Support and resistance levels which were not violated in almost ten years, were crushed in a matter of seven minutes starting around 0930 this morning in Sydney. The AUDJPY dropped almost 8% while the TRYJPY plunged over 10% during that period. Against all currencies in the G-10 basket the Japanese Yen moved a minimum of 1%. Half of those moves have been reversed as traders are still trying to pinpoint what caused this flash crash. A wave of orders flooded Asian trading desks to sell the Australian Dollar and the Turkish Lira against the Japanese Yen.

The 72.000 level in the AUDJPY was a well protected level of support which weathered the storm of a trade war between the US and China, the worst equity market sell-off since the global financial crisis in 2008, the budget stand-off between Italy and the EU as well as interest rate increases by the US Federal Reserve which rippled through the global economy. Australia is very vulnerable due to its dependence on China, but despite all negative factors for the Australian Dollar, it managed to defend the 72.000 mark against the Japanese Yen. Given the safe haven status of the Japanese currency makes this an even more impressive stunt.

While some analysts suggest that Apple’s first profit warning since 2007 initiated the sell-off, others point to algorithmic trading during thin volume which exacerbated the move. Japan was closed for a holiday, but Japanese retail traders were faced with stop loss orders which further added momentum to the flash crash. It was most likely a combination of all factors which overflooded the market with orders. Grant Samuel Funds Management Advisor Stephen Miller noted that “The moves were very violent. It would have caught some by big surprise.”

Will today’s Japanese Yen flash crash be reversed? How big of a blow did traders confidence take during the even? Can the Australian Dollar recover? There have been plenty of pressure points in the global system which had traders worried, and during the Asian morning trading session all of them have been pushed. Open your PaxForex Trading Account today and start building a profitable forex portfolio with the help of our expert analysts.

The timing of the Japanese Yen flash crash, after the end of trading in the US and before the start of trading in Asia, added to the scope of it. National Australia Bank Head of FX Strategy Ray Attrill added that “We can only speculate on whether the behavior of Japanese retail FX accounts, suffering further losses on short yen positions overnight and being forced to exit, was an initial catalyst for the scale of the moves.” This morning’s flash crash was a surprise, but the Japanese Yen strengthening is expected to continue throughout 2019 as safe haven assets are expected to attract bids. Here are three forex trades to keep your portfolio moving in the right direction as global uncertainty is in the rise.

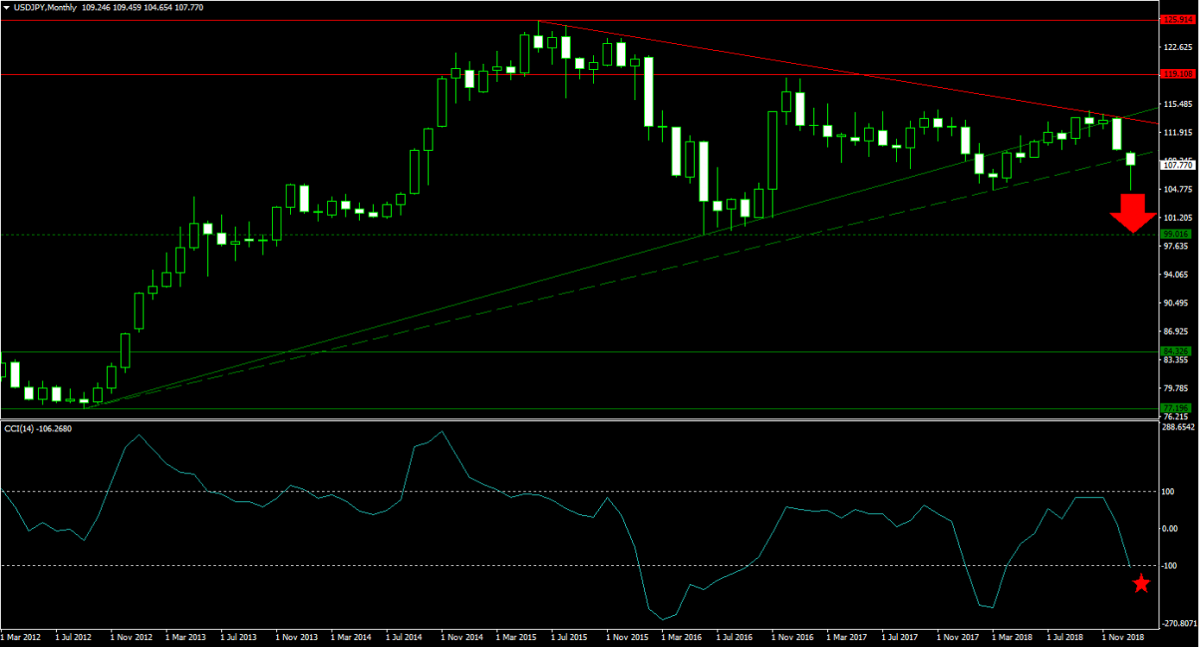

Forex Profit Set-Up #1; Sell USDJPY - MN Time-Frame

The Japanese Yen is expected to continue to strengthen as forex traders flock to safe havens. The USDJPY has been guided to the downside by its primary descending resistance level. A breakdown below its primary ascending support level has turned it into resistance and price action dropped below its secondary ascending support level this month. This has cleared the path for this currency pair to extend its move until it will reach its next horizontal support level which is located below the psychologically important 100 level. Selling the rallies in the USDJPY is favored.

The CCI entered extreme oversold conditions today as the flash crash unfolded, but it remains well off its previous lows which suggests that more downside cannot be ruled out from current levels. Subscribe to the PaxForex Daily Forex Technical Analysis and simply copy the recommended trades from our expert analysts into your own trading account.

Forex Profit Set-Up #2; Buy AUDNZD - MN Time-Frame

Trading floors were flooded with sell orders in the Australian Dollar after Apple’s profit warning which briefly collapsed the AUDNZD below parity. This move was quickly reversed and price action spiked back above its horizontal support area. The reversal also pushed this currency pair above its primary descending resistance level which now acts as support. The increase in bullish momentum is now expected to result in a breakout above its secondary descending resistance level which will clear the path for the AUDNZD to challenge its next horizontal resistance level. Forex traders are advised to buy the dips from current levels.

The CCI slid deep into extreme oversold territory and is expected to recover over the next few weeks. A move above the -100 mark is anticipated to initiate a short-covering rally which will further boost price action. Fund your PaxForex Trading Account today and take the first step in building a successful forex portfolio at PaxForex, where you earn more pips per trade!

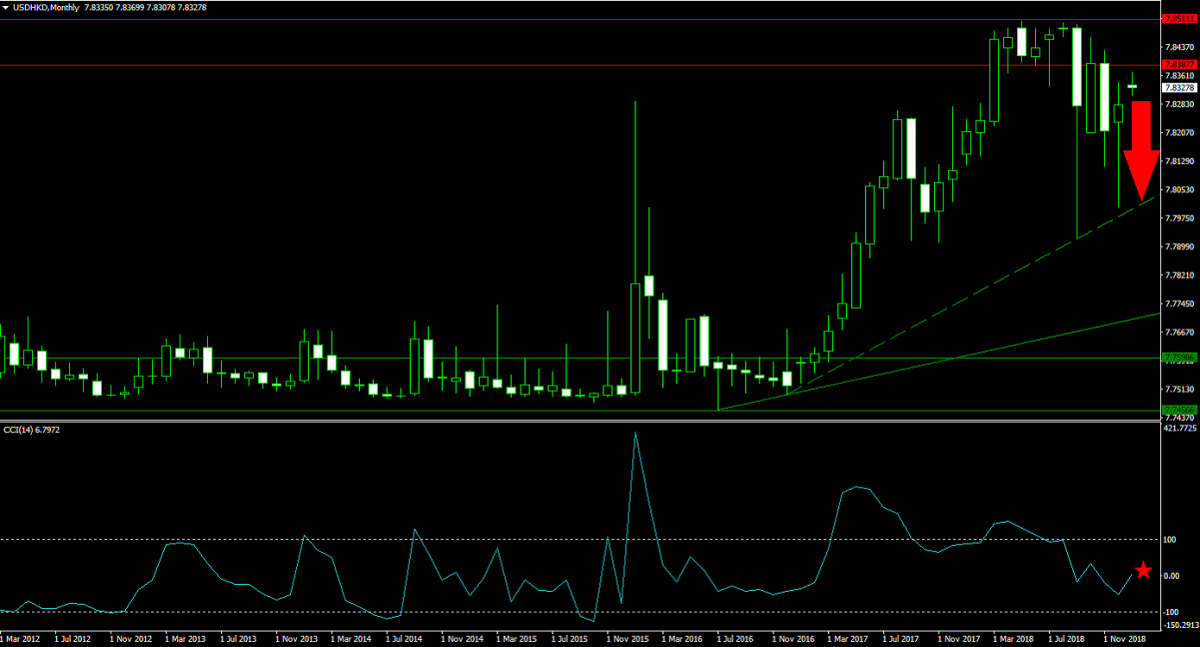

Forex Profit Set-Up #3; Sell USDHKD - MN Time-Frame

With the Apple profit warning comes a reminder that US firms are losing as a result of the US-China trade war. Given the increase in negative news flow in the US Dollar, further weakening is anticipated. The USDHKD pushed below its horizontal resistance area which increased bearish pressures. Volatility surged last month as price action dropped into its secondary ascending support before reversing below the lower band of its horizontal resistance area. A new contraction is expected in the USDHKD which will once again challenge the secondary ascending support level and forex traders are recommended to sell the rallies.

The CCI is trading above and below the 0 mark which separates bullish from bearish momentum. A renewed move below 0 is likely to trigger profit taking which will push price action lower. Follow the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide you through the forex market; earn over 500 pips per month in profits as we do the hard work so that you may earn the easy way.