In a sign that the US-China trade talks may be progressing to the point that an agreement can be announced which will please both sides, US President Trump is wasting no time. While many analysts have pointed to the EU auto sector, and Germany specifically, as the next target for Trump’s trade war, he may have just opened an entire new front. Germany is the key driver behind the EU’s export machinery and the auto sector a crucial component of it. It has been therefore expected that Trump will apply pressure on this sector in order to get the desired trade concessions. The Eurozone economy is already contracting faster than anticipated and can’t afford any more malaise.

According to Larry Kudlow, top economic advisor to Trump, the US and China are getting closer to a trade deal. He pointed out that “We’ve made great progress on the IP theft. We’ve made good progress on the forced transfer of technology.” As progress is being made, Trump can free up resources for a trade war with the EU. Besides the issues with the EU auto sector, Trump has now tasked the US Trade Representatives Office to look into new tariffs on $11 billion worth of helicopters, motorcycles, wine and cheese imports. This is in response to the ongoing EU subsidies for Airbus which the US claims give them an unfair advantage over US based Boeing.

In a twist to the approach, the US claimed that additional tariffs will only be applied once the WTO will give it a green light. Trump has previously criticized the WTO and threatened to pull out of it. The EU is currently in the process to word a mandate for trade negotiations with the US which were first agreed on last year in order for auto tariffs to be placed on hold. France has complicated a mandate for the EU to initiate trade talks as it claims the EU should not negotiate a trade deal with any country which didn’t sign the Paris Accord on climate. Trump has pulled out of the Paris Accord which angered the French and this is now further complicating the situation. In addition, there is a clause which allows the EU to opt-out of trade talks if the US will invoke Section 301 justification for tariffs as it currently plans.

US Trade Representative Robert Lighthizer claimed the US has lost patience and added “This case has been in litigation for 14 years, and the time has come for action.” The Euro has been under pressure as the economy is worsening, but the US Dollar has felt the impact of the global economic slowdown as well. Will the US engage into a trade war with the EU? Open your PaxForex Trading Account today and start creating a market beating portfolio with the help of our expert analysts!

After raising tensions and the potential for a trade war with the EU, Lighthizer further noted “Our ultimate goal is to reach an agreement with the EU to end all WTO inconsistent subsidies to large civil aircraft. When the EU ends these harmful subsidies, the additional U.S. duties imposed in response can be lifted.” Boeing added that it “supports the US trade representative and his team in their ongoing efforts to level the playing field in the global aircraft marketplace.” Given the French position and anger towards the US plus the German disappointment of how Trump has acted towards the EU, will both sides find a solution or engage into the same steps which led to the US-Chinese trade war in the middle of a global economic slowdown which may lead to a recession? Trump takes aim at the EU and here are three forex trades which aim at great profit potential!

Forex Profit Set-Up #1; Buy EURUSD - D1 Time-Frame

Following a breakout above its horizontal support area, the EURUSD is gaining momentum. While economic data out of the Eurozone remains soft, the impact of a prolonged global economic slowdown will be greater on the US as it will be on the EU. This is due to the different stages of both economies where the US Dollar has attracted bids due to central bank policy which may be on course to reverse. An extension of the breakout is expected to take the EURUSD back into its secondary descending resistance level after pushing it above its primary descending resistance level. Forex traders are advised to buy the dips down to the lower band of its horizontal support area.

The CCI has moved out of extreme oversold conditions and bullish momentum was strong enough to further push it above the 0 mark. This resulted in a bullish momentum change which is expected to lead price action further to the upside. Download your PaxForex MT4 Trading Platform now and join our fast growing community of profitable forex traders!

Forex Profit Set-Up #2; Buy USDMXN - D1 Time-Frame

A narrow trading range has defined the upper and lower boundaries for the USDMXN since the start of this year. This is expected to continue as the US is staging trade wars in the midst of a global economic slowdown. Price action has just entered its horizontal support area from where bearish momentum is being depressed. A price action reversal is anticipated to follow which will allow for a breakout above its secondary descending resistance level. This will clear the path for the USDMXN to challenge its next horizontal resistance level and forex traders are recommended to spread their buy orders inside the horizontal support area.

The CCI is approaching extreme oversold territory, but remains well off of its previous low. As this momentum indicator is expected to stabilize near current levels, a price action reversal is anticipated to follow. Subscribe to the PaxForex Daily Fundamental Analysis and earn over 50 pips per month with the guidance of our expert analysts!

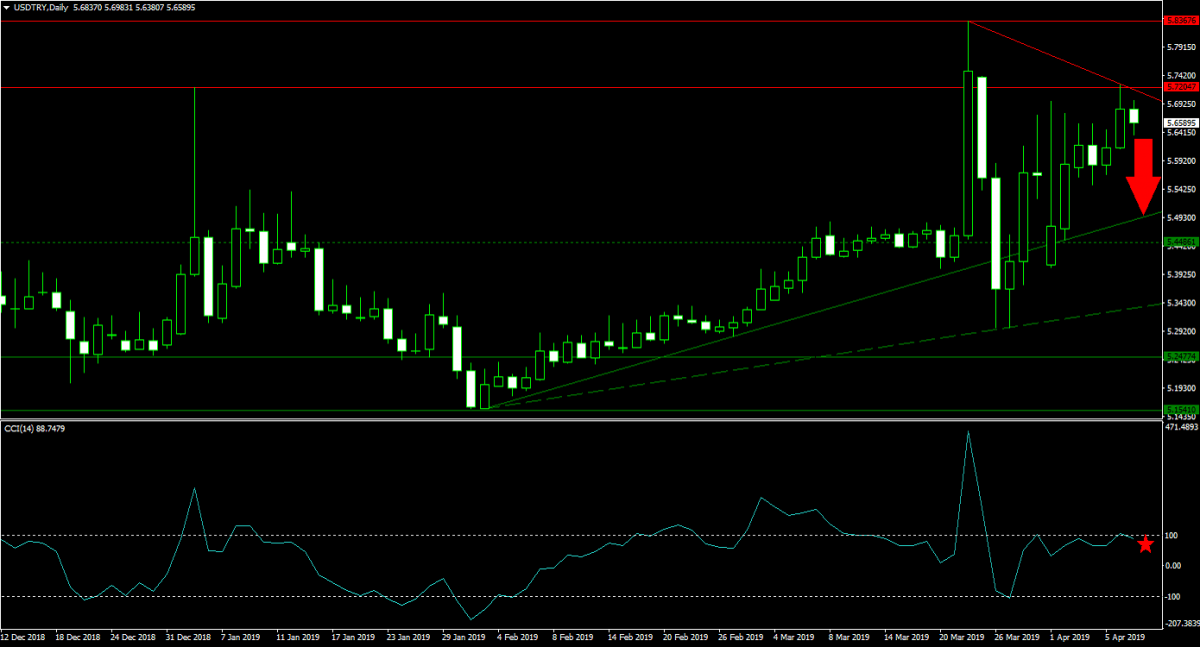

Forex Profit Set-Up #3; Sell USDTRY - D1 Time-Frame

After a few extremely volatile trading sessions, the USDTRY is now approaching the lower band of its horizontal resistance level. Elections across Turkey saw the loss of several key cities to the opposition and away from President Erdogan which further enhanced the wild price swings. As calm is returning, this currency pair is expected to contract as the Turkish Lira is anticipated to strengthen once again. The primary descending resistance level is exercising additional bearish pressures and the USDTRY is likely to contract back down into its primary ascending support level. Selling rallies into the lower band of its horizontal resistance area is the favored trade.

The CCI has been trading in-and-out of extreme overbought conditions, but a sustained move to the downside is anticipated with bullish momentum fading. This technical indicator may gather enough bearish momentum for a push below the 0 level. Follow the PaxForex Daily Forex Technical Analysis and simply copy the recommended trades and profits into your own account!

To receive new articles instantly Subscribe to updates.