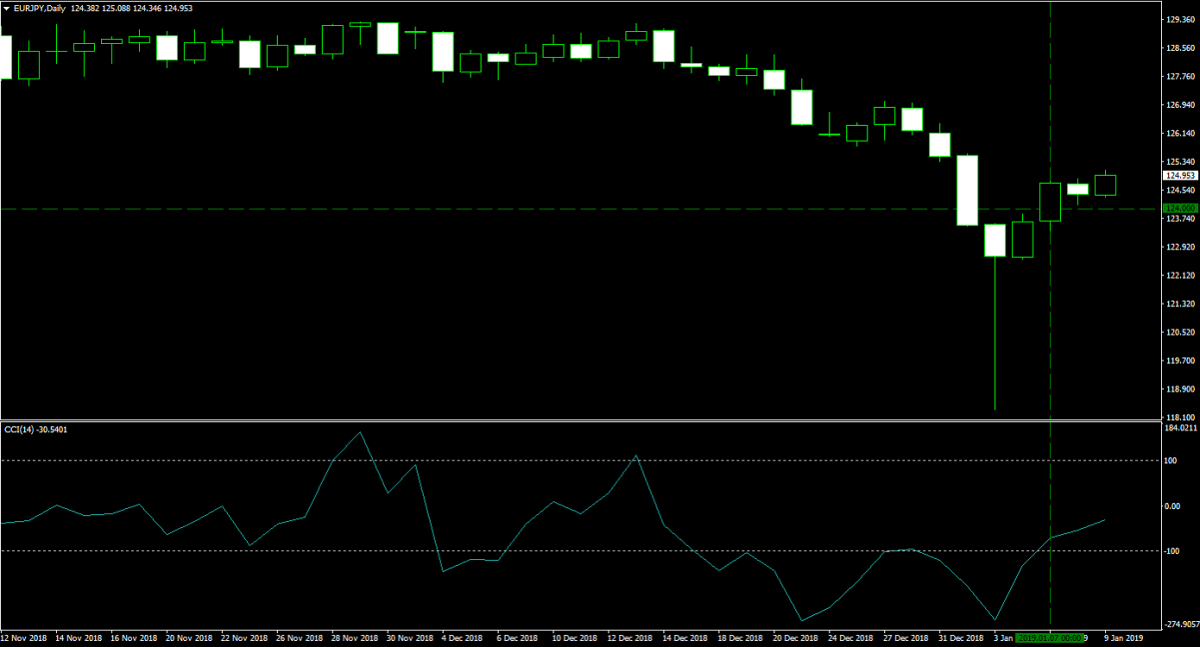

After the Japanese Yen Flash Crash, I bought 75 lots in the EURJPY on January 7th 2019 at 124.000. You can find the original analysis at “EURJPY Fundamental Analysis – January 7th 2019”. The margin requirement was $17,073 and each pip is worth $692.34. I have adjusted my stop loss to 124.750 for a guaranteed profit of 75 pips or $51,926. The image below shows my protected trade.

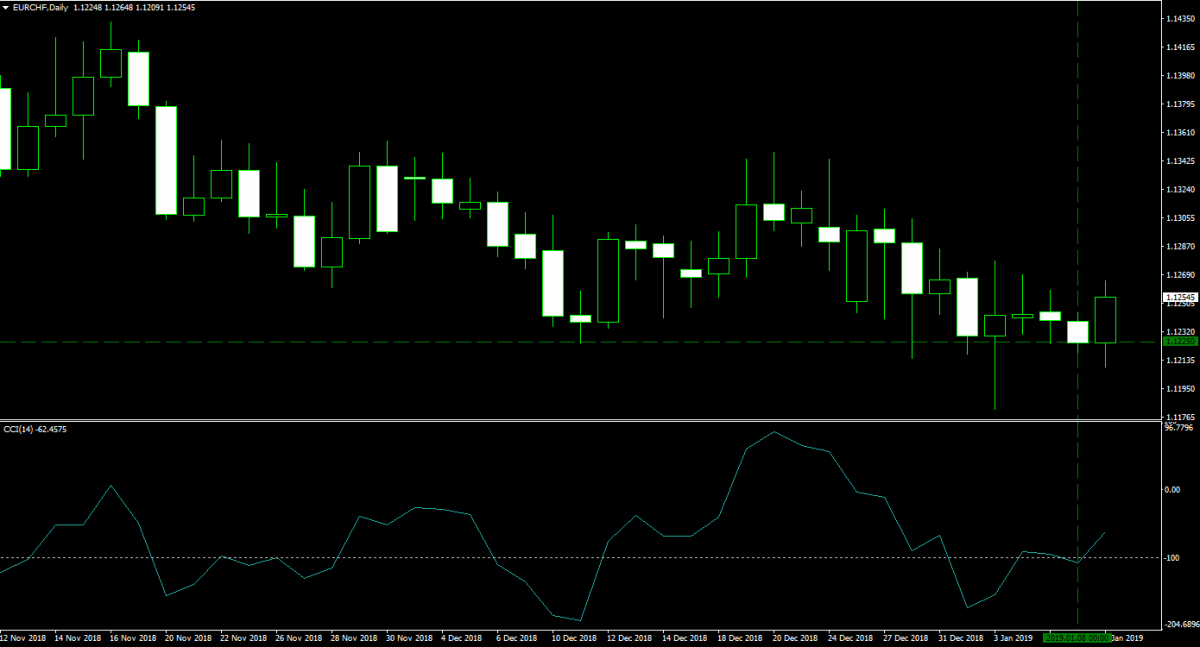

Yesterday on January 8th 2019 I bought 75 lots in the EURCHF at 1.1225. The margin requirement was $17,074 with a pip value of $768.03. I took this position according to this trading recommendation “EURCHF Fundamental Analysis – January 8th 2019” and the image below shows my trade.

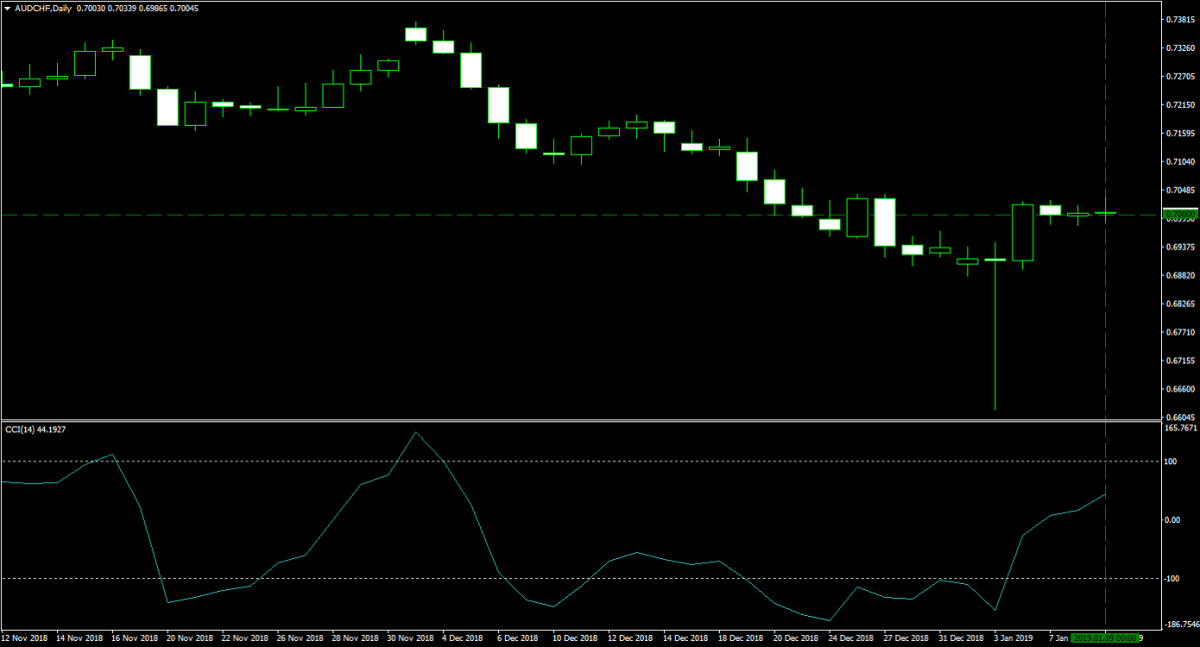

This morning, January 9th 2019, I added to my bearish Swiss Franc theme with a long position in the AUDCHF. You can read about the trading recommendation at “AUDCHF Fundamental Analysis – January 9th 2019”. I bought 75 lots at 0.7000 for a margin requirement of $10,478 with a pip value of $768.03. You can see my entry in the image below.

Let’s wrap up with a portfolio update. My 100 Bitcoins are worth $394,950, my 1,500 Ethers are worth $217,655 and my 300,000 Ripple are worth $106,860. My Gold portfolio is worth $1,057,179. I also have three open forex trades, a 75 lots long position in the EURJPY worth $77,999, a 75 lots long position in the EURCHF worth $34,739 and a 75 lots long position in the AUDCHF worth $10,478 plus $568,200 in cash. My total portfolio is currently worth $2,468,060, up $435,601 to a new all-time high! Now it’s a great time to jump on board my Bitcoin-Forex Combo Strategy and boost your earnings with a PaxForex Trading Account and my trading strategy!

To receive new articles instantly Subscribe to updates.